Norwegian oil company Aker BP on Monday said it had awarded contracts to alliance partners for front-end engineering and design (FEED) valued at approximately 440 million kroner (around $49 million).

The contracts, awarded to Aker Solutions, ABB, and Subsea 7, cover a new central platform on Valhall, as well as a new platform and tie-in of the King Lear field, offshore Norway.

The joint development will contribute to an extended lifetime and increased value creation from Valhall, Aker BP said.

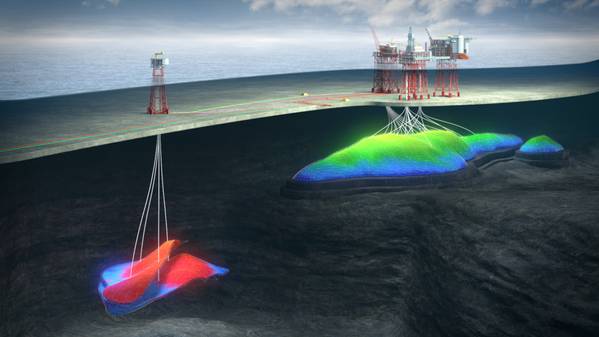

The concept consists of a new process and wellhead platform (NCP) which has a bridge connection to the Valhall field center, and an unmanned platform on King Lear around 50 km from the field center. New infrastructure will be laid on the seabed to connect the two fields. A total of 19 wells are planned, and the concept also includes considerable modification work on the Valhall field center, Aker BP said.

Aker Solutions, as part of the “Fixed Facilities Alliance” will be responsible for work on topsides and jackets for both NCP and King Lear. ABB, also as part of the “Fixed Facilities Alliance” will take care of the electrical, instrument, control systems, and telecom (EICT) for NCP and King Lear.

Aker Solutions as part of the “Subsea Alliance” has secured a contract for umbilicals for King Lear and related subsea infrastructure. Subsea7 as part of the “Subsea Alliance” has secured a FEED deal for risers and pipelines, and Aker Solutions as part of the “Modification Alliance” will be responsible for modifications on the Valhall field center.

In a separate statement, Aker Solutions shared more details on its Valhall and King Lear scopes.

It said that the scope related to the NCP includes a nearly 12,000 metric-ton topside, a 7,500 metric-ton steel jacket substructure, and a bridge in excess of 1,000 metric tons. The scope of the King Lear platform includes a nearly 2,500 metric-ton topside and 3,000 metric-ton steel jacket substructure. King Lear will be tied back to the Valhall field center for processing and export.

Aker BP SVP Operations & Asset Development Ine Dolve said: “This development will allow Aker BP to secure continued high production from the Valhall field center and the flank platforms in the area after 2028. The development also provides access to resources from Valhall and King Lear. Aker BP is planning pre-investments for extra well space on both installations and secure flexibility to tie in of new discoveries as there is still additional upside potential in the area,” says Dolve.

The Valhall area is powered from shore resulting in close to zero emissions during normal operations. The plan is to connect the new installations to the existing power from shore solution.

FID in 2022

Pandion Energy is Aker BP’s partner in the Valhall licence. PGNiG is the partner in King Lear, which was discovered in 1988. The partnerships have decided to proceed with the selected concept for NCP and King Lear. Further maturing will now follow through the FEED phase, until a final investment decision and submission of plan for development and operation is planned in late 2022.

"Aker BP has a record-breaking investment program going forward to 2028. NCP and King Lear will become one of the company’s largest development projects. A large part of the contracts is expected to be awarded to Norwegian suppliers. We are talking about significant investments and the development will provide ripple effects throughout the entire country. This will contribute to further development of the Norwegian supplier industry, and secure work at the yards as we move into the energy transition,” says SVP Projects Knut Sandvik.

First production from the development is planned in 2027, Aker BP said.

“The ambition is to produce a total of two billion barrels from the Valhall area. A comprehensive modernization of the area is underway, with the tie-in of new flank platforms, removal of old installations and permanent plugging of wells. Together with NCP and King Lear, this will enable us to operate Valhall up to around 2060,” concludes Valhall Asset Manager Ole Johan Molvig.