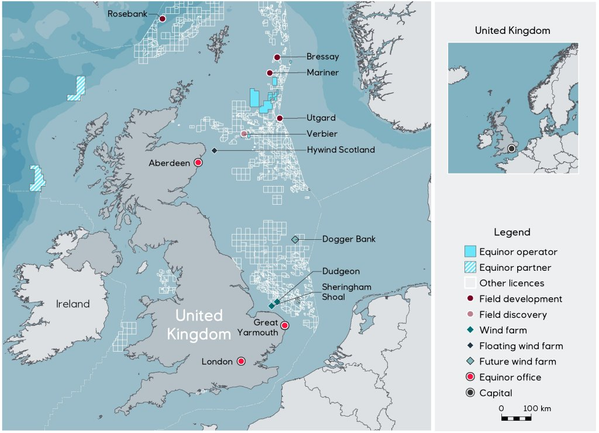

Equinor has signed an agreement to acquire Chevron’s 40 percent operated interest in the Rosebank project, one of the largest undeveloped fields on the U.K. Continental Shelf (UKCS). The parties did not disclose the commercial terms of the agreement.

“Today’s agreement allows us to buy back into an asset in which we previously had a participating interest, demonstrating our strategy of creating value through oil price cycles. The acquisition of Rosebank complements our portfolio of oil, gas and wind assets in this country, in line with our strategy as a broad energy company. This new investment underlines Equinor’s commitment to be a reliable, secure energy partner for the U.K.,” said Al Cook, Equinor’s executive vice president for global strategy & business development and U.K. country manager.

The Rosebank field was discovered in 2004 and lies about 130 km northwest of the Shetland Islands in water depths of approximately 1,110m. The other partners in the field are Suncor Energy (40 percent) and Siccar Point Energy (20 percent).

“With Rosebank, a standalone development in the underexplored West of Shetland region, we strengthen our upstream portfolio, which also includes Mariner, one of the largest investments on the UKCS in over a decade. As we have done with other projects in our portfolio, such as Johan Castberg and Bay du Nord, we intend to leverage our experience and competence to create further value in Rosebank, in alignment with the U.K. Government’s priority of maximising the economic recovery of the UKCS,” said Hedda Felin, Equinor’s senior vice president for U.K. & Ireland offshore.

The transaction is subject to customary conditions, including partner and authority approval, with completion targeted as soon as possible.