Crude inventory build has reared its head again. And fears of an oil glut returning have sent oil prices south.

According to the International Energy Agency (IEA), OECD oil stocks increased by 58.1 million barrels in Q3 2018, the largest gain since 2015. The agency in November said OECD oil holdings are likely to exceed the five-year average when October data are finalized.

Looking forward, the IEA expects an implied stock build of 2 mb/d in the first half of 2019 – assuming OPEC producers continue at their current production pace and global demand grows at a rate of 1.4 mb/d.

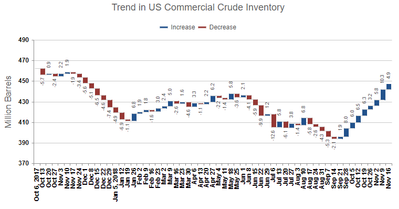

Weekly survey results by the U.S. Energy Information Administration (EIA) confirm the crude inventory build. While EIA data include only U.S. inventory the survey results are considered more reliable than international figures and are often used a surrogate for global inventory status.

The latest EIA survey results show that U.S. crude inventories have increased in each of the past nine weeks, and the EIA in its November 21 weekly report said, "U.S. crude oil inventories are about 6 percent above the five-year average for this time of year."

The inventory build is the result of increased Saudi, Russian and U.S. crude production, which is more than offsetting the decrease in Venezuela and Libya production and loss of some Iran crude supply due to U.S. sanctions. Demand growth has also slowed a bit – which has added to the imbalance.

Next month OPEC producers and Russia will meet to discuss a cutback in oil production. While it is likely some type of cutback agreement will be reached, it is far from certain that the agreement – and its execution – will be sufficient to stop the inventory build. Fast increasing U.S. crude production will likely wreck OPEC/Russian efforts to control the market.

Crude production in the U.S. is expected to average 10.9 mb/d in 2018, up 16 percent from last year. The increase is being driven by U.S. shale oil producers, who are continuing to add production despite logistics barriers that have been constricting the supply channel.

U.S. production will get a boost in 2019 as new pipelines in the Permian Basin come on stream – and many of the 8,500+ drilled-but-uncompleted wells (DUCS) in the U.S. will likely be completed next year as additional pipeline capacity becomes available. U.S. crude production is expected to grow to 12.1 mb/d by end 2019 – up 11 percent from this year.

On 21 November Brent was trading around $64, down 26 percent from the high of $86 reached in early October – and talk of $100+ oil has all but disappeared.

But never count out the possibility of oil prices spiking. A major supply interruption is all it takes. The most likely source remains the U.S. sanctions on Iran. So far, the Trump administration has bowed to pressures from oil importers to provide waivers to the sanctions. These waivers could be very temporary – and talk about harsher enforcement of the sanctions will send chills through the market.

As everyone knows, oil is a volatile market that easily tips out of balance. And more than in the past, today’s oil market is being driven by unpredictable geopolitical tensions and pressures.

(Source: IMA)

(Source: IMA)