Africa's offshore oil and gas potential remains largely unexploited, and 2019 may turn out to be a good indicator on whether countries with shallow-, deep- and ultra-deepwater hydrocarbon resources can make headway in attracting exploration and production investments, especially after some announced major policy reforms in the recent past.

Although countries such as Equatorial Guinea and Tanzania have been seen by some as defiant when it comes to sweetening of upstream, midstream and downstream regulations to woo international oil and gas companies, many more countries in Africa have recently made changes to their fiscal regimes to make them attractive to investors who are keen on tapping into the region's offshore hydrocarbons sector as has been the case for Gabon, Congo (Brazzaville), Ghana, Angola and even Cameroon.

Notwithstanding progress in the fine-tuning of hydrocarbon regulations by majority of countries with offshore resources, producers such as Nigeria have delayed the approval of new petroleum rules, hence holding back reaching of final investment decisions for some of their offshore oil and gas projects.

For the first time in decades, Angola recently moved to improve the image of its oil and gas industry by establishing a new industry regulator, National Oil and Gas Agency, leaving Sonangol, a parastatal that for years was the face of the country's hydrocarbons sector, to concentrate on exploration and production activities. This came barely months after the state-owned company's top leadership had been accused of corruption and removed from office by the government of the new President João Lourenço who succeeded José Eduardo dos Santos that had been in power for 38 years.

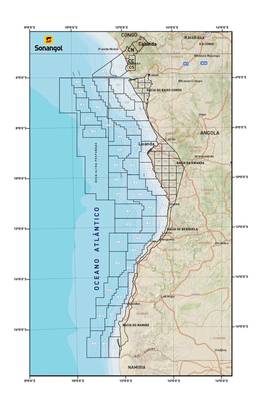

In addition, President Lourenco has announced a 50% reduction of taxes on development of oil projects with less than 300 million barrels of reserves. The petroleum production tax comes down to 10% from 20% while petroleum income tax on marginal fields has dropped to 25% from 50% in addition to other regulatory regime changes as the country prepares for a new round of licensing for its offshore blocks in 2019.

But a more drastic policy change has been announced by Gabon and Congo, two countries in sub Saharan Africa that launched their offshore licensing rounds in late 2018. The bids close this year with expectations high the changes to their oil and gas regulatory framework would attract high class suitors for the offshore blocks on auction in respective countries.

Gabon, which has in recent years been forced to embrace stringent financial measures that have seen the country's fiscal deficit reduce from 6.6% in 2016 to 0.3% in 2018, is keen on wooing major international oil and gas exploration and production companies to take up the 12 shallow water and 23 deepwater blocks that are on offer in the ongoing 12th licensing round that closes in April 2019.

To attract potential suitors for the offshore blocks, Gabon recently announced the removal of corporate tax for all companies involved in exploration and production operations in the West African country, which curiously reported a 2% economic growth in 2018 up from 0.3% in 2017 despite oil production having fallen by 4.3% within the same period to an estimated 200,000 barrels/day.

In Congo (Brazzaville), the government announced a 3% and 10% reduction in oil and gas royalties respectively in 2016 in readiness for the second licensing round that was launched last year. The intention was to attract oil and gas exploration and production companies that would take up opportunities of re-starting maturing fields, but which still hold substantial resource and explore more hydrocarbons deep offshore the country.

By the time the ongoing licensing round closes next June and preferred bidders announced weeks later, Congo would have assessed the effectiveness of the amendments to its hydrocarbons regulations. Congo had reduced the oil royalties to 12% from 15% and gas royalties from 15% to 5% in addition to banning gas flaring and fixing stake of local companies in oil and gas projects to 15%.

Elsewhere, Ghana has maintained what the government terms “adequate legal and regulatory framework” even as the country launched its first formal licensing round in November last year with a closure date of May 2019.

By the end of 2018 reports said the licensing round had attracted the participation of Tullow Oil, Total, ENI, Cairn, Harmony Oil and Gas Corporation, ExxonMobil, CNOOC, Qatar Petroleum, BP, Vitol, Global Petroleum Group, Aker Energy, First E&P, Kosmos, Sasol and Equinor.

Ghana believes its wide range of upstream regulations such as Petroleum (E&P) General Regulations 2018, Local Content & Local Participation Regulation, Petroleum E&P- Data Management Regulations and the Petroleum E&P-HSE Regulations 2017, make investment in the country's hydrocarbons sector more transparent and provides the much needed clarity for international investors.

However, a lot remains undone in Africa's top oil producer Nigeria, where the delayed Petroleum Industry Bill has not only created uncertainty in the country's upstream sector but also pushed back possible final investment decisions for offshore oil and gas projects. With an estimated oil and gas reserves of 37.5 billion barrels and 5.2 trillion cubic meters respectively, Nigeria is a country rich in hydrocarbon resources but without a simplified, transparent and investor-friendly regulatory and legal framework, the country's offshore segment may not achieve its optimum.

Nevertheless, with 2019 still at its infancy, there is much more to expect in Africa's offshore space, especially in countries where some effort has been put into reviewing existing oil and gas sector regulations to align them to the emerging investment trends that call for change of tact by petroleum producing governments to support a sustainable hydrocarbons market both now and in the future.

Some of the new concession blocks offshore Angola (Image: Sonangol)

Some of the new concession blocks offshore Angola (Image: Sonangol)