New solutions which could break the plugging and abandonment mold are making their presence felt on the Norwegian continental shelf.

At some point in the future, plugging and abandonment operations (P&A) will be a regular and relatively unexciting activity for the offshore oil and gas industry; part of the decommissioning process.

But, that’s in the future. Today, this activity is still something of a new challenge and there’s still plenty to play for.

At the annual Plugging and Abandonment Forum (PAF) Seminar, supported by Norsk olje & gass, held in Stavanger, some of the latest advances and the challenges were laid out. There are new products entering the market, new techniques being suggested and tested, and constant learnings. There are also challenges: technical, regulatory and environmental.

In its simplest form, plugging a well means putting barriers down the well to stop anything from beneath leaking out – and the industry wants easier ways to do it, especially those that mean it doesn’t need to use a rig. The challenges include verifying the quality of cement put behind the well’s casing, sometimes decades ago, (and if it can’t be, it has to be removed, at considerable expense) and then verifying that the new barriers are permanent, impermeable and will last.

Reactionary

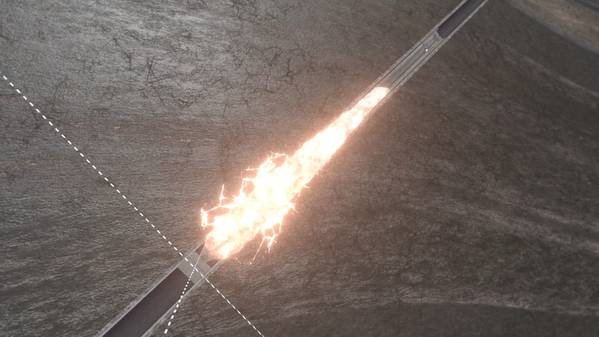

Two emerging technologies which could reduce P&A costs are Interwell’s thermite plug technology, which literally burns through casing, cement and surrounding rock, to create a barrier, and BiSN’s bismuth plug, which creates a metal to seal by melting bismuth.

Aker BP has put bismuth in the ground in 2018 and plans to do the same with thermite in 2019, both to test the technologies. Interwell’s thermite plug uses the exothermic reaction sparked when aluminum and iron oxide are heated (using an electric heating element for downhole application), resulting in 4,500-5,000 degree Fahrenheit temperatures. The process has been used in a controlled way for decades to weld railway lines. Interwell’s thermite plug has been placed in onshore wells in Canada in 2017 and onshore in Italy and in the U.K. in 2018, but not being able to view the impact it has had downhole is something of a limiting factor, said Martin Straume, P&A Engineering Manager at Aker BP, which is part of a joint industry project (JIP) testing this technology. So, in August 2018, the firm and its JIP partners, including Equinor, spent not an insignificant sum building a full-scale test cell in Norway so that it could then slice open a section of the barrier created by Interwell’s thermite.

“We had never seen inside before,” Straume told the PAF event. “An 8.5-in hole was drilled and a 7-in case cemented inside it. After the thermite was run, the plug was about 9-in, bigger than the drilled hole, and the 7-in. casing was gone. The whole zone was about 11 in.”

Next, Aker BP took BiSN’s technology a step further. BiSN’s Wel-Lok M2M technology leverages the fact that bismuth has a density 10 times greater than water and, when melted, has a viscosity similar to water, so that it fills crack and fissure it finds. It then expands when it cools, by about 3%, according to the firm, creating a gas tight seal in the well. BiSN also uses modified thermite, as the heating element, which is a chemical reaction activated with 240 volts and 60 milliamps for about 15 seconds. BiSN’s technology was first field trialed in 2016, in 4.5-in tubing onshore Alaska, then offshore in the Gulf of Mexico and Angola, to shut-off areas of wells where water was coming in. In 2017, the technology was used by Aker BP offshore Norway, on the Valhall field, in wells which had bridge plugs and barriers, but were leaking gas. Now, it’s been trialed as an upper barrier, again in a well on the Valhall field, creating what’s been called the world’s largest Bismuth plug.

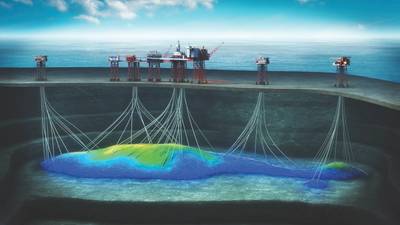

Aker BP is still drilling on the Valhall field, but recently completed a successful P&A campaign. (Source: Aker BP)

Aker BP is still drilling on the Valhall field, but recently completed a successful P&A campaign. (Source: Aker BP)

The Wel-lok M2M plug was deployed on the A-30 well, which already had a cement-based lower abandonment barrier, using an E-line (a type of wireline conveyance into the well) run by Altus Intervention. Over a couple of hours, some 3,500kg of bismuth alloy was placed at 380m downhole and melted to create a 2m-long plug inside 18.625-in casing, through a section milled window cut in the 13.375-in casing. The heating element was removed at 37 minutes, before the Bismuth could set, to remove any possible leak paths it could create, Straume said.

A benefit of the Bismuth is that it effectively locks itself in place, because it expands the casing it’s in, he said. This also exerts pressure on the surrounding rock, creating a tight seal. For Straume, using both cement and one or both of these new technologies could be a good solution. “If cement is used for multiple barriers in a well, it has the same failure mechanism,” he pointed out. “If cement and another medium is used, there are different failure mechanisms, so you’re less likely to fail across the multiple barriers.”

The goal for both of these tools is helping to reduce how much steel (tubing and casing) needs to be pulled out of the wells, as well as to create long-term impermeable barriers.

The world’s largest Bismuth plug being deployed via e-line in the Valhall field. (Source: Altus Intervention)

The world’s largest Bismuth plug being deployed via e-line in the Valhall field. (Source: Altus Intervention)

More with modular

Operators are trying to take work off rigs, by doing as much of the work it can with wireline and coiled tubing. For the Jotun B well plugging and abandonment program, ExxonMobil and then Point Resources (which acquired the facility as part of a package in 2017) used a modular rig for the final phase of P&A operations.

Jotun B, a fixed facility in the Norwegian North Sea, had 20 wells, a platform rig that would have required significant refurbishment and the platform had limited bedspace. Using a modular rig, which could be installed on the original Jotun B drillfloor, meant it didn’t have to do this refurbishment work or hire a jackup rig for the project, P&A contractor Halliburton’s senior project manager Jan Tore Helgesen told the PAF seminar.

ExxonMobil also reduced the modular rig’s workscope by doing wireline and coiled tubing work upfront, including perforate, wash and cementing techniques, which meant less steel had to be pulled out of the well. Explosives are used to make holes in the tubing and casing, then washes out these sections so that cement can be pumped in through all the gaps to make a plug or barrier in that section.

In total, 3,174m of tubing (over 15 wells) was perforated during 16 runs, with 67,626 holes made with perforation guns (using up some 1,887kg of explosives), said Helgesen. The electrically powered Optimus P&A unit, which has 350-metric-ton pulling capability (and can be upgraded to 500-metric-ton), then did the remaining work that couldn’t be done by wireline or coiled tubing. The conductors will be removed by heavy lift vessel.

Halliburton’s modular rig, for the Jotun B P&A operations. (Source: Halliburton)

Halliburton’s modular rig, for the Jotun B P&A operations. (Source: Halliburton)

Making an Intervention

When there’s not a platform to work from, as on ConocoPhillips’ MacCulloch field, a modular rig cannot be used. ConocoPhillips used a light well intervention vessel (LWIV) to remove well suspension work the subsequent semisubmersible rig campaign.

MacCulloch, which produced 120MMbbl from 1997 to 2015, when it was shut-in, was developed via 11 wells, from two drill centers tied back to the North Sea Producer floating production, storage and offloading vessel (FPSO), in the U.K. North Sea. In 2015, the wells were isolated at the Xmas trees prior to the North Sea Producer being removed. In 2017 the wells were suspended and Metrol downhole gauges were installed during the LWIV campaign. The Metrol gauges send their data to the tree, from where it’s transmitted acoustically through the water column to passing vessels, so the well status can be monitored over multiple years.

Doing the upfront work with a light well intervention vessel “helped us to de-risk wells that were 20 years old, had been producing for 18 years and had no intervention history,” said Alistair Agnew, ConocoPhillips. “Splitting the P&A campaign into two phases (with the ability to monitor the well barriers via the downhole gauges) also gave us more time to optimize the P&A design and let technology catch up.” Indeed, in 2015, the base case was section milling. “Waiting opened the door to a perforate, wash and cement (PWC) solution,” which had, by 2017, been tried and tested by ConocoPhililps’ Norwegian business.

The firm was also able to use divers to reinstate barriers for tree cap recovery and subsequent well access, by using Helix Well Ops’ Well Enhancer well intervention vessel, which has an 18-man saturation diving system – something a more conventional LWIV couldn’t provide without DSV support. They ran with nine divers, working in three teams of three, which meant 18 hours a day of diving coverage.

Helix Well Ops’ Well Enhancer light well intervention vessel, used on the McCulloch subsea P&A campaign. (Source: Helix Well Ops)

Helix Well Ops’ Well Enhancer light well intervention vessel, used on the McCulloch subsea P&A campaign. (Source: Helix Well Ops)

ConocoPhillips also did its subsurface homework, which meant being able to reduce the number of barriers it needed to place. “It really starts at the subsurface, that’s where we can make most savings; do a really in-depth subsurface review and understand what actually needs to be abandoned,” Agnew told the PAF event. “We went from setting four barriers down to two.”

The light well intervention operations were done last year. The Phase 2 rig-based work will start 2019.

Taking a risk-based approach

Others are also looking to the subsurface and a risk-based approach to reduce P&A scope. Repsol and Shell took this approach as part of their P&A campaigns on Varg and Brent, respectively.

The challenge on Varg was to understand two rock formations above the Varg reservoir, called Ekofisk and Tor. These were understood to have influx potential, which could mean plugs were needed above them. Repsol used logging and scanning tools to assess the formation bond and to see if creeping shale – which sees surrounding rock tighten on the well – was evident to decide on its barrier design.

On Brent, Shell has a much bigger challenge. While Varg had 12 wells, the Brent field, operated from four platforms (one of which, Delta, has now been removed), has 154, from which about 400 wells bores run. Initially, said Alexander Watson, Shell U.K., the P&A strategy was quite prescriptive, i.e. to abandon all permeable zones, “one size fits all.” In some wells, there could be two casing strings across the main reservoir and two shallow zones, which, taking a conservative approach and doing section milling and placing barriers across all three, would be a major task. “We needed something different,” Watson said.

Shell looked to dual casing PWC, which hugely reduced the time it would take on each well. There are limitations to PWC, however, he said, which Shell used in 7 5/8in and 9 5/8in sections. Bigger sections would need larger perforation guns and larger fluid volumes, which may not be possible when there’s limited topside facilities to handle high volumes.

But, looking for creeping, or squeezing, shale and assessing the subsurface, through logging, monitoring and modeling, also helped to reduce the number of barriers that needed to be placed.

However, “This isn’t the end,” Watson said. There’s work around barrier verification to be done and further steps could be taken, such as moving to through tubing abandonment, which would mean tubing, as well as casing, could be left in the well, reducing the time and cost to P&A further.

Learning by doing

Operators are also learning by doing. Aker BP’s BiSN trial on Valhall is a sideline to a larger ongoing P&A program, in tandem with a rejuvenation project on the field. Through two campaigns, starting in 2014 and 2017, Aker BP has made strides in P&A efficiency, Straume said.

During the first campaign, through 2014-2016, using the Maersk Reacher jackup rig, 12 well slots were P&A’d (amounting to 13 wells, as one had a producer and injector from it) over two years. At the start, the first well took 120 days to P&A and the fastest well was plugged in 40 days. The campaign averaged 62 days/well for these 13 wells. “If you do a P&A campaign, you have the opportunity to collect all your data, and evaluate and focus on what you can improve on,” Straume said. “That’s what we did. We gathered 1,500 learning points on the first campaign. We condensed that to 60-70 learning points and focused on reducing these further.”

The result was that second campaign, using the Maersk Invincible jackup to P&A 14 wells, saw a 52% reduction in P&A per well time; 14 were done in 13 months instead of 13 over two years. Wells with similarities were bunched together to enable a more factory style approach, Straume said, and in total some 125 well barriers were placed, 49km of tubing pulled and 2,100-metric-tons of steel removed. The rig has a main rotary table and an auxiliary working station, so it can pull out tubing and casing in stands and unscrew them off the critical path, he added. The last campaign also saw a sandwiched casing pulled for the first time and an area section milled in one run over 110m inside 13 3/8in casing, including underreaming to clean out the milled window for logging purposes.

“The learning curve has been steep,” said Karl Johnny Hersvik, Aker BP’s CEO, who also spoke at the PAF event. “If we continue, we could get to 14 days from a starting point of 120 days.”

Renewing the regulation

The challenges are not just technical. The technical challenges – and new solutions – create regulatory challenges and means standards need rewriting, both of which can be lengthy processes.

Norway’s Norsok D-010, which focuses on well integrity, was last revised in 2013. The first hearing to update it was in 2017, a draft is due to be published early in the new year, with the final revision in place sometime in 2019. Revisions of other NORSOK standards, including D-002 on well intervention equipment, and D-007 on well testing, are expected to kick off in early 2019.

Norway’s Petroleum Safety Authority (PSA) has greater worries. Specifically, around unconventional well barriers, such as some of those mentioned above. Johnny Gundersen, principal engineer the PSA, said, “It looks like the industry’s main focus is reducing cost and time. We don’t mind that, but, it’s important to have robust barriers that won’t leak now or in the future.” But, he said, existing barrier verification methods are unfit for the unconventional or new barriers being developed. These still need to be tested and proving the new subsurface theories will be really challenging, he said.

“The question is, are we taking more risk than we used to? What’s the way forward? It’s challenging for companies but also for the regulator. The promise is robust barriers and no leaking wells. Verification and documentation of the well barriers are established requirements.” Higher focus needs to be given to this earlier, he said, and more subsurface data needs to be collected.