Norwegian energy company Equinor is continuously solidifying its position in Brazil.

Indeed, Equinor is considering participating in the upcoming tender of the surplus oil of the “Onerous Assignment”, which saw Petrobras awarded a certain pre-salt acreage — 5 billion-barrels of federal oil reserves for Petrobras stock — that the government intends to carry out in the second half of this year.

The Stavanger headquartered company is also focusing on the 16th Round of post-salt bidding and on the 6th Pre-Salt Auction, both confirmed for this year by the National Agency of Petroleum, Natural Gas and Biofuels (ANP).

Significantly, since 2017 Equinor has invested around $3 billion in asset acquisitions and nearly $2 billion in signature bonuses at oil auctions in Brazil. Equinor can also boast strategic partnerships with Brazil’s state-controlled oil company Petrobras, along with majors Shell and Total.

"The surplus of the Onerous Assignment may be an opportunity this year if it is commercially attractive," said the Executive Vice President of Development and Production of Equinor in Brazil, Margareth Øvrum, to Valor Econômico newspaper. "But we do not know the conditions yet."

Øvrum, who took over the company's top position in Brazil late last year, said she has a good relationship with the new government and is optimistic about business development in the country. She added that Brazil has a tradition of respecting contracts and that Equinor's plans for the country are long-term. According to Øvrum, Brazil is a priority area for the group, along with the U.S. and Norway.

"The opportunities in Brazil are enormous," said the executive. At the time, she also pointed out that Equinor and operator Petrobras have doubled their target of additional volume of recoverable oil and gas at the huge Roncador field in the Campos Basin — to 1 billion boe.

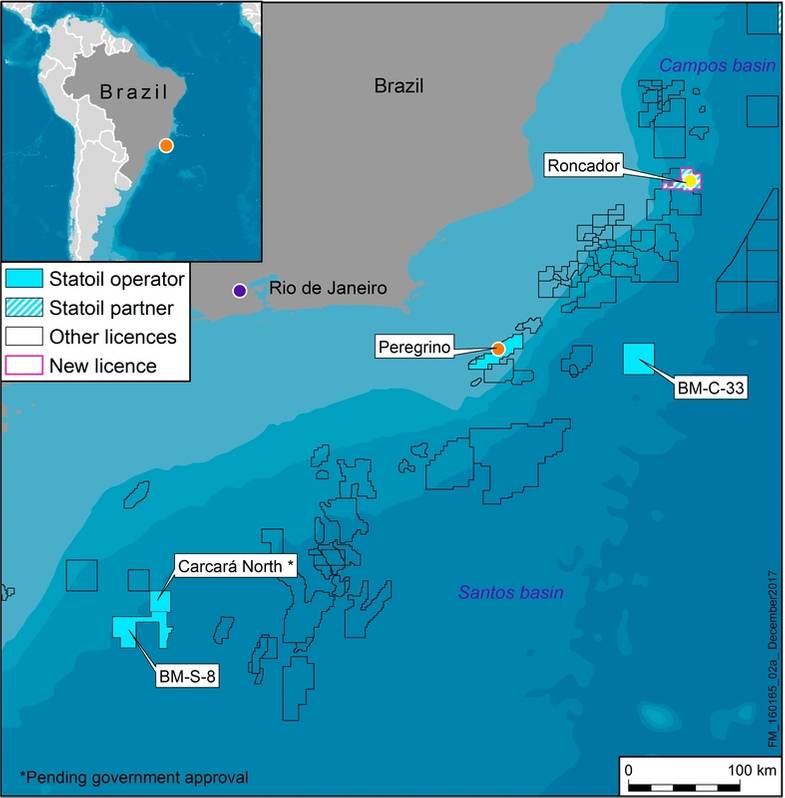

Roncador - Carcará Nort (Image: Equinor)

Roncador - Carcará Nort (Image: Equinor)

Equinor, which was originally planned to add only 5 percentage points to the 29% recovery factor, now plans to add 10 percentage points, coming close to a 40% recovery factor. According to the Equinor and the ANP, Roncador has nearly 10 billion boe "in place", with remaining recoverable volumes of more than 1 billion boe. In June last year, the two companies concluded a transaction in which Equinor acquired a 25% stake in Roncador. According to information from Petrobras, the Norwegian company paid $2 billion, in addition to an advance of $117.5 million given on the date of signing the contracts, in December 2017. In addition, Equinor will make contingent payments for investments in projects aimed at increasing the recovery factor, limited to US$550 million. Petrobras remains the operator of the field, with a 75% stake.

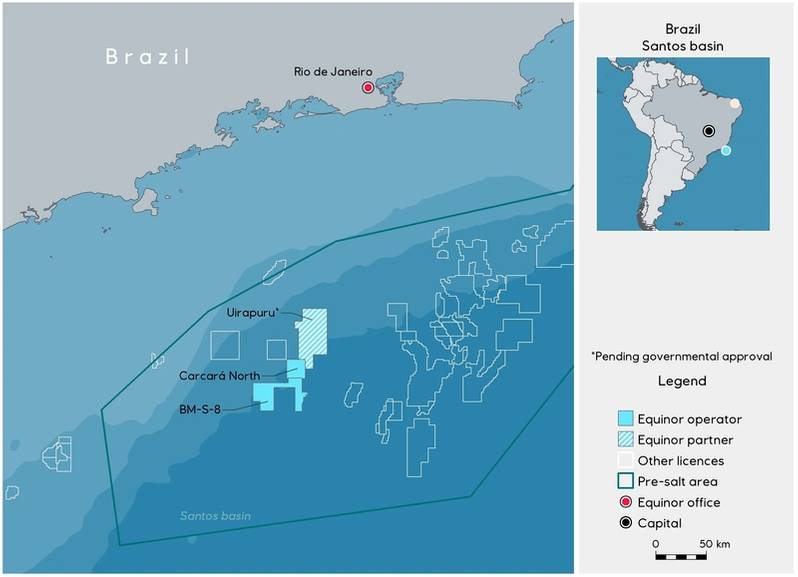

In the hugely promising Carcará area, in block BM-S-8, and the adjacent Carcará Norte block, in the Santos Basin pre-salt — where Equinor is operator, with 40% interest — the Norwegian firm will be making its biggest investment in Brazil, and it is where they are set to reap their biggest rewards.

Carcará is a large discovery with very good light oil and significant associated gas reserves. It was one of the largest discoveries in the world in recent years. Equinor's estimates the recoverable volumes from Carcará (including Carcará North) to be over 2 billion boe. The company expects to start production on site between 2023 and 2024.

| Equinor assets in Brazil | |||

|---|---|---|---|

| Asset | Location | Interest | Status |

| Peregrino field | Campos Basin | 60% (operator) | Production at around 70,000-80,000 barrels a day. Reserves of 300-600 million barrels of oil. |

| Peregrino Phase II | Campos Basin | 60% (operator) | Construction. Production from 2020 at around 60,000 barrels a day. Reserves of around 255 million barrels of oil. |

| Roncador field | Campos Basin | 25% | Production at 280,000 barrels of oil equivalent per day. |

| Block BM-C-33 including the Pão de Açúcar discovery | Campos Basin | 35% (operator) | Evaluation/development. Around 1bn boe in recoverable reserves. |

| Ten exploration blocks | Espírito Santo Basin | Six operated by Equinor | Exploration |

| Block BM-S-8 comprising the Carcará discovery and exploration prospects | Santos Basin | 36.5% (operator)* | Appraisal |

*Pending the closing of transactions with partners which are subject to certain conditions, including government approvals (interest in BM-S-8 is currently 76%).

(Source: Equinor)

Equinor assets in the Santos Basin (Image: Equinor)

Equinor assets in the Santos Basin (Image: Equinor)