Currently one in every five barrels produced in the United States comes from the Gulf of Mexico (GoM), and 88% of that output flows from reservoirs in water depths greater than 500 feet.

In 2016 the GoM produced 575 million barrels of oil, and in 2017 621 million barrels. In 2018, it was almost 639 million barrels, according to Scott Angelle, director of Bureau of Safety and Environmental Enforcement (BSEE). In 2017, 11 GoM facilities produced 50% of all offshore oil, which was 1% of the 974 producing facilities. A decade ago, it took 37 facilities to produce 50% of the total GoM production. The 37 facilities still represented only 1% of the total facilities producing at that time, which was 2,118.

“The change is because oil exploration has moved to deepwater areas,” Angelle says. “The Gulf is changing. There are fewer production facilities, and those facilities are larger, in deeper water and more technologically advanced.”

Angelle notes oil production on the shelf, where production began 70 years ago, has declined 77% in the last 20 years, while deepwater oil output has risen by 198% in the same period. Gas production on the shelf is down 92% in the same two decades while deepwater gas production has remained flat. About 50,000 wells have been drilled on the shelf compared to about 5,000 wells in deepwater, where production began about 45 years ago.

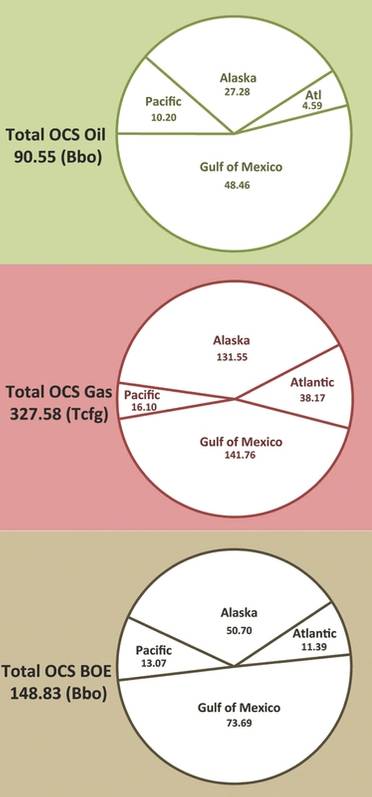

Mean undiscovered technically recoverable resources by type and region from BOEM’s 2016 assessment, which includes data and information available as of January 2014. (Source: BOEM)

Mean undiscovered technically recoverable resources by type and region from BOEM’s 2016 assessment, which includes data and information available as of January 2014. (Source: BOEM)

Optimism in the GoM’s resources is strong. Last year, Hess’s Stampede and Chevron’s Big Foot tension-leg platform developments went onstream. A host of pipeline and subsea tiebacks have begun producing or are slated to begin operation in 2019, and Shell’s Appomattox semisubmersible is slated to go online later this year.

When Appomattox begins production, “that’s going to tell us a lot,” William Turner, senior research analyst at Wood Mackenzie, says of the first Jurassic reservoir to begin production. “Everyone is going to be eager to learn more about that reservoir. It will tell about future development and investment in future Jurassic plays.”

The Appomattox semi is a “monster” facility that has “taken almost an urban planning approach,” Turner says, noting its potential as a game changer for future investment opportunities around Appomattox as a hub.

At the same time, Turner is keeping a watch out for final investment decision at Chevron’s Anchor field, which would be a play-opener in the lower tertiary. Analysis has indicated play-openers tend to be some of the most “significant finds” in that play, he adds.

Angelle notes some significant recent discoveries in the deepwater GoM include Chevron’s Ballymore find, Shell’s Whale discovery, and LLOG’s discovery on the Nearly Headless Nick prospect.

“There has been a recent upward trend in drilling permits approved in both shallow and deep water,” Angelle says, noting a 44% increase in applications for permits to drill new wells, bypasses and sidetracks from 2016 to 2018. He says 141 permits to drill were issued in 2016 and 202 in 2018. There’s been a 36% increase in wells spud on the outer continental shelf, with 139 in 2016 and 190 in 2018.

“Folks believe that the commodity prices are where they need to be on the crude oil side to spur investment,” he says.

Angelle believes the country’s predictable and reliable regulatory regime, coupled with a focus on safety, is attracting interest in developing the country’s resources.

“I think the word is out,” Angelle says. “The Gulf of Mexico is back, and America is interested in seeing investment there and is making it as competitive as possible.”

Last year was one of the safest years the offshore industry has ever had, and was the highest producing, Angelle says.

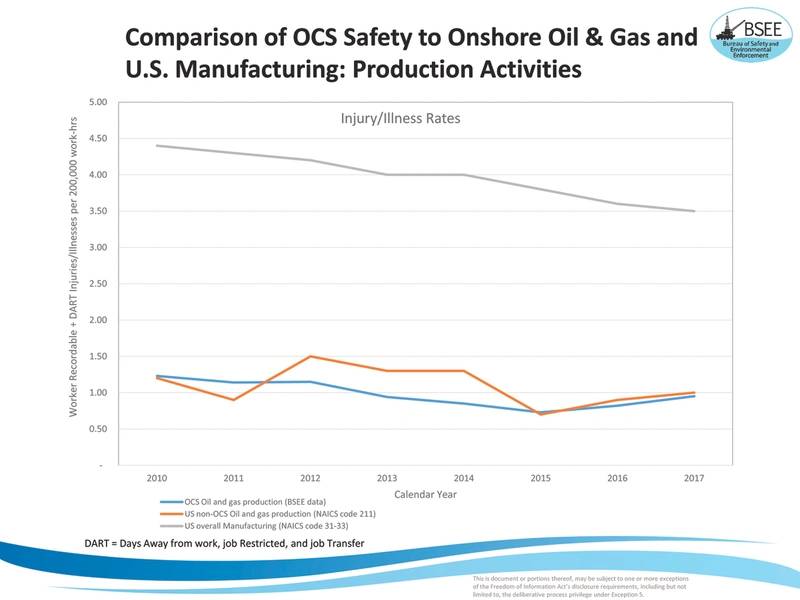

When comparing industry-wide illness and injury data since 2010, the offshore industry has a better safety record than the onshore oil and gas, construction and mining industries, Angelle says.

From 2016 to 2018, BSEE has increased overall inspections by nearly 21%. At the same time, participation in the SafeOCS voluntary near-miss reporting program shot up by about 2,700% from operators representing 3% of US Outer Continental Shelf (OCS) production in 2016 to operators representing 85% of OCS production in 2018.

One of BSEE’s recent safety initiatives, the Risk-Based Inspection Program, which was in pilot phase in 2017 and implemented in 2018, supplements BSEE’s annual inspection program and focuses on higher risk facilities and operation.

“It’s not either/or. It’s not safe operations and good environmental stewardship or robust production,” Angelle says. “We aren’t instituting an either/or but an and equation. We can have it all. We are proving to America that we can produce in a robust, safe and environmentally sustainable way.”

Last year was one of the safest years ever for the offshore industry. (Image: BSEE)

Last year was one of the safest years ever for the offshore industry. (Image: BSEE)

While the GoM has been a powerhouse of production, and there is some production off the coasts of California and Alaska, the country is working to open up other offshore areas to production.

Walter Cruickshank, Bureau of Ocean Energy Management (BOEM) acting director, says the country’s next five-year OCS leasing plan may open up more of the country’s coastlines to exploration. For decades, lease sales have been in the Gulf of Mexico and offshore parts of Alaska. No leasing has occurred on the West Coast since 1984 and none in the Atlantic for about 35 years, he says.

Development of the new National OCS Leasing Program, under the America First Offshore Energy Strategy covered by executive order 13795, began in July 2017 with information gathering. The first draft, released in January 2018, received about 2 million comments, which “was a record for us,” Cruickshank says. BOEM is conducting a detailed analysis of the proposed schedule of sales, and the second draft of the five-year plan was expected to be released this spring. The final draft of the plan could be approved around year’s end.

Walter Cruickshank, acting director, BOEM (Photo: BOEM)

Walter Cruickshank, acting director, BOEM (Photo: BOEM)

“What we’re seeing in this program, for the first time since the 1982-87 program was put together, is an analysis of the entire OCS,” Cruickshank says. “We believe there is still a lot of potential left in the OCS.”

There has been interest in seismic activity in the Atlantic, he says.

“There’s a lot of reprocessing of what (seismic) exists, and analogs from West Africa to better understand the resources, but seismic has not been collected there in over three decades. The technology then just couldn’t see as deeply under the seabed as current technology,” Cruickshank says.

BOEM geologists are also bullish on the GoM. “It is the view of our geologists that half of the total endowment of oil and gas in the Gulf of Mexico is not yet discovered,” Cruickshank says. “We think there is a lot left there to find.”

Alaska is an area with “a lot of promise” and BOEM geologists believe it holds 27 billion barrels of oil and over 130 trillion cubic feet of natural gas to be discovered.

“The draft proposed program includes Alaska planning areas, which could put the Arctic back on the table for leasing,” Cruickshank says. Currently, there’s some production off the coast of Alaska, and BOEM has approved the development and production plan for Hilcorp’s Liberty asset, which is entirely in federal waters.

There are still 34 producing leases offshore southern California, although a few decommissioning plans are expected there in the coming years, he says.