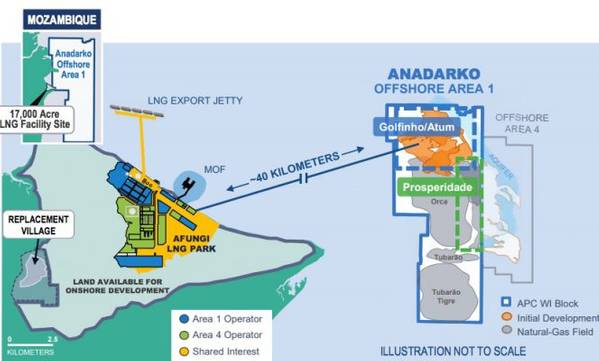

Anadarko Petroleum, the U.S. independent energy group in the midst of a takeover, said on Wednesday it was ready to make a final investment decision on its $20 billion liquefied natural gas (LNG) project in Mozambique on June 18.

Chief executive Al Walker met Mozambique President Filipe Nyusi on Tuesday, a statement from Anadarko said. A final investment decision on the Mozambique LNG project would be the largest outside of North America since 2013.

“With commitments for financing in place, off-take secured, and all other issues under negotiation successfully addressed, we are excited to take the next step with the expected announcement of a final investment decision (FID) for the Mozambique LNG project on June 18,” Walker said.

Anadarko had been finalising the financing for the huge LNG export terminal when Chevron Corp announced a bid for the company.

That bid was quickly followed by another from Occidental Petroleum, which went on to agree with Total SA to sell Anadarko’s Africa assets to the French oil major should it succeed in taking Anadarko over.

The LNG project, together with another export terminal planned by Exxon Mobil close by, will turn Mozambique into a top global LNG producer.

Anadarko’s partners in the Mozambique LNG project are Mitsui , Mozambique state energy company ENH, Thailand’s PTT and Indian energy firms ONGC, Bharat Petroleum Resources and Oil India.

(Editing by Louise Heavens)