Brazilian state-owned oil company Petrobras predicts that the pre-salt slice of its total oil production will rise from the current 49% to up to 60% this year. The company's director of Exploration & Production, Carlos Alberto Pereira de Oliveira, recalled that the national operator's goal is to reach 2.8 million barrels per day of oil and gas this year, a level that was already reached in early May.

In the first quarter of this year, Petrobras – which going forward will release production data every three months and not monthly as has been the norm to date – recorded production of 2.5 million barrels per day, down 5% in production compared to the same period last year. According to Oliveira, the decline was due to the volume of scheduled maintenance stops and the sale of assets.

But from now on, the trend is for increased production, since seven new floating production, storage and offloading units (FPSO) have become operational in the last 11 months, and the company intends to put another 11 units into operation by 2023.

“We have a longer commissioning (installation) period for the new FPSOs, since they are more complex. But this is already solved and we had scheduled stops that were in greater quantity,” said Oliveira.

“When we look to the future with the seven new platforms, production in May is already at 2.8 million barrels of oil and gas. This is important . . . At the beginning of next semester, we will have more scheduled stops, but this is already within our projection.”

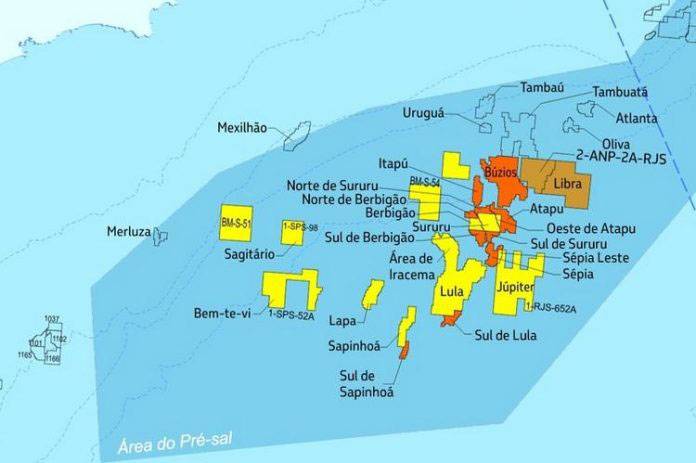

The pre-salt Santos Basin (Image: Petrobras)

The pre-salt Santos Basin (Image: Petrobras)

Although Petrobras is primarily focused on pre-salt development and selling assets abroad, the company has purchased geological packages and geophysicists studies in areas of Israel and Guyana.

Petrobras CEO Castello Branco has stressed that this does not mean a change in the company's policy, which is focused on investments in the country.

President Jair Bolsonaro, on a recent visit to Israel, said Petrobras could invest in the country. But, when asked if the investment in Israel would be on account of a request from President Bolsonaro, Branco said no: “Friends, friends, business apart. We do not have the strategy of turning into a global company. One thing is research, wanting to know and know more about the characteristics of other places where there are provinces of oil and unconventional gas. We want to know. There is no policy change. At the moment, there is no intention to invest outside of Brazil. We have no money."

Future investment plans

Petrobras plans to invest US$27 billion in the pre-salt and US$20 billion in the post-salt, over the next five years. The company should have another 11 production systems in the period, including seven in the pre-salt.

According to a Petrobras director Rudimar Lorenzatto, the company is preparing for a 20% increase in global energy consumption over the next 20 years, and is therefore ramping up exploration.

"Our agenda is based on exploration, [with a] focus on pre-salt and digital transformation," he said.

The company is expected to have 62 offshore exploration wells between 2020 and 2023.

Of the total investment, the oil and gas sector will account for R$1.4 trillion with three projects: the huge auction of the onerous assignment, a pre-salt round under a sharing regime and another round under a concession regime.

According to the Minister of Mines and Energy, Bento Albuquerque, the oil and gas auctions alone should yield between R$120 and R$130 billion for the Union (in grants). Of this total, around R$106 billion is forecast to come from the onerous assignment contracts.

CNOOC to expand production in Brazil

Petrobras is not the only company seeking to grow production in Brazil. Among other interested parties is Chinese oil company CNOOC, who is considering participating in a bidding round of Brazilian oil and gas areas scheduled for this year, said the president of the Brazilian unit of the company, Sheng Jianbo.

In addition to the pre-salt oil auction, on November 7, Brazil plans to hold another round of sale of fields in the major producing region, from surpluses in the onerous assignment area, scheduled for October 28.

CNOOC, which is already a Petrobras partner in the mega area of Libra, estimates that this project in the Santos Basin pre-salt is progressing well, with the EWT producing 58,000 barrels of oil equivalent per day, Jianbo said. He also stated that the company is looking for a partner for Bloco-592, in Espírito Santo.

The Pioneiro Libra FPSO (Photo: CNOOC)

The Pioneiro Libra FPSO (Photo: CNOOC)