Australia-based Woodside Energy has awarded Halliburton nine conditional contracts for drilling and completion services for Senegal's first deepwater offshore oil development, the oilfield services company announced on Monday.

The SNE Field Development Phase 1 drilling campaign, which is due to start in late 2020 or early 2021, is for drilling and completing 18 wells with up to eight optional wells over an estimated three- to four-year term. The contracts awarded include drilling, logging, cementing, lower completions, e-line/slick line, coiled tubing and well testing services, Halliburton said.

The multi-contract award follows an earlier conditional award to Halliburton in December 2018 for drilling and completion fluids services, the services company said.

Halliburton said it plans to begin initial engineering work in Perth, Australia, later this year, and then will transfer the work to Dakar, Senegal in 2020.

“We are excited to win this work and to provide services from our multiple product service lines on what is likely to be the first deepwater oil development in Senegal,” said Shannon Slocum, senior vice president of the Eurasia, Europe and Sub-Sahara Africa region for Halliburton. “In addition to our services, Halliburton will invest in Senegal through constructing facilities, hiring local staff and potentially utilizing local vendors/suppliers.”

Woodside is the operator of SNE and has 35% interest. Its partenrs in the field are are Cairn (40%), FAR (15%) and Petrosen (10%).

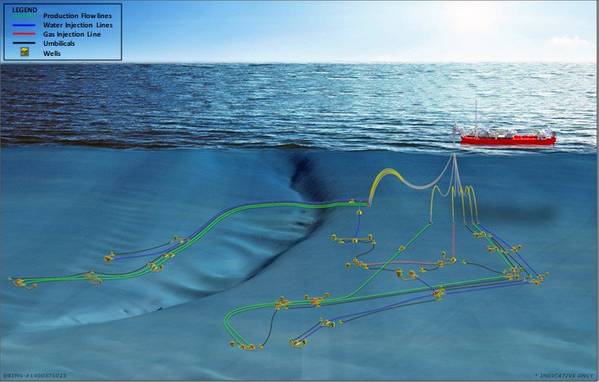

The Phase 1 development concept for the SNE field is a standalone floating production, storage and offloading unit (FPSO) with subsea infrastructure. It will be designed to allow subsequent SNE development phases, including options for potential gas export to shore and for future subsea tiebacks from other reservoirs and fields, Woodside said. First oil production is targeted in 2022.

In December 2018 Woodside awarded the subsea front-end engineering and design (FEED) contract for SNE Phase 1 to the Subsea Integration Alliance, a partnership of OneSubsea, Schlumberger and Subsea 7.

In February 2019 Woodside awarded Modec the FEED contract for the FPSO, due to be the first production facility offshore Senegal. According to World Energy Reports (WER), the FPSO will be designed to have plant capacity for 90,000 b/d oil,100 mmcf/d gas, 95,000 water production and be capable of storing 1.5 million barrels. The FEED contract is intended to morph into an engineering, procurement and construction (EPC) contract and lease, subject to a final investment decision (FID) on the project expected this year.

The SNE field is located within the Sangomar Deep Offshore permit area, approximately 100 kilometers south of Dakar, Senegal. World Energy Reports lists best estimate 2P reserves on SNE as 573 million barrels. Oil is 32° API oil gravity. Phase 1 will target oil production of 230 million barrels via 11 producer, 10 water injection and two gas injection wells, WER says.

Two subsequent phases will target a further 250 million barrels via 32 to 34 additional wells. According to WER, Phases 2 and 3 are anticipated to begin two to four years after Phase 1.

WER reports expected development expenditure for the project is in the range of $13 to $15 per barell and expected opex is in the range of $12 to $14 per barrel, including the FPSO lease.