Brazil's Senate passed the main text of a bill late on Tuesday defining the distribution of proceeds from a blockbuster auction of oil prospecting rights, a key milestone for the enormous offshore region known as TOR - the 'transfer-of-rights' area.

The bidders who win exploration and production rights in the massive November 6 auction will be obliged to pay the government a combined signing bonus of some 106.5 billion reais ($25.8 billion), making it the largest oil bidding round in history, according to Brazilian authorities.

The fields are unique as Brazilian state-run oil firm Petroleo Brasileiro SA, better known as Petrobras, has already done significant exploration work in the area. As a result, it is already known to hold billions of barrels of untapped crude, reducing so-called exploratory risk.

Brazilian oil regulator ANP now estimates there are some 6 billion to 15 billion barrels of surplus oil in the TOR area, in addition to the original 5 billion barrels granted to Petrobras - a glittering prize for the world's oil majors.

But the TOR auction is also unusually complex, presenting unique challenges for any potential bidder.

What is the TOR area?

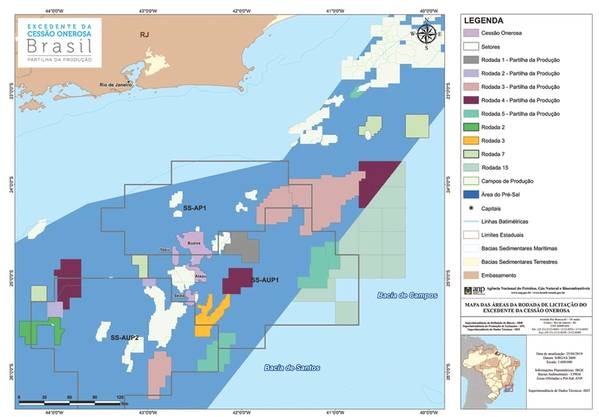

TOR is a roughly 2,800-square-kilometer zone off the coast of southeastern Brazil, where billions of barrels of oil are trapped beneath a thick layer of salt under the ocean floor, according to surveys. It is part of a larger oil-producing zone known as the 'pre-salt', which has emerged as one of the world's most promising conventional oil plays.

The area was defined in a 2010 deal between the government and Petrobras, when the giant company raised some $70 billion in the world's largest-ever share offering at the time.

In order to maintain control of the company, the government granted Petrobras the rights to extract 5 billion barrels of oil in the TOR area in return for new shares worth 74.8 billion reais, or about $42.5 billion at that era's exchange rate.

The deal was complicated by a provision that provided Petrobras and the government room to revise some terms when fields were declared commercially viable, taking into account shifts in oil prices, production costs and other variables.

Petrobras began declaring parts of the TOR area commercially viable in 2013 and haggled over contract terms with the government for the better part of six years, as oil prices swung sharply and studies showed larger reserves in the area.

Brazil's cash-strapped government had not previously been able to offer that additional oil at auction because it had not come to terms with Petrobras on the revised TOR contract.

But those talks, which had long seemed stuck, accelerated after President Jair Bolsonaro took office in January, tapping a new economic team in his cabinet and a new chief executive officer for Petrobras. In April, the government agreed to pay Petrobras more than $9 billion to settle the dispute, and scheduled the TOR bidding round for October.

The auction was later delayed to November 6.

How will the auction work?

The TOR area is divided into four zones: Buzios, Sepia, Atapu and Itapu.

The winners of those four areas will have to pay signing bonuses to the government of 68.2 billion reais, 22.9 billion reais, 13.7 billion reais and 1.77 billion reais, respectively.

While the signing bonuses are fixed, the fields will be awarded to the companies or consortia that offer the highest 'profit oil' — the percentage of oil from the respective zones that will go to PPSA, the state agency responsible for managing the oil delivered to the government.

The minimum offers for profit oil have been set at 23.24% for Buzios, 27.88% for Sepia, 26.23% for Atapu and 18.15% for Itapu.

Petrobras has already exercised its preferential rights to be the operator in Buzios and Itapu, so it will have at least a 30% stake in those zones.

But the company could also end up being the operator in Atapu and Sepia. Petrobras retains the rights to operate throughout the TOR area, given that it still has rights, under the 2010 deal, to extract 5 billion barrels from the zone.

To date, Buzios is the only part of the TOR area in which Petrobras is producing oil.

As a result, companies or consortia that present winning bids will need to come to a so-called 'co-participation' agreement with Petrobras in separate negotiations. The deadline for Petrobras and winning parties to strike those deals is 2021.

Separately, winning companies and consortia will be required to compensate Petrobras for exploratory and infrastructure work already done in the region. While there is no consensus estimate for how much that might add up to, it is widely believed to be at least several billion dollars.

Who is interested?

The November auction is expected to attract a range of major global oil companies, which have been discussing the opportunity with government officials in recent months.

Fourteen firms were approved to participate: BP PLC, Chevron Corp, China National Oil and Gas Exploration and Development Corp (CNODC), China National Offshore Oil Corp (CNOOC), Ecopetrol SA, Equinor ASA, Exxon Mobil Corp, Galp Energia SGPS SA, Petrobras, Petronas, Qatar Petroleum, Royal Dutch Shell PLC , Total SA and Wintershall Dea GmbH.

However, Total said last week that it was dropping out of the process. Galp and BP have said publicly that they believe the assets are getting expensive.

Ecopetrol, Qatar Petroleum and Wintershall are approved to participate only as non-operating members of consortia.

Nonetheless, the assets are seen as a prize given that they are guaranteed to hold massive amounts of oil. A push in Mexico under leftist President Andres Lopez Obrador to increase state control over the industry has also made Brazil the most sought-after conventional oil play in Latin America.

Not least among the interested parties is Petrobras itself. While the firm is aggressively cutting debt, CEO Roberto Castello Branco has said the $9 billion TOR payment from the government agreed last April would be used to participate in the auction.

Among the companies with exploration and production assets adjacent or relatively close to the TOR area - offering potential cost savings - are Shell, CNOOC and China National Petroleum Corp Ltd, the joint owner of CNODC with PetroChina Co Ltd.

(Reporting by Gram Slattery Editing by Kenneth Maxwell)