Petrogas NEO UK has hired the UK-based oilfield services provider Petrofac to establish its North Sea operation.

Petrogas NEO UK is a company formed last year by the Norwegian private equity fund HitecVision and Omani oil group Petrogas.

Petrofac said Tuesday that it had been selected by Petrogas NEO to establish the oil and gas company's North Sea operation following its recently announced asset acquisition.

As previously reported, Petrogas NEO in July 2019 agreed to buy French oil major Total's 10 UK offshore fields for $635 million. The assets were formerly owned by Maersk Oil which Total had acquired in 2018.

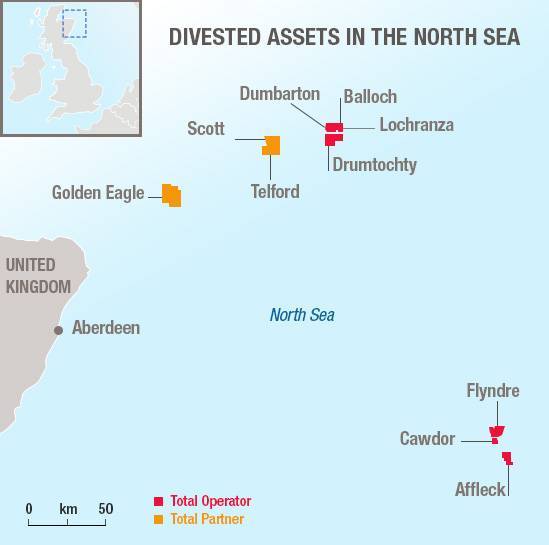

The fields bought by Petrogas NEO were deemed non-core by Total. The package included Total's operating stakes in Balloch, Dumbarton, Lochranca, Flyndre, Drumtochty, Cawdor, and Affleck offshore fields, as well as Total's non-operating stakes in CNOOC's fields Golden Eagle, Scott and Telford.

The map shows the offshore fields sold by Total to Petrogas NEO in 2019 (Image by Total)According to Petrofac, the two-year deal with Petrogas NEO is worth around $50 million.

The map shows the offshore fields sold by Total to Petrogas NEO in 2019 (Image by Total)According to Petrofac, the two-year deal with Petrogas NEO is worth around $50 million.

Under the contract, Petrofac will integrate the services of Petrogas NEO's Operations, Projects, and Well Engineering service lines.

"As well as assisting in the transition of operations on the Quad 15 & Flyndre area assets, Petrofac will also provide ongoing operational, maintenance, engineering, and construction support; and deliver well engineering and project management support services for Petrogas NEO UK’s activities," Petrofac said.

Nick Shorten, Managing Director for Petrofac’s Engineering and Production Services (EPS) business in the Western Hemisphere, said the deal was a significant new strategic partnership in the company's core UK market.