There’s a shake-up happening in the pipeline inspections business. More evolved remotely operated vehicles (ROV), digital aspirations and unmanned surface vessels (USV) are driving a new era of data acquisition and deliverables.

It’s offering something of a revolution in the amount of new insights that operators can acquire on their pipelines, while reducing offshore campaign time.

Some of those operating in the space are Equinor, Shell and BP. A big driver has been reducing cost, as well as minimizing safety exposure. It’s the latest evolution in this space, Tom Glancy, Advisor Pipeline Mapping & Geographical Information at Equinor outlined at an October Hydrographic Society meeting in Aberdeen.

He says remote vehicle operation – during his own career – has gone from untethered manned submersibles (putting humans at risk) to ROVs, to unmanned underwater vehicles (UUV, usually referred to as autonomous underwater vehicles/AUVs, while not being wholly autonomous, highlights Glancy). While the move to ROVs removed humans from risk, the tether connecting them to a support vessel limited their scope. AUVs meant surveys could be done faster, but, AUVs weren’t able to stop and do detailed spot assessments if and when an issue was spotted.

A more recent evolution has been toward fast ROVs. Equinor has agreements with the two main providers, DeepOcean, using the Superior ROV, and Reach Subsea with the Surveyor Interceptor ROV, says Glancy. While both are tethered, they can survey faster than an ROV, at 4 knots (kt) compared with 2kt, says Glancy, thanks partly to their onboard HD imaging and laser packages. But, that does also means they come with a support vessel – and over overheads that comes with.

These fast ROVs have become a popular tool, completely changing the traditional pipeline inspection workflow. “Over the last two-three decades, pipeline inspection been a relatively simple workflow; one campaign, utilizing two contractors, doing two separate surveys,” starting in April and ending in August, Calum Shand, senior project surveyor at Shell told Offshore Europe in Aberdeen earlier this year. First, a geophysical survey vessel tows a remotely operated towed vehicle (ROTV) with a side scan sonar over the open water pipeline sections. Anomaly reports are then created, necessitating a second survey where a work class ROV (with a DP2 class vessel), undertakes spot dives and acquires video footage which is then used to plan any further rectification. But, “it’s time consuming and relatively inefficient, with regards to using a two-vessel campaign,” says Shand.

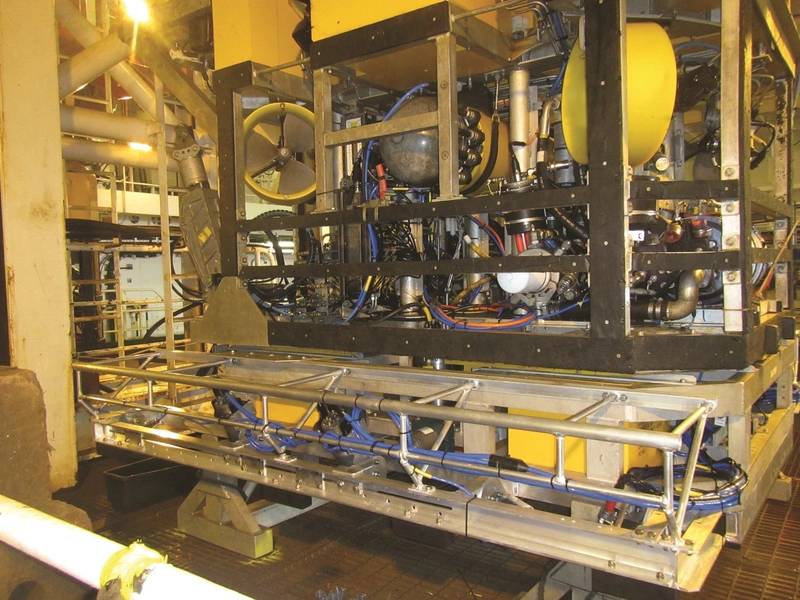

The Superior SROV (Photo: DeepOcean)

The Superior SROV (Photo: DeepOcean)

Increasing efficiency

For Shell, with more than 200 pipelines and umbilicals, totaling 3,000 kilometers (km) in length, in the UK North Sea alone, easier, faster surveys is a tangible bonus. In 2018, Shell ran a new survey using DeepOcean’s “Fast Digital Imaging Service”. This involved a Kyst Design Superior ROV, with auto tracking capability, operated from the Edda Flora vessel on a 45-day nonstop campaign, starting in September 2018. The Superior was fitted with Teledyne dual head multi-beam echo sounders, Edgetech side scan sonar and sub bottom profiler, pipetracker, a CathX ultra-high definition (UHD) cameras (x3) and high specification inertial navigation. An ability to launch the vessel in up to 4.5-meter seas meant work could be started earlier in the season and run late into Autumn, says Shand, with speeds of 5kt in acoustic mode and 3.5-4kt for pipeline inspection.

Furthermore, having the side scan sonar meant the vessel could break out of the pipeline survey to execute “ad-hoc fly-by jobs”, such as a jack up rig site survey in the Shearwater field, says Shand. But, the biggest benefit was the UHD stills created by the CathX system, that enabled “incredible detail”. “When you zoom in, you presented with sub-centimeter detail and can make inferences about what’s going on, such as scoring on the top of a pipe from fishing interference,” he says.

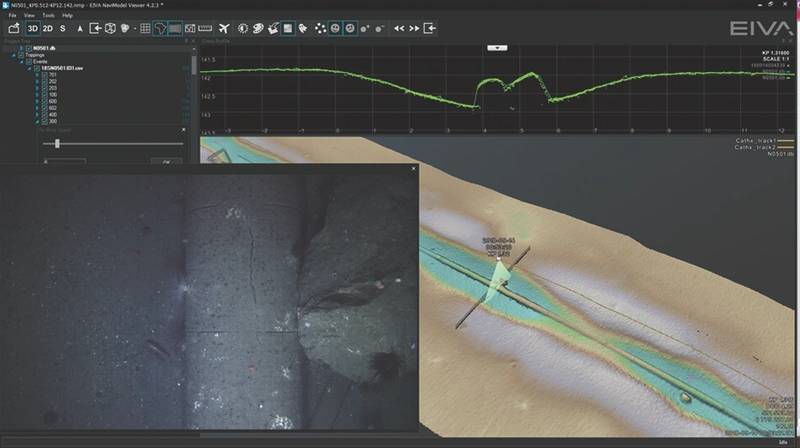

Combined with high-resolution multibeam bathymetry data, these UHD photos offer a completely new way of review incidents and anomalies, through 3D mesh models and color point clouds, with automatic comparison of annual survey data sets now possible, he says. “These data sets are creating quite a stir,” says Shand. “It’s a radical change.”

(Image: Shell)

(Image: Shell)

Data driving decisions

With this capability, remediation can also be faster. For example, on discovering a new pipeline free span, Shell was able to export the muiltbeam data and pass it to the contractor – Van Oord – who were able to accurately calculate the amount of rock needed. What’s more, pipeline engineers now have a better ability to compare legacy ‘as-built’ information, with recently “as-found” multibeam data.

This year [2019], Shell went back out again, this time with Reach Subsea using the Surveyor Interceptor vehicle, designed with MMT and Kyst, fitted with boom arms. These provide better circumferential coverage of the pipe. “We have gone from doing one campaign with two vessels to one campaign with a single vessel / contractor,” says Shand. “We’ve saved around £800,000 ($1 million), compared with the old way of doing it, and emit less carbon dioxide (CO2) as a consequence” largely thanks to 50% less vessel time.

There has been a learning curve, especially around trying to automate the associated data processing and then in handling the sheer volume of data generated, adds Shand. There are also some barriers to doing this work differently, related to behaviors and workflows. But, Shand says the potential is significant, including integrating external, GIS-linked, 3D modeled survey data with CAD models and also internal pipeline inspection data, enabling a powerful view of the entire pipe system. Adding machine vision and deep learning on to that, where rocks, debris, scouring, etc. detection is automatic, will enable more automated operations and greater ability for predictive analytics instead of reactive operations, says Shand.

(Image: Shell)

(Image: Shell)

Fast Digital Imaging Inspection

Fast Digital Imaging Inspection (FDII), moving from video to digital that can enable automated eventing, and increasing inspection speed, has also been a driving force for BP. Eric Primeau, a Senior Technology Specialist for BP, told Subsea UK’s Underwater Robotics conference in Aberdeen that it’s about taking a bottom-up approach, selecting a sensor package, then the vehicle that package should go on, instead of picking the vehicle first.

The company ran its first FDII campaign with DeepOcean in 2017, performing 478km of pipeline inspection, with UHD digital imaging, laser, dual head multibeam and side scan sonar at an average of 5.1km/hour. The project was completed in 94.7 hours compared with 578 hours predicted with a traditional methodology. Final data included 3D mesh and colorized laser point clouds.

BP has followed up with another two campaigns in 2018, with MMT and i-Tech7, and then another in 2019, again with i-Tech7. Throughout these projects, BP has also been testing non-contact field gradient cathodic protection sensors. Like Shand, however, processing the data gathered by this approach has been a challenge.

(Image: BP)

(Image: BP)

Going without a manned surface vessel

Yet, this method still requires use of a manned support vessel. So, operators have been trailing use of USVs for pipeline inspection. Earlier this year (2019), BP tried pipeline inspection using an XOCEAN XO-450 USV – a first for the North Sea. Deploying the USV out of Peterhead, in northeast Scotland, BP surveyed a shallow water section of the 30in abandoned Miller export pipeline. On a second run, from just 2.5m water depth to 40m depth over a 4.75km section of pipeline, the USV was set up with an R2Sonics Dual Head multibeam system, Valeport SWiFT sound velocity profiler and Applanix POSMV OceanMaster for vehicle heading, attitude, heave and velocity.

Success on the Miller project led BP to commission the same system for deployment in the Caspian Sea in Azerbaijan for inspection of hundreds of kilometers of shallow water pipelines (12-25m water depth). “The offshore industry is on the cusp of great change as the use of USVs increases and functionalities develop. It’s challenging the use of manned vessels for routine inspections,” Primeau says. “The USV is becoming a standard tool for performing high resolution seabed surveys and it’s also a gateway for developing complementary underwater systems, such as the integration of ROVs and AUVs.”

Shell’s also been looking at USVs, Shand says, testing an XOCEAN XO-450 along the coast north of Aberdeen on a short trial survey in 2019. Here, while data and bandwidth will be a challenge, the roll-out of 5G and use of the cloud will help, opening the door to real-time inspection and analysis, he says.

Equinor has also been using USVs for pipeline survey. In September 2019, XOCEAN completed pipeline surveys for Equinor off the east coast of England and the north coast of Germany. Using MBES, four pipelines totaling 120 miles in length in from 2-40 meters water depth, were surveyed in water depths from 2-40 meters, XOCEAN has said. Another USV vessel operator, 4D Ocean, has performed inshore surveys for Equinor earlier this year with a hull-mounted MBES.

XOCEAN has also done what it’s claimed is the first trailing wire cathodic protection (TWCP) pipeline survey from a USV, also in September 2019. This involved TWCP surveys, with multibeam sonar, for PX Group on pipelines up to 9km from shore near Shetland and off the coast of Aberdeenshire. PX Group operate and maintains, for North Sea Midstream Partners, the St Fergus Gas Terminal and associated Frigg UK and the Shetland Island Regional Gas Export System (SIRGE) offshore pipelines which link the Aberdeenshire facility with the North Sea.

(Image: Shell)

(Image: Shell)

Combining USVs with AUVs

However, sensors onboard USVs will only reach so deep. If deeper water pipeline surveys are to do done with USVs, an alternative approach is needed. That’s meant deploying an AUV from a USV – and that’s just what Swire Seabed has been doing for Equinor, in Norway. In October 2018, in the first of two projects, it deployed a Kongsberg Hugin AUV with a small surface vessel that enabled it to maintain position updates and communication to a control from in Bergen. The inspections were performed on three pipelines between Kollsnes (an onshore plant) and Troll A (just 65km off Bergen). In total, 180km of pipeline was inspected over two AUV dives with bathymetric, synthetic aperture sonar and HD image data acquired to verify the subsea pipelines’ integrity.

In July 2019, Swire then laid claim to the “first fully unmanned offshore pipeline inspection ‘over the horizon’”, surveying up to 100 km from the shore, again for Equinor. This saw a Hugin with MBES, side scan sonar and CathX camera system, used in conjunction with a SEA-KIT Maxlimer USV, made by UK firm Hushcraft. Four pipelines, totaling 175 km in length, were surveyed, again using bathymetric, synthetic aperture sonar and HD image data. Using the SEA-KIT Maxlimer meant the Hugin could stay offshore doing the survey for longer – docking at sea in the USV to recharge, as well as using it as a communications and control link to the remote center in Bergen. Swire says that by using a small unmanned vessel, fuel use – and carbon emissions – are reduced by 95%. Tom Glancy puts it another way – putting people offshore is reduced 100%. His ultimate goal is to have no surface vessel at all.

[Editor’s note: Swire Pacific Offshore (SPO) announced in November it will shutter its Swire Seabed subsidiary from the end of February 2020 as oilfield services firms continue to feel the effects of the pronged industry downturn. Vessels currently managed by Swire Seabed will be operated and marketed as part of the SPO fleet based in Singapore.]

The SEA-KIT housing a Hugin AUV for remote pipeline operation. (Photo: Swire Seabed)

The SEA-KIT housing a Hugin AUV for remote pipeline operation. (Photo: Swire Seabed)

The next steps

Some are working on this. In 2018, Modus Seabed Intervention deployed one of its HAUVs (a modified Saab Seaeye Sabertooth AUV) offshore NW Australia to perform approximately 240km of pipeline survey using a CathX Scout laser profiling and HD imaging spread alongside a multibeam echosounder (MBES). While this was performed with the HAUV on a tether from a vessel, for real-time data collection, it would be possible without at tether, the firm, which has more projects in the pipeline, as it were, says.

Oceaneering’s Freedom hybrid vehicle, while much promoted with regards to subsea resident vehicles, was in fact initially designed for autonomous pipeline survey. Oceaneering’s key goal was to have an efficient aerodynamic vehicle that could stop and carry out additional inspection work, if it detected an anomaly. Indeed, Steffan Lindsø told an Underwater Intervention Drone demo event near Stavanger in October that vehicle’s first project, in 2020, would be a pipeline inspection, “probably in the UK”.

Kawasaki Subsea is also testing its second-generation vehicle, which incorporates pipeline tracking for survey inspection, offshore Japan. This year (2020) it will come to total to test pipe tracking with DeepStar and the Nippon Foundation. There’s been disruption in the pipeline inspection space and there more yet to come.

Machine vision technologies are also helping to improve how pipeline surveys are provided. i-Tech 7, part of Subsea 7, is one of those providing close-inspection fast digital inspection services, increasingly supported by automation.

(Photo: i-Tech 7)

(Photo: i-Tech 7)

FDII

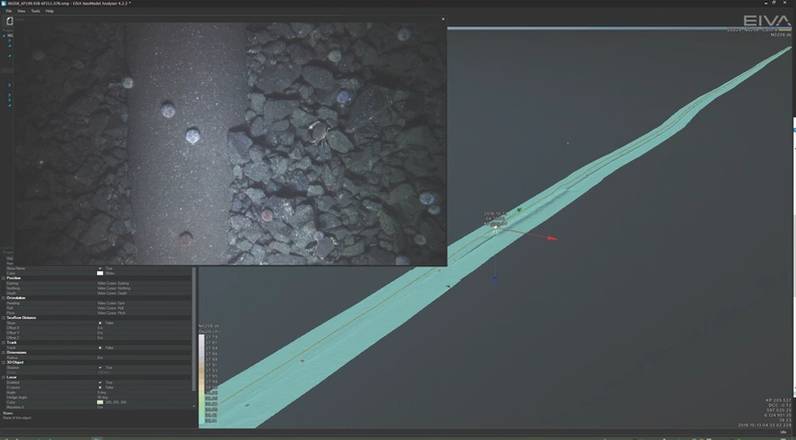

Its fast digital inspection pipeline services are provided via a dedicated skid which can be easily shipped and mobilized on board any of the work class ROVs in its fleet, depending on where services are required. The skid is fitted with a modified CathX Pathfinder suite, which has three ultra-high definition cameras – port, center and starboard – laser profilers and a pilot camera, synchronized between still images (a safety feature, so that the high-powered strobing LED lights do not influence the ROV pilot’s view).

Using a digital imaging suite like this means surveys can be run faster, at 3-4.5km/hour, compared with video-based surveys which have traditionally been run at 1km/hour to allow manual eventing online and to avoid blurred imagery, says Danny Wake, Chief Surveyor, i-Tech 7. A general visual inspection project for BP, in 2018, which covered eight pipelines, with a total length of 310km, plus two structure inspections, saved 10 vessels days (taking just over 14 days) against traditional pipeline inspection speeds. Equivalent savings were realized for the 2019 FDII pipeline inspection campaign for BP, with the added benefit of contributing to reduced CO2 emissions.

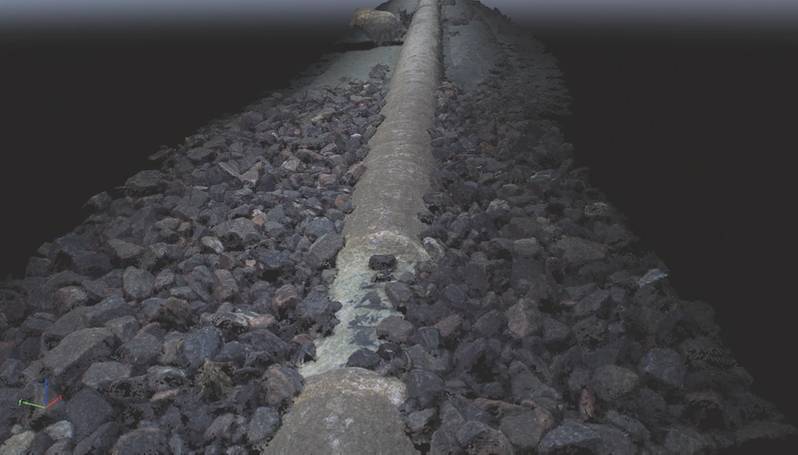

Pipeline engineers also get orthomosaics and 3D models of the pipeline which can be located spatially (rather than sequentially, like video). But that’s not all. I-Tech 7 has been working with US IT, science and technology firm Leidos on ways to automate the data processing routines to provide useful information to engineers faster. For example, automatically analyzing imagery to extract images containing possible events, thereby dramatically reducing the amount of imagery to be reviewed by a human. i-Tech 7 ran its first survey using these techniques this year (2019).

Interestingly, it’s a technique not limited to digital imagery. Some 60% of the algorithms developed for digital inspection will also work on video, says George Gair, Global Inspection Manager at i-Tech 7, making broader use of this technology.

“The holy grail is automatic classification and eventing,” says Wake. “We’re making steps towards that, tuning the algorithms, increasing automation, starting with machine vision that detects possible events.” The next step after that is doing the detecting live, giving engineers faster access to inspection results so they can act on them more quickly.

(Image: i-Tech 7)

(Image: i-Tech 7)

Despite the hype around these types of technologies, including machine learning, which use computing power to compare millions of images and detect specific attributes, it’s not that easy, especially in an industry that likes to do the opposite to standardized designs. Having the training data – images of pipelines – is also difficult.

But, about 90-95% of the pipeline integrity issues that are found tend to be freespan and burial exposure related, says Gair, so this has been the company’s main focus. Damage, which tends to be atypical, will take more time. Humans will also still be needed in some parts of the process, he says.

In terms of vehicle platform, i-Tech 7 has stuck with ROV-based skids. While using AUVs also helps run surveys faster, they tend to swim higher above the pipeline and don’t necessarily carry the full FDII sensor packages that offer such comprehensive view of the pipe, says Wake. While there has been focus on having systems that are able to stop and gather more data if an anomaly is detected, he says, with the FDII data, where you can see the pipe from more angles than just from above in ultra-high resolution, engineers already have all the information they could need – they’d not need to go back and do more detailed inspection.