With three Chinese cities and about 23 million people “quarantined”, the newly formed corona virus looks set to disrupt all from the oil price to crew movement to the ability of managers to travel unobstructed — that’s if it gets that bad.

Already key fabrication centers Singapore and Korea are reporting corona-cases. Does it mean anything?

Chinese investors have shown they’re especially worried about what travel restrictions might do to trade and internal travel in China, as homes in the interior of the country are cordoned off. Analysts in Scandinavia are noting the falls on Asian stock exchanges as merely that, for now.

Norwegian DN points out that during the six-month run of the SARS virus in 2003, the oil price dropped 29 percent over six months. They cited DNB Markets and Platts reporting that Chinese travel in China and from cities like Wuhan to other Asian energy centers is worth about 300,000 barrels of oil demand per day.

SARS and coronavirus are said to be related, but the latter could yet mutate into a more virulent “transmission stage”. Like SARS, the new pathogen has spread across borders, judging by the latest news reports.

Seemingly on expectations of further curtailed travel and quarantined Chinese cities, Brent has fallen two days in a row. WTI, too, has dropped.

On Thursday, North Sea Brent was at $62.84 late in the European business day, or down $1.37 over yesterday’s close on the continent. That slide came after US crude stockpiles were reported.

The worst effects on oil’s buoyancy are what DNB Markets says are “uncertain growth outlook and signals about growing American crude oil stockpiles”. They noted Wednesday’s WTI single day drop of $1.50 to $56.76 after inventory reports.

Two days of increasing inventory might be behind the drops. Even the IEA points to less demand and some “over-supply”.

Correlation contradictions

Yet, as a Chinese man from Wuhan tests positive for the virus in fabrication town, Singapore, it’s worth a look at a history of viruses versus oil. More pertinently, though, yard activity means Singapore hotel stays for visitors from East and West (the infected person stayed at Singapore’s Shangri-La’s Rasa Sentosa Resort).

But back to the oil price and the flu. Judge for yourself whether there’s a connection:

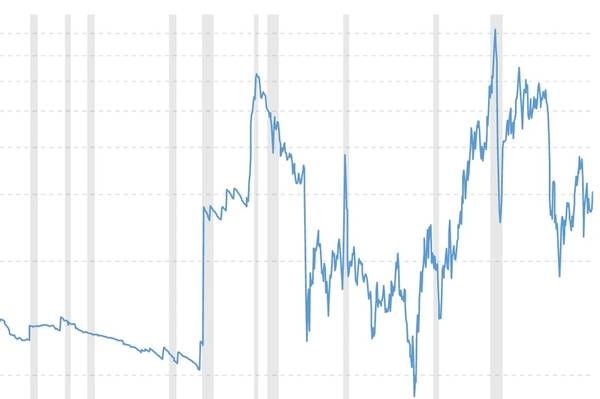

The 2009 swine flu “pandemic” lasted from early 2009 to late 2010. In that time the price of oil doubled from $51 to $107.

The bird flu “epidemic” of late 1997 forced the slaughter in Hong Kong of 1.3 million fowl. WTI dropped during the worrying months from $39 to USD 28, before dropping all the way to $18 in September 1998.

In contrast to newspaper reports mentioned above, the SARS epidemic in late 2002 and 2003 saw little change in the oil price range. WTI fluctuated between $42 and $43 over those two years.

And perhaps reductions in air travel have little effect, too, as refineries can use stores. During the March-April 2010 ash cloud crisis caused by volcanic eruptions in Iceland, over 107,000 flights were cancelled over eight days. European air travel was cut by a half.

And WTI rose about two dollars to $101.