The long awaited first ever offshore licensing by Senegal has finally been launched as the West Africa country inches closer to achieving its national medium- and long-term hydrocarbon sector investment plan and drive to transform the upstream resource into a source of clean electricity generation.

The launch of the licensing round this week in Dakar, Senegal by the country’s National Oil Company, Société Nationale des Pétroles du Sénégal (PETROSEN), is also good news to seismic data generators and providers as it opens new business opportunities in the lucrative offshore West Africa region where a notable increase in demand for 2D seismic, 3D seismic, multibeam and seafloor sampling solutions has emerged.

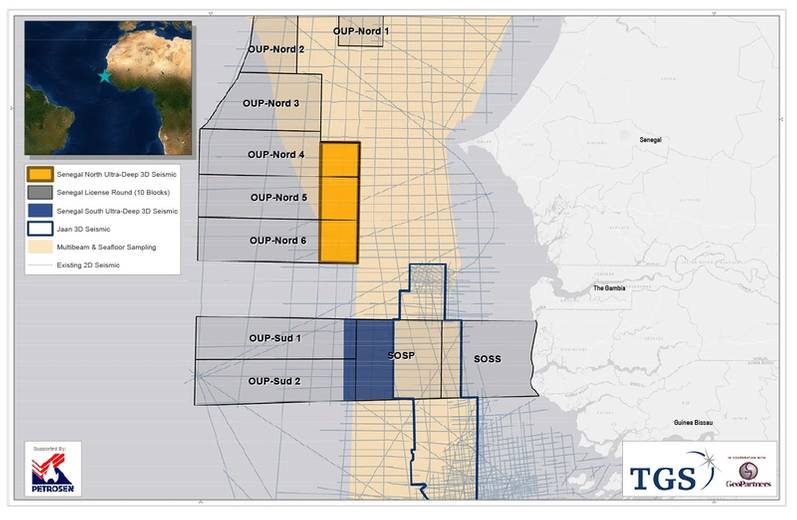

According to PETROSEN, the licensing round, which comprises 12 offshore blocks, including ultra-deep ones in the Mauritania-Senegal-Gambia-Guinea Bissau-Conakry (MSGBC) basin, which has recently recorded several high-profile oil and gas discoveries, will also be marketed in planned events in the UK and US in late February.

With the promulgation of Senegal’s new petroleum code last year, the licensing of these offshore assets is expected to be more structured and transparent as the West Africa offshore investment space gains more traction with the international oil companies and also providers of associated hydrocarbon exploration and production hard and soft solutions.

And now with the launch of Senegal’s offshore licensing round seismic data providers have an opportunity to trade with PETROSEN and potential upstream investors in making available detailed data on the existing shallow, deep and ultra-deep assets ready for acquisition.

Already, global seismic data provider TGS, which boasts of capacity to provide a library of multi-client geoscience data to oil and gas exploration & production (E&P) companies worldwide, has said it will work with PETROSEN, especially with the required 2D seismic, 3D seismic, multibeam and seafloor sampling solutions to ensure the Senegal’s first ever offshore licensing round is a success.

Furthermore, TGS said on Tuesday it is “partnering with GeoPartners on an active 3D seismic acquisition to acquire additional regional data so that interested parties can gain greater subsurface understanding ahead of bid submissions.”

Recently TGS completed the acquisition of SS-UDO-19 3D data in southern Senegal and has now shifted focus to the stand-alone survey, SN-UDO-19, in northern Senegal as part of the company’s effort to “illuminate plays in ultra-deep water, enabling explorers to build upon the success the basin has experienced with the Sangomar field, the GTA complex and Yakaar discoveries.”

TGS expects the full dataset to be available by the end of this year although fast track data could be accessed by the second quarter of this year.

Some of Senegal’s offshore blocks that are up for grabs in new licensing round. (Image: TGS)

Some of Senegal’s offshore blocks that are up for grabs in new licensing round. (Image: TGS)

Meanwhile, Senegal is expected to utilize the available unique high-quality data provided by TGS and other seismic data providers during the licensing period, to woo potential oil and gas explorers into acquiring and interpreting the subsurface information as they decide whether to submit their applications for a share of the 12 open offshore blocks.

In addition, this week’s launch of Senegal’s offshore licensing round comes at a time when the country is strategizing on how to achieve some of its short and medium term energy sector goals including the commencement of the 2022 planned oil and gas production.

Senegal is in need of more oil and gas production to meet the demand expected from the ongoing expansion of Société Africaine de Raffinage (SAR), which is the country’s largest crude processing plant. The refinery’s intake is expected to increase from the 1.2 million tons per year to 1.5 million tons annually once the ongoing modernization program is complete.

Furthermore, Senegal is eager for more oil and gas discoveries and subsequent production as the country moves towards an all clean electricity generation sources such as gas.

“Apart from the production of liquefied natural gas (LNG) for export, gas will be used primarily for electricity production, but also the options for processing into fertilizer and other derived products are envisaged,” PETROSEN Managing Director, Mamadou Faye was previously quoted saying.

Probably for Senegal, time has come for the country to make decisions that would enable it take its position as one of the key players in the global energy arena and as Faye put it previously, the new offshore licensing round and investment drive, will support the West Africa nation’s eagerness to capitalize on its “strong track record to attract new operators and exploration.”