Brazilian oil company PetroRio has agreed to buy the OSX-3 FPSO for $140 million, and acquire an 80 percent stake in the Dommo Energia's Tubarao Martelo field off Brazil where the FPSO is currently deployed.

The OSX-3 FPSO was built and delivered to the Tubarão Martelo Field in 2012. It has the capacity to process 100,000 barrels of oil

per day and store 1.3 million barrels.

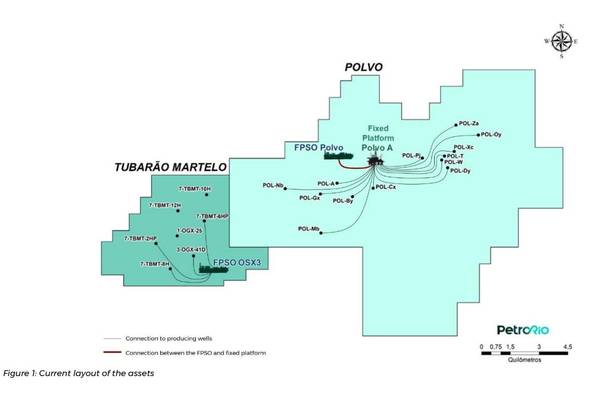

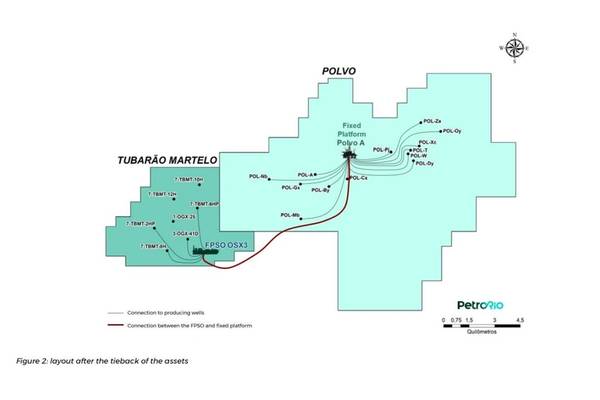

PetroRio said the acquisition would allow for a 9 km tieback between the Tubarao Martelo and its nearby Polvo field, which would simplify the production system and create a private oilfield cluster.

The company said the move would enable "significant synergies, lifting cost reductions, and the extension of the useful life of both fields." "Once the tieback takes place, the company estimates Polvo’s and TBMT’s combined Opex, which is currently over US$ 200 million per year (US$ 100 million for Polvo + US$ 100 million for TBMT), will be reduced to less than US$ 80 million per year, after having captured these synergies," PetroRio said, adding that the lifting cost could be reduced to under US$ 16 per barrel as a result of "air, sea, and land logistics synergies, and the decommissioning of the FPSO currently chartered to Polvo."

"The cluster’s Opex reduction will allow for a longer-term operation, during which more oil can be recovered. PetroRio estimates the assets’ useful life could be extended to at least 2035 – a 10-year extension- and 40 million barrels added to Polvo’s current reserves," PetroRio said.

Leading up to the tieback’s completion, PetroRio will own rights to 80% of TBMT’s oil and will be responsible for 100% of the FPSO’s charter, the Field’s Opex, Capex and abandonment costs. During this phase, the Company will be reimbursed by Dommo at a monthly fee of US$ 840 thousand, equivalent to 20% of Dommo’s current Opex (ex-charter costs).

Once the tieback is completed (estimated for mid-2021), PetroRio will remain responsible for 100% of the abovementioned costs for the cluster, while Dommo will be relieved of the monthly fees. In this new phase, PetroRio will have the rights to 95% of the oil produced by the Cluster up to the first 30 million barrels produced post-tieback, and 96% thereafter.