Projects worth $4.2 billion in capital expenditure (capex) are expected to get underwater offshore India this year and next, an event in Aberdeen this morning was told.

The projects, across India’s Krishna Godavari (KG) Basin in the Bay of Bengal, northeast India, range from shallow water to ultra-deepwater and are set to come onstream between 2022 and 2024.

Ketan Pednekar, senior trade specialist at Scottish Development International (SDI), was highlighting opportunities open to the subsea industry during this morning’s Global Opportunities Business Breakfast at Subsea Expo in Aberdeen.

He said that India’s offshore oil and gas production and exploration is focused on the east coast of India, mostly owned by either ONGC (Oil and Natural Gas Corp.) or Reliance Industries, with some also to the west.

While there’re also some opportunities in decommissioning activity, the big money is being spent on ongoing projects led by ONGC in the KG Basin, totaling 34 wells, for which some of the subsea trees are already being built in Montrose, Scotland.

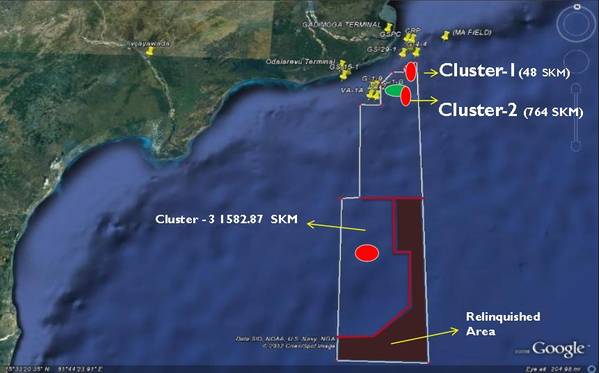

In the KG basin, there are three clusters of developments coming up: KG-DWN 98/2 Clusters 1 and 3. Cluster 3 is the biggest, involving nine gas wells in ultra-deep waters at 2,400-2,900 meters, 140 kilometers offshore, tied to a floating production system, with estimated capex totaling $3.2 billion. Awards are expected to be made in 2021 with first production in 2023-24.

Cluster 1, which also includes the GS-29 development, involves six oil wells and two gas wells, tied to a platform and floating production facility, in 80-700 meters water depth, according to Pednekar’s slides. This project is pegged at $665 million capex, with award of contracts expected in 2021, with production in 2022.

The two are distinct from Cluster 2, a 34 well (15 oil, eight gas and 11 water injection developments), which is due on stream this year in 280-1,300 meters water depth at a cost estimated by the UK’s Department for International Trade (DIT) at $5 billion.

Meanwhile, the KG-OSN-2004/1 and GS-49 developments will comprise 11 (nine and two respectively) gas wells in 7-320 meters water depth. Its cost is estimated at $560 million with awards expected this year and first production in 2022.

Pednekar says DIT has asked Indian operators what needs they’ll have from the international subsea industry. He said ONGC is looking for expertise around ultra-deepwater, high-pressures, high-temperature wells, deep-sea maintenance, building new infrastructure, inspection repair and maintenance, intelligent pigging, low-cost deepwater intervention, AI and integrated solutions, but also marginal fields.

Meanwhile, Reliance Industries is interested in inspection repair and maintenance, while Cairn India is mostly focused on drilling and marginal field development. Another operator, Oil India Ltd., which discovered small fields recently, is looking at small pools development, with fields with a seven-year life, so it wants to develop in them in a more cost-effective manner, which could tie into UK Oil & Gas Technology Center initiatives such as the Tieback of the Future and small pools, said Pednekar.

Meanwhile, some of the earlier projects, installed 10-12 years ago by Reliance, are now coming up for decommissioning. Reliance has ceased production at the D1, D3 and MA fields in the KG Basin and they want to abandon the 25 wells across these, with low-cost solutions, in next 3-4 years. These are Aker trees, which they’d look for expertise in.

ONGC is also looking at plugging and abandonment, as well as waste management and environmental consultancy for eight platforms on India’s west coast in the next 10 years. But India’s offshore isn’t over yet. Bidding for Open Acreage Licensing Policy Round 5 is ongoing, said Pednekar.