Tower Resources has found a farm-in partner for its Thali block offshore Cameroon. The company on Monday said it had executed binding heads of terms for a farm-out of a Thali block share with OilLR Pty Ltd.

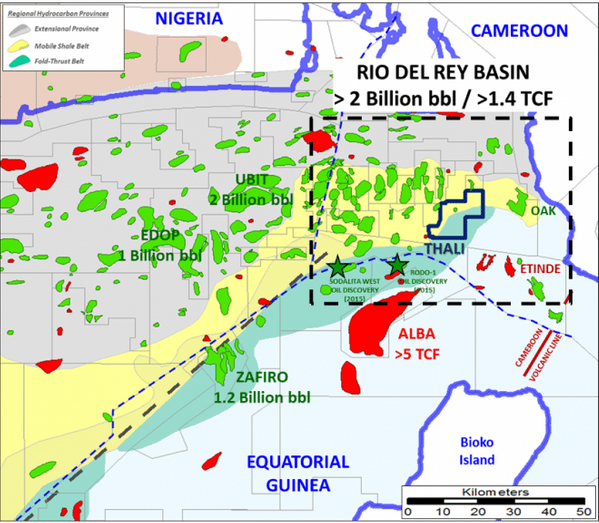

The farm-out covers US$7.5 million towards the cost of the NJOM-3 well that Tower is planning to drill on the Thali block to test a discovery previously made by Total. The Thali PSC covers an area of 119.2 km², with water depths ranging from 8 to 48 meters, and lies in the prolific Rio del Rey basin, in the eastern part of the Niger Delta.

Under the terms signed, OilLR will receive a 24.5% working interest in the PSC, subject to an overriding royalty of 10% for Tower on the contractor share of production under the PSC. The well cost is currently expected to be approximately US$15-16 million, of which approximately US$3 million has already been spent.

"The HoT are binding even though further documentation is required to effect the transaction, and the parties' intention is to complete the transaction by 15th April 2020, subject to usual confirmatory due diligence and OilLR having provided payments to Tower and into escrow of $7.5 million in total at completion, and Tower having demonstrated that it has funding from its own or other sources for the balance of the US$15 million," Tower said.

Also, the Heads of Terms will terminate automatically on March 29, 2020, in the event that Tower has not received proof of funding in a form acceptable to it from OilLR by that date.

OilLR is a private company incorporated in Brisbane, Queensland whose principal shareholders are Art Malone and Greg Lee.

Tower said that, in addition to its farm-in to the Thali license, "OilLR is presently in the final stage of acquiring interests in two additional appraisal/production assets".

"Tower is still in discussion with several other parties regarding the farm-out of up to a further 24.5% interest in the Thali PSC on similar terms," the company said.

Jeremy Asher, Tower's Chairman and CEO, commented: "We are delighted to have the opportunity to work with Greg Lee and Art Malone of OilLR on this project in addition to securing this funding for the well, and we intend to have the balance of the funding in place by the time this transaction completes.

"This agreement is also consistent with our intention to commence drilling NJOM-3 in June, subject to finalization of the rig schedule and the service companies' schedules. We expect this well to transform the Company by converting current contingent resources into proven reserves, so putting us firmly on the path to production in 2021."