Energy intelligence company Wood Mackenzie has downgraded its expectations when it comes to new orders for floating production systems in 2020, citing the oil price crash.

Mhairidh Evans, principal analyst in Wood Mackenzie’s upstream supply chain research team said pre-FID greenfield projects stand out as the first to fall, which will have a serious impact on the supply chain.

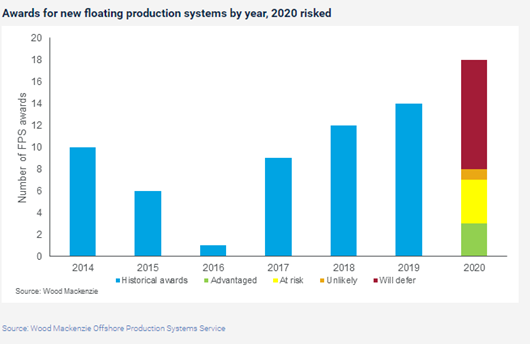

"We had forecast growth in floating production systems (FPS) market for 2020 with up to 18 new contract awards. Now we expect only a handful to go ahead, which would take the FPS market to 2015/16 levels.

Coming into 2020, the service sector had been struggling with low margins, over-supply and weak investor sentiment, Woodmac says, adding that any optimism regarding an uptick in 2020 has been "unequivocally crushed."

Evans said: "Even more capital discipline from operators will reduce demand significantly in 2020. Whether offshore or in the Lower 48, only a handful of major projects are expected to move forward this year.”

"Our preliminary analysis suggests global upstream capital investment will fall by at least 25% in 2020. Most of that impact will be through activity reduction, although OFS pricing deflation will play a role."

“In the US Lower 48 market, we are already seeing major pricing concessions. Some pressure pumpers have reduced prices by as much as 20%, while rig rates have dropped by about 15%.”

There have been fewer immediate reactions by offshore service providers, but we expect now very low levels of new offshore contracting, Evans said.

"Requests for concessions on existing contracts seem inevitable. And any operator bold enough to enter into new rig contracts can expect rock bottom rates as the rig market heads towards low utilization levels over the next year."

"We question how much further OFS pricing can reduce though. Stretched balance sheets and low margins were still commonplace for the service sector coming into 2020. Companies had already cut so much, it’s hard to identify further savings without drastic measures. This includes refinancing and the restructuring of business models. Headcount cuts and bankruptcies are inevitable."

She added: “Excess capacity is also an issue. Companies holding onto idle assets ‘just in case’, will quickly think again. The prospect of sub-US$40/bbl oil will force profound change in the sector’s footprint. While there’s short-term pain associated with this, it could ultimately create a more sustainable business for those that survive the downturn.”