Norwegian energy intelligence firm Rystad Energy expects that majority of Africa’s top planned oil and gas projects that were expecting final investment decisions under an oil price assumption of between $55 and $60 per barrel will be hit hard by the current oil prices and coronavirus impact.

"Now, with oil prices falling to below their break-even costs, Rystad Energy expects many projects to be delayed, causing the continent’s expected liquids production to decline for most of this decade and energy-reliant state budgets to take significant hits," Rystad said.

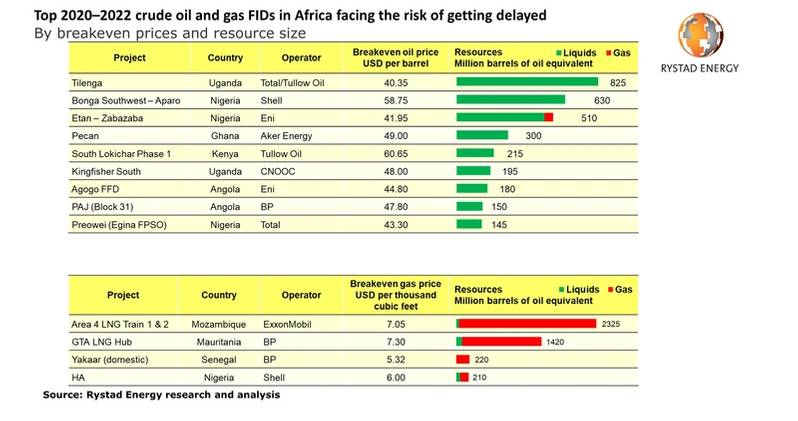

While the oil price is currently hovering well below $35 per barrel, the top upcoming final investment decisions (FIDs) in Africa have a breakeven crude price of over $45 per barrel, with some even close to $60 per barrel, Rystad added.

"The investments for major planned oil and gas projects will now see a timeline shift or even spending cut altogether, which will ultimately impact production levels in this region," says Siva Prasad, senior upstream analyst at Rystad Energy.

High long-term impact

Rystad estimates that the timeline delays for these pre-FID projects in Africa could lead to a 200,000 barrels-per-day drop in expected liquids production on average between 2021 and 2025. The impact could be much higher in the longer term, with liquids production set to drop on average by close to 1.185 million barrels per day over the years 2026 to 2030.

"The economies of the hydrocarbon-producing African nations are heavily reliant on their respective oil and gas output to meet both domestic energy needs and exports. For example, Nigeria based its 2020 capital budget on plans to produce 2.1 million barrels per day of oil this year at a crude price of $57 per barrel," Ristad said.

“An extended period of the current price scenario could, therefore, prove detrimental to the health of these economies,“ adds Prasad.

Although the OPEC+ members that are currently pumping millions of unneeded barrels of crude into the market are mainly seeking to undercut the US shale revolution, the collateral damage on African petroleum producers’ economies whose hydrocarbon projects are disrupted may be severe.