Following the double whammy of the collapse in the oil price and the COVID-19 pandemic, exploration plans are being redrawn and the well count is expected to drop by as much as 35% on 2019 levels.

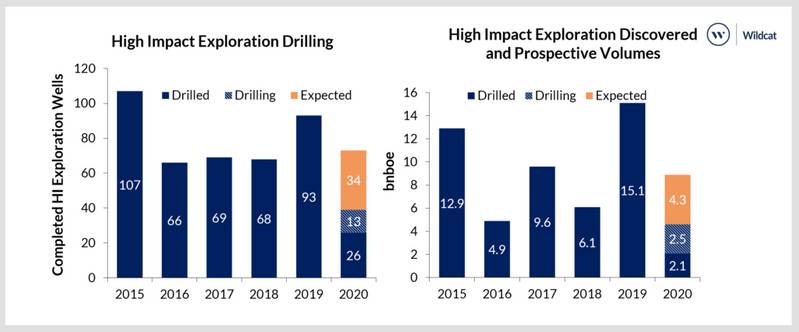

At the start of the year, the high impact well count had been expected to be similar or slightly higher than the 93 wells completed in 2019.

Westwood now expects ~60-70 high impact exploration wells to be completed by the end of 2020, back to the numbers seen from 2016 to 2018 after the 2014 oil price crash.

SOURCE: WILDCAT, WESTWOOD ANALYSIS

Around 2.1bnboe has been discovered so far this year from the 26 high impact wells completed and 2.5 bnboe of risked volume is being tested by wells currently drilling, dominated by the Shafag Asimam well in Azerbaijan, with about another 4.3 bnboe risked from the remaining ‘expected’ wells in the program yet to spud.

Westwood now expects to see a total volume of around 6 to 9 bnboe to be discovered in 2020, down 40% or more from the 15 bnboe discovered in 2019, which included giant discoveries in Russia and Iran.

In 2020 a firm rig contract is no guarantee of a well being drilled. For example, CNOOC’s planned Pelles A-71 well in Canada’s Flemish Pass, has been postponed due to COVID-19 concerns as has the Stangnestind prospect in the Barents Sea, by Aker BP.

Contracts are being closely scrutinized and in some cases, force majeure clauses triggered.

All regions are expected to see a decline in drilling, with North America (including Mexico) likely to take the biggest hit, although it will still see the most wells. The Eastern Med may have very few high-impact wells in the rest of the year, and Sub-Saharan Africa will likely only see 3-5 wells completing.

Drilling plans in the Central North Sea, in Guyana and Suriname and the shallow water Campeche area in Mexico are likely to be less affected, although COVID-19 may yet limit operations even where companies are keen to drill.

2020 could have seen the increase in exploration drilling seen in 2019 continue but COVID-19 and the collapse in oil prices has put paid to that. A 60-70 high impact well program now looks a reasonable estimate, though 2020 plans remain fluid. Exploration is down in 2020 but is not out.

About the author:

Kai Gruschwitz is a Senior Analyst, Global E&A with Westwood Energy