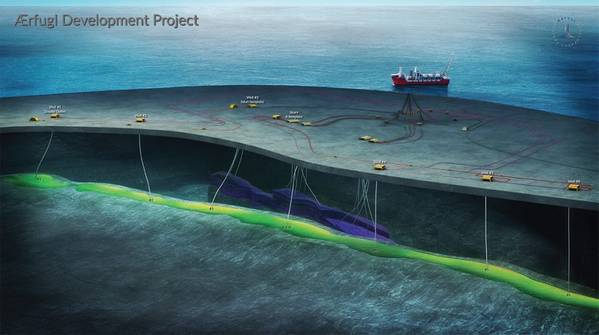

Norwegian oil firm Aker BP has started production from the first Ærfugl phase 2 well in the Norwegian Sea, which is, according to the company, three years ahead of the original plan.

The Ærfugl field produces via Skarv FPSO approximately 210 km west of Sandnessjøen. According to the operator, it is one of the most profitable development projects on the Norwegian shelf with a break-even price of around USD 15 per barrel (converted from gas).

"The Ærfugl field development is adding five years lifetime extension to the Skarv FPSO and is an important part of the area development and value creation in the area, though the profitability will be dramatically reduced in the current oil price environment,” says Ine Dolve, VP Operations & Asset Development in the Skarv area. The original start-up plan was 2023.

Kjetel Digre, SVP Operations & Asset Development in Aker BP: “The acceleration of production from Ærfugl Phase 2 means increased value creation for the Ærfugl joint venture, the supplier industry and the Norwegian society in the form of increased revenues. Thus I’m very pleased to mark this milestone."

"However, the good news are offset by the fact that we are facing a global crisis that none of us have experienced before. Investments and explorations activities offshore Norway are put on hold. Tens of thousands of employees in our industry are currently at risk."

As a response to the oil price rout, Aker BP has said it has halted all non-sanctioned projects, including the Hod redevelopment project in the Valhall area which was just about to be sanctioned prior to the turmoil.

Digre also touched upon the Norwegian oil industry's proposal for tax regime changes.

“It is clear that the industry’s proposal for temporary adjustments in Norway’s tax regime to improve the industry’s cash flow in the short run – without reducing the total tax payments in the long run – will result in increased activity and new investment opportunities offshore Norway within the next 12 – 24 months,” he said.