The oil price crash has transformed the outlook for the region’s E&P sector. Globally, governments and operators have been forced into action to rework investment plans in response to the dual impact of the precipitous fall in both demand and oil prices.

Asia Pacific’s diverse resource themes – from China’s mature oil basins to undeveloped gas in Australia – are all impacted.

Sharp and immediate cuts to near-term investment are the prescribed medicine, with effects that will be felt for years to come. How is Asia Pacific’s upstream industry is shaping up and how will the sector look as it emerges from the crisis?

I spoke with Andrew Harwood, our APAC upstream research director.

What's been the immediate impact on Asia Pacific's upstream sector?

As elsewhere around the world, operators across the region have acted swiftly to reduce investment and cut costs. Using our Lens Upstream platform, we have reworked all our APAC asset models to reflect the severe cuts to near-term investment and production.

Clearly, it’s a challenging outlook. Even with the deep investment cuts companies have announced, most are unable to offset the valuation impact of a lower oil price outlook: we've revised our long-term Brent price assumption from US$60/bbl to more difficult US$50/bbl.

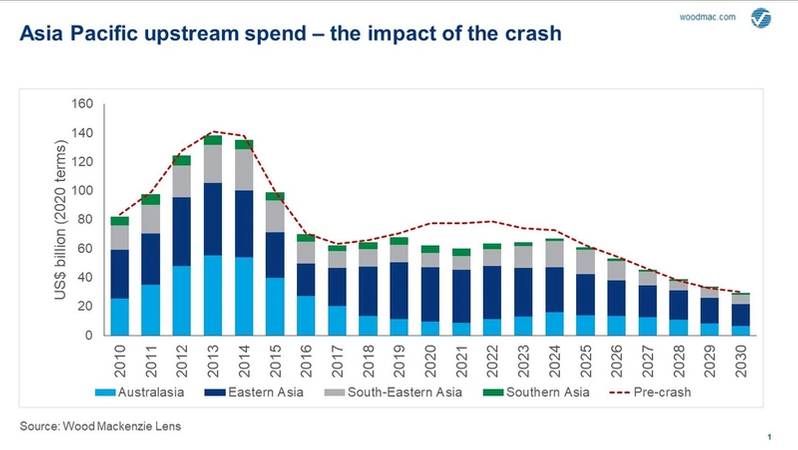

Investment – upstream development spend in 2020 is down 20% or US$15 billion on our pre-crisis forecast.

Virtually all projects are hit, with deferred pre-FID LNG projects in Australia, lower NOC spending in Southeastern and Southern Asia, and major capex cuts across much of China's onshore assets.

Production – near-term oil and gas output will fall by 3%, down over 500 kboe/d in 2020. This sounds modest, but the impact will really be felt later this decade as oil declines accelerate and delayed LNG investment impacts future supply.

Economics – almost US$200 billion has been slashed from portfolio valuations. Steep cuts to investment just can’t offset the downwards revision of our long-term Brent price assumption from US$60/bbl to US$50/bbl (2020 terms).

Where will the investment cuts be felt most across the region?

Nowhere escapes unscathed, with over US$60 billion of spend being cut over the next five years. The biggest cuts will come from China and Australia.

In China, legacy oil areas suffer from old age and difficult geology. CNPC has been swift to announce cuts at many of its mature oil assets, with the Ordos Basin and the Daqing oil complex hit hardest. Other Chinese companies are deferring growth projects. As the price crash sparks the deferral of most investment decisions, Australia’s pre-FID projects have been impacted.

Delays to projects including Barossa, Scarborough and Browse will result in a major reduction in LNG investment.

Across the region, 2020-2025 pre-FID investment is now down 28%. We see 2022 as a key year for new FIDs and investment. As operators prioritize survival overgrowth and push back new investment decisions, Australia’s pre-FID LNG projects will bear the brunt of the biggest deferrals.

The so-called 'second wave' of Australian LNG will now come later as FIDs at Barossa, Scarborough and Browse are delayed, raising questions for plant operators looking for new sources of feedgas.

Across the region, 2020-2025 pre-FID investment is now down 28%. 2022 is shaping up as a key year for new FIDs and investment, but only if operator confidence in the price outlook improves.

Whose production profile is most impacted?

While we expect production will only decline by around 3% over the next two years, the deferral of major new investments will have a much bigger impact from 2024-2025.

Our modeling shows that some 10% of output is at risk by 2025 if low prices persist. Investment cuts will have a heavier impact on gas production, but won’t truly be felt until the second half of the 2020s.

As Chinese NOCs continue to prioritize gas production, cuts to conserve cash flow will impact short-term output and accelerate declines over the longer-term – significant for a country that produces over half of Asia Pacific’s liquids. From a gas perspective, the impact of deferrals in Australia will be longer-dated.

Elsewhere, lower NOC spending in South-Eastern and Southern Asia on mature gas producing assets also contributes to an overall 5% lower supply outlook by the time we reach 2030. With Asia’s NOCs dominating production, it is unsurprising that they will also bear the brunt of revisions. But others also feel the impact. The production outlook for the Majors and IOCs in the region shows decline as capital is cut or spent elsewhere. We now expect APAC output by the Majors to fall over 20% by 2025.

What’s the impact on corporate cash flow and valuations?

After re-running all our asset models to reflect capex cuts and our lower oil price assumption, overall Asia Pacific upstream NPV10 falls by around 30%, reflecting an almost US$200 billion drop in value. The prevalence of gas cushions the impact of lower oil prices across much of the region. China’s NOCs are hit hardest, primarily due to their high cost, mature oil assets.

While upstream value has fallen by an average of 27% for the 20 largest Asia Pacific portfolios, for CNPC, Sinopec and Yanchang the drop is over 40%. The impact on assets in Australasia is lessened by the huge amount of earlier investment in LNG projects, providing cash flow resilience as production ramps up.

This is reflected across corporate peer groups, with the impact on the Majors and Large Caps softened by their larger weighting towards Australasian gas than the NOCs.

What are the key factors to watch?

There is a huge amount of uncertainty as we begin to rebuild after the crisis. Clearly, economic and oil price recovery remains at risk. How much upstream capital will NOCs, Majors, IOCs, and regional players allocate to Asia Pacific in this environment? As economies take the first steps towards recovery in the wake of coronavirus, will regional governments prioritize short-term oil and gas revenues over industry stimulus? In addition, if we see the Majors and other IOCs reducing exposure to APAC upstream, can the region’s NOCs deliver the technical and financial capability to fully exploit the remaining resources?

Looking further ahead, how will the impact of the energy transition and alternative technologies influence their future investment? Uncertainty is the watchword.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice-Chair, Gavin Thompson. In his blog, he shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.