French energy company Total is seeking to sell its 25.7% stake in the Shearwater Elgin Area Line (SEAL) natural gas pipeline in the British North Sea, industry sources said.

The sale could raise about $200 million, one of the sources said.

Total has engaged in direct discussions with several interested parties in recent weeks, the sources said.

A spokesman for Total declined to comment.

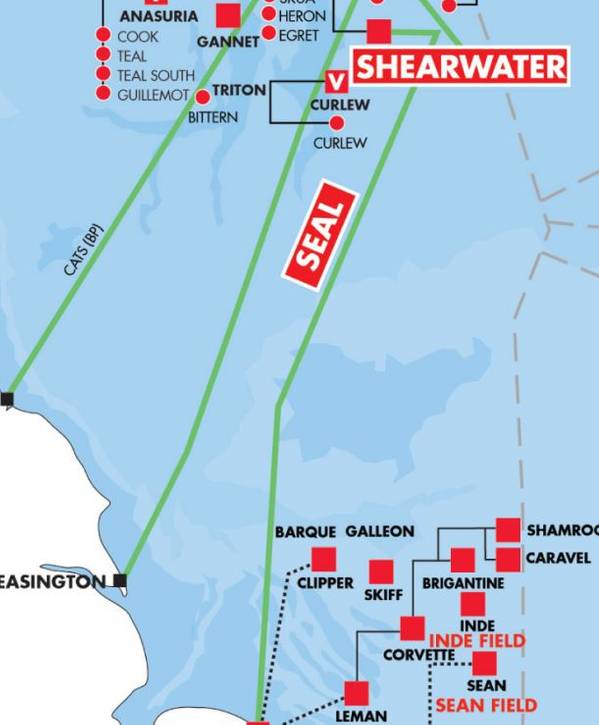

The SEAL pipeline, operated by Royal Dutch Shell, transports natural as from the Shearwater and Elgin Franklin platforms to the Bacton Gas Terminal on the Norfolk coast.

The recent collapse in oil and gas prices due to the coronavirus epidemic and the uncertain outlook have led to a sharp slowdown in dealmaking in the energy sector.

But energy pipelines and infrastructure remain attractive assets for investors as they often guarantee steady returns over long periods of time.

Private-equity group HitecVision recently renegotiated its deal to buy North Sea oilfields from Total.

(Reporting by Ron Bousso; Editing by Edmund Blair)