Australia's No. 2 independent gas producer Santos Ltd paid out a weaker than expected half-year dividend amid uncertainty over a recovery from the coronavirus pandemic, as the oil market slump halved its first-half underlying profit.

Disappointed investors sent its shares down more than 5%, in a broader market that finished down 0.8%.

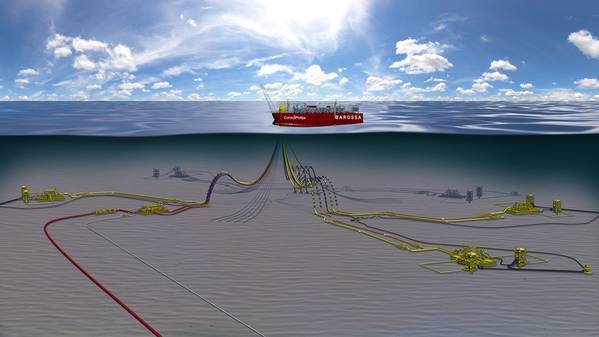

Despite the oil market gloom, Santos is preparing for final investment decisions on three Australian projects, expected to cost about $6.9 billion - developing the Barossa gas field, the Dorado oil field and a carbon capture and storage site.

At the same time it is pursuing a big push to cut costs, targeting free cash flow breakeven at less than $25 a barrel, down from $29 last year.

"Santos remains confident that when prices and demand recover, our projects will be better placed than those in our competitor countries to leverage the opportunities that will inevitably re-emerge," Chief Executive Kevin Gallagher said.

Santos will only go ahead on Barossa and Dorado when market sentiment improves, oil and gas inventories decline, and the coronavirus pandemic has clearly subsided globally.

"We'd like to see...a little bit more than the green shoots of recovery we're seeing today," Gallagher told Reuters.

For Barossa to go ahead, Santos must be confident that shipyard building equipment for the project will not be hit by pandemic-related delays, he said.

Underlying profit slumped to $212 million for the six months to June 30 from $411 million a year earlier, hit by a one-third drop in oil prices and a 14% decline in its average price obtained for liquefied natural gas (LNG).

The result was slightly above a consensus estimate of $200 million, but Santos' dividend, which was slashed to 2.1 cents a share, was well below a consensus forecast of 6 cents.

Including $526 million in asset impairments due to weaker long term oil price assumptions, Santos reported a first-half net loss of $289 million. (Reporting by A K Pranav in Bengaluru and Sonali Paul in Melbourne; Editing by Rashmi Aich and Clarence Fernandez)