Building a versatile OSV fleet is expensive, even more expensive when your timing is wrong.

Buy at the top and you can quickly find yourself exposed if the market suddenly turns, those shiny new assets depreciate rapidly, and large debts, that the (new) poor market cannot service, mount up.

In contrast, enter at the bottom, purchase distressed assets cheaply, and an equivalent fleet can be purchased for a significantly lower price tag.

These vessels also have the potential to increase in value if/when the market turns in your favor. A perfect example of a company employing this strategy is Kim Heng Offshore.

(Table 1 outlines the current OSV fleet). This article will discuss their purchases this year.

H1 2020 for the majority of offshore vessel owners involved battening down the hatches and coping with a once in a generation market shock (COVID 19).

The focus was (and still is) switched to cutting costs, negotiating with banks/lenders, offloading non-core assets, and just surviving the remainder of 2020. The appetite for expansion or purchasing tonnage certainly wasn’t (and still isn’t) high on the to-do list.

Singapore-based Kim Heng, however, saw an opportunity with the POSH Terasea liquidation process -POSH Terasea late 2019 defaulted on debt payment and also had outstanding debts of c. USD 28 million - compounded with COVID 19, which created a perfect storm to grab a good deal. In the space of 6 months, #10 million was spent and four large AHT vessels were purchased.

First was the AHT pair Salveritas and Salviceroy, 12,000 bhp, 2007-built, purchased at auction for USD 5 million en bloc.

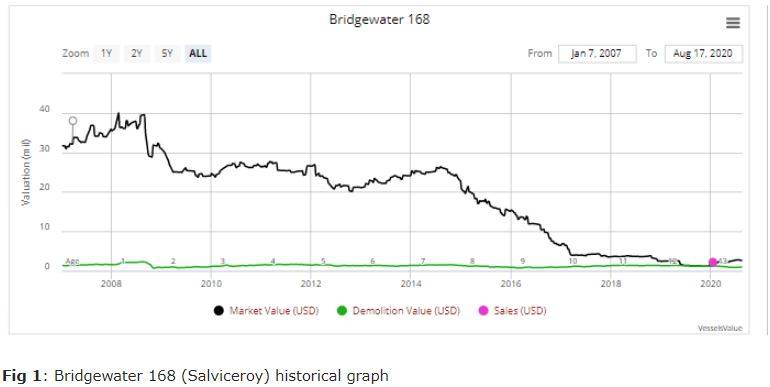

Fig 1. shows the VV historical valuation for the ex Salviceroy (now Bridgewater 168). Pre-Offshore downturn the Salviceroy was valued at around $24 million.

Fast forward 6 years and the VV value today is USD 2.65 mil. To note, the newbuild contract price historically would have been C.USD 25-30 mil. In the space of 13 years, it lost 90% of its original value.

Next up was another pair of POSH Terasea AHT, the Salvigilant and Salvanguard 12,000 bhp 2007 Keihin were purchased early July (just as the majority of the world was starting to come out from under the shadow of COVID 19) for USD 4.8 million en bloc.

VV value a day before the sale was $2.86 million and $2.28 million, respectively.

These vessels were valued at around $26 mil pre-offshore downturn. VV value today is around $2.74 million and $2.2 million, respectively.

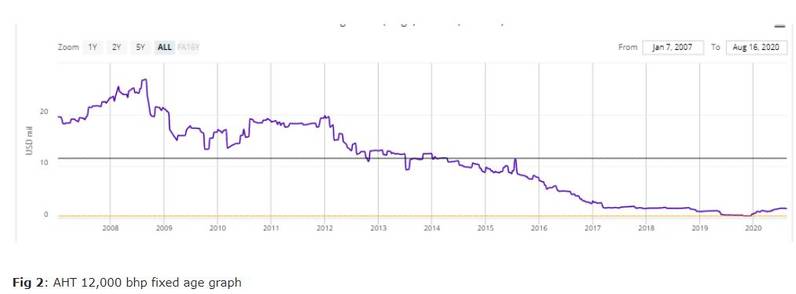

As mentioned timing is everything, as shown in Fig 1 although Kim Heng didn’t buy at the lowest historical value (yellow line).

The VV fixed age analysis shows a good future value increase potential with a median value for the asset (black line) of $11.5 million which is nearly $10 million more than the purchase price.

As with all things in life, not everything is perfect. Kim Heng did report earlier this month that on their operating side the circuit breaker measures [a lockdown due to COVID-19 ] imposed by the Singaporean Government had taken its toll on their earnings.

The company saw a 46% decrease (first six months of 2020 SGD 17.7 mil, down from SGD 32.7 mil compared to last year)

With the Offshore market in a state of retraction and many within the industry pushing a recovery back to 2021 / 2022, we are likely to see more casualties, and with that more distressed assets hitting the market only time will tell.

However, for those in the right position it could prove a strategic springboard to take them from smaller owner/operator to a larger power player, and best of all, done at a fraction of the price.