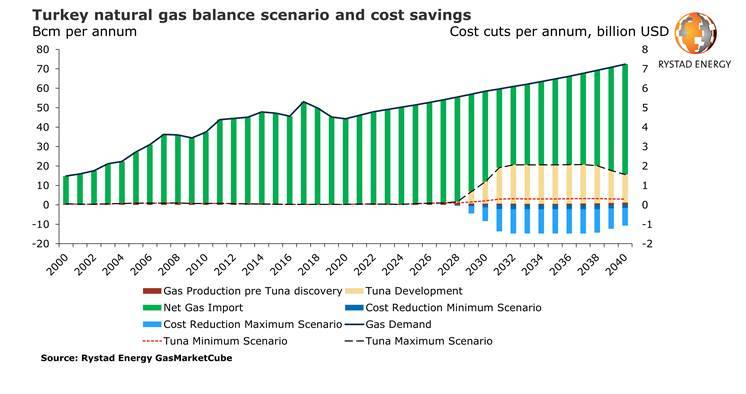

Turkey could save up to a whopping $21 billion in gas import costs with the development of it recently hit Tuna-1 gas discovery in the Black Sea, Norwegian energy intelligence firm Rystad Energy has estimated.

As previously reported, Turkish president Recep Tayyip Erdogan made the announcement of the giant gas discovery on August 21, 2020

He said: "Our Fatih drillship discovered 320 billion cubic meters of natural gas reserves, thanks to the drilling in the Tuna-1 well [...]. There is no stopping and resting for us until we become a net exporter in energy."

As for the level potential import savings from the discovery development, Rystad said Wednesday that this will depend on the field’s peak output, which remains to be determined pending appraisal drilling and further testing, as the discovery is reported to have an initial gas reserve volume of approximately 320 billion cubic meters (Bcm), but the size of its actual recoverable reserves is still uncertain.

"Actual savings could be even higher [than $21B ] as global gas prices and import costs are expected to rise in coming years," Rystad said.

Rystad Energy’s calculations are based on a peak production range of between 2.5 Bcm and 20 Bcm per year. The lower end reflects a more cautious approach, while the higher end a far more bullish outcome, Rystad explained.

"In any case, a successful development of the field would represent a substantial reduction to the country’s import costs – between $200 million and $1.5 billion per year – based on the field’s breakeven price range and Turkey’s average gas import price for 2020," Rystad said.

“The timing of the discovery could hardly be better, as nearly 40% of Turkey’s contracted import volumes – representing 24 Bcm out of the country’s 59 Bcm per annum imports of pipeline gas and LNG – are set to expire in 2020 and 2021,” says Sindre Knutsson, Rystad Energy’s Vice President Gas Markets. A successful development of the Tuna-1 discovery could offer Turkey significant natural gas supplies at much more competitive terms, taking effect from the field’s estimated startup date of 2028. Rystad Energy estimates the breakeven price for the field to be between $3.00 and $3.50 per MMBtu, significantly below the cost of imported gas, Rystad said.

A successful development of the Tuna-1 discovery could offer Turkey significant natural gas supplies at much more competitive terms, taking effect from the field’s estimated startup date of 2028. Rystad Energy estimates the breakeven price for the field to be between $3.00 and $3.50 per MMBtu, significantly below the cost of imported gas, Rystad said.

Rystad Energy estimates that the import price for LNG to Turkey in 2020 will average about $4.70 per MMBtu, including both Brent index contracts and spot volumes.

"We further estimate that the average price of Brent-indexed pipeline imports to Turkey will be about $6.40 per MMBtu this year. The effect of weak Brent prices this year will be seen in the second half of 2020, as Brent-indexed gas prices are normally priced with a lag of three to six months," it added.

Tuna won't go online before 2028, but can serve as a bargaining chip in the meantime

"We do not expect the volumes from the Tuna-1 field to come online before 2028, but the prospect of a new competitive source of gas, and the confidence that Turkey will be less reliant on imports in the future, will increase the country’s bargaining power in relation to its current suppliers," Rystad added.

The Norwegian company also thinks Turkish buyers will likely be keen to move away from oil-indexed contracts and instead use a European price benchmark, such as TTF, to which they can index their contracts.

Turkey is currently fully reliant on imports to meet its natural gas demand. Rystad says that domestic production stood at only about 0.3 Bcm in 2019, representing less than 1% of domestic demand.

The country remains heavily dependent on pipeline imports of gas from Russia, Iran and Azerbaijan, which collectively accounted for about 33 Bcm, or 73% of total imports, in 2019.

The growth in the LNG market has, however, allowed Turkey to diversify its supply sources, opening the market to a long list of LNG exporting countries, Rystad said.

Algeria, Nigeria and Qatar all have long-term LNG contracts with Turkey, and the United States has emerged as one of the largest suppliers of LNG to the country over the past two years. Cheap spot prices in the LNG market have made flexible US LNG cargoes attractive for Turkey, replacing supplies from other traditional sources of pipeline gas such as Russia and Iran, both of which have Brent-indexed long-term contracts with the country.

LNG has outcompeted pipeline gas in Turkey this year, driven by a vast oversupply in the LNG market that has caused spot prices to plunge. Rystad Energy estimates that Turkey’s pipeline imports will fall from 33 Bcm in 2019 to 30 Bcm in 2020, while total LNG imports will increase by 50% from 12 Bcm in 2019 to 18 Bcm in 2020.

“Turkey’s newfound hope that low-cost discoveries are feasible will no doubt pave the way for further exploration programs. The government seems to have grasped the strategic importance of this breakthrough, as demonstrated by its decision to send no fewer than five warships to escort the seismic vessel Oruc Reis through the Mediterranean Sea,” Knutsson concludes.