With the offshore wind industry growing, even during the global pandemic, offshore wind turbines are expected to grow in size and capacity, too, and Rystad Energy believes bigger is better.

As previously reported, Siemens Gamesa in May announced the launch of what will be the world's largest offshore wind turbine, the SG 14-222 DD offshore Direct Drive turbine with 14-megawatt (MW) capacity. The prototype will be ready in 2021 with the turbines expected to be commercially available in 2024.

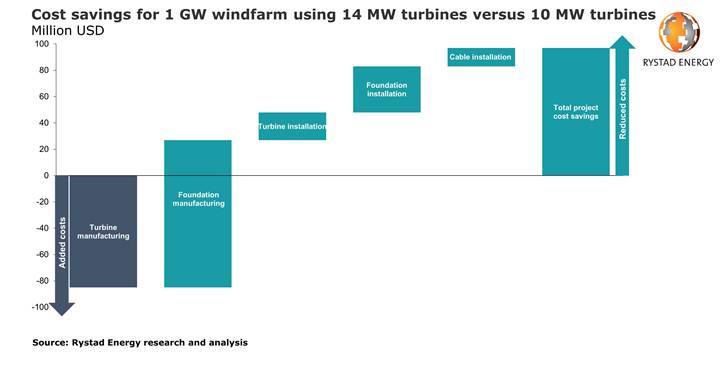

Norwegian energy intelligence firm Rystad Energy is of the opinion that while these giant turbines may be more expensive, they reduce the overall cost of large-scale offshore wind farm development - up to $100 million compared to using 10MW turbines at 1GW wind farm projects.

"Their added costs are expected to be mitigated by fewer required units and the efficiency gains associated with the newer, more technologically advanced turbines. For every project, there is also the cost of manufacturing a number of foundations, so the reduction in the number of turbines will also lead to fewer array cabling runs, which in turn reduces the installation scope," Rystad said in a statement.

Rystad Energy analyzed the cost of using turbines of differing sizes for the case of a 1 gigawatt (GW) offshore project.

The SG 14-222 DD model will surpass GE’s new 12 MW Haliade-X prototype and become the largest turbine available, globally. At the moment, the largest turbines to be commissioned between 2020 and 2021 have nameplate capacities of up to 10 MW, Rystad said.

"Utilizing 14 MW turbines instead of 10 MW ones, the number of units required for a 1 GW project falls by 28 units, from 100 to 72. Moving to a 14 MW turbine from a 12 MW turbine still offers a reduction of nearly 11 units. Overall, the analysis shows that using the largest turbines for a new 1 GW wind farm offers cost savings of nearly $100 million versus installing the currently available 10 MW turbines," Rystad has found.

“Siemens Gamesa’s newest turbine is a step towards dramatically reducing development and levelized costs world-wide. With larger turbines come greater savings in other project segments and greater revenue generation potential over the duration of future projects, increasing the offshore wind industry’s competitiveness,” says Rystad Energy’s product manager for offshore wind, Alexander Flotre.

Illustration Credit: Siemens Gamesa

Illustration Credit: Siemens Gamesa

In its analysis, Rystad assumes that the cost of a turbine is approximately $800,000 per MW on average for currently available units (i.e. turbines with up to 10 MW nameplate capacities), with a 2.5% premium applied for each additional MW for the larger units expected in the medium-term, to reflect anticipated efforts by manufacturers to capture upside.

"Thus, for this analysis, we estimate that the cost of a 10 MW turbine is $8 million, while a 12 MW and a 14 MW turbine would cost approximately $10.1 million and $12.3 million, respectively. Therefore, moving from a 10 MW turbine to a 14 MW turbine could result in higher costs of approximately $85 million for manufacturing, while utilizing a 14 MW turbine in lieu of a 12 MW unit could add almost $45 million to manufacturing costs," Rystad said.

Foundations are the main components that offer opportunities for cost reductions if larger turbines are utilized. Rystad Energy estimates that a foundation typically costs between $3 million and $4 million, with variations relating largely to foundation type and water depth. In a 10 MW to 14 MW switch, such cost savings could surpass $100 million for the developer, while savings in a 12 MW to 14 MW scenario would likely range from $30 million to $50 million.

The cost of array cables varies based on the turbine size. While the use of larger turbines implies potential cost savings through fewer foundations, the added length required for array cables for 14 MW turbines is likely to keep overall cable costs flat. However, the lower turbine count reduces the number of cabling runs and connection of turbines to the offshore substation, which in turn could cut installation costs.

This example shows that while larger units are expected to drive up the cost of turbines, reductions from other segments – namely foundations – could result in cost savings of $100 million to $120 million on manufacturing alone, helping to offset some of the developer’s expenses.

Haliade-x prototype Image: GE Renewable Energy

Haliade-x prototype Image: GE Renewable Energy

Rystad Energy also estimates that the cost to install a turbine ranges between $0.5 million to $1 million, while the cost of foundation installation ranges from $1 million to $1.5 million per unit.

Using the midpoint in each range, Rystad said, for a 1 GW project the implied savings surpass $50 million if using 14 MW instead of 10 MW units. Under similar circumstances but comparing 14 MW against 12 MW turbines, potential savings are beyond $20 million.

Furthermore, the Norwegian company explained, the reduction in cabling runs and connections due to the lower number of array cables could lead to additional savings of between $5 million and $15 million when using 14 MW turbines rather than 12 MW and 10 MW turbines.

On top of potential cost savings from the reduction in units, the increase in turbine size can also drive other efficiency gains. Rystad Energy has analyzed the potential reduction in the levelized cost of energy (LCOE) using Equinor’s Empire Wind in the US as a case study.

In this case, using 10 MW turbines, the estimated LCOE is approximately $75/MWh. Opting instead for 12 MW turbines, the LCOE falls to approximately $71/MWh. With a further upgrade to 14 MW turbines, the LCOE is estimated to be $68/MWh.

"Thus, with the incremental increases in size, turbines and offshore wind plants become more economical – not just in lower upfront costs, but also in longer-term power generation potential," Rystad said.

Credit: Rystad Energy

Credit: Rystad Energy