Advanced design software supports growth of additive manufacturing applications in the oil and gas industry

Additive manufacturing (AM, aka 3D printing) is beginning to impact product-development strategies in the oil and gas industry just as it already has in many other industries—by shifting the production paradigm in unexpected ways.

Particularly in the case of downhole tools, overall tool size is compatible with the range of part dimensions that today’s AM systems are capable of manufacturing. Consider a common piece of equipment on any oil and gas rig: the tricone drill bit. Required to function within relatively narrow spaces, together with mechanical components that force drill mud down the well hole to carry rock, dirt, and clay back up, the bit is part of an intensely technical setup that undergoes extreme heat and pressure.

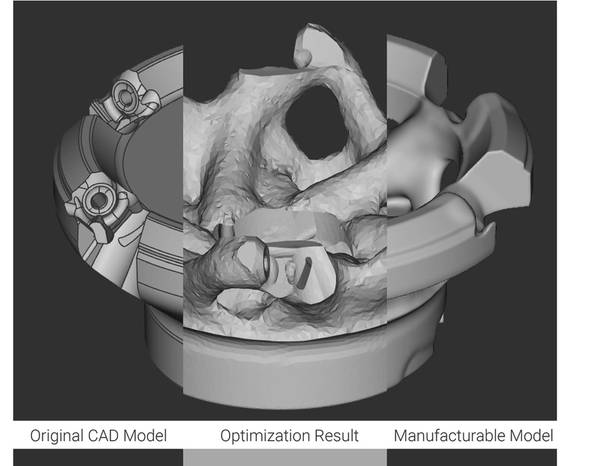

With AM, engineers could be given an extended ability to embed sensors practically anywhere within the drill head, or to control the design and manufacturing parameters of the components for maximum mud flow through the part. Advanced design-for-AM tools and 3D printing now make this possible. What if similar improvements could be made to the perforation tools for the fracking process, tailoring them for cleaner and deeper perforations? What effect would more efficient pumps have on these extraction methods? When driven by advanced design software capable of generating the component geometries that can answer such questions, additive manufacturing offers these capabilities and more. While not an end-use oil and gas product, the cutting tool image shown demonstrates how such tools could be redesigned.

It’s also important to note AM’s broad range of material capabilities as well. Where the first 3D-printers were limited to prototypes made of simple polymers—suitable for testing form and fit but not function—today's machines print a wide range of engineering-grade plastics as well as fully-dense metals, including titanium, duplex and stainless steels, nickel and chromium-based superalloys. AM's ability to build complex, optimized part geometries from these and other high-grade materials means that less metal is needed to meet the oil and gas industry’s stringent mechanical requirements, shortening manufacturing time, reducing costs, and helping streamline operations.

More efficient drilling and fracking operations are essential to industry growth, but so is an optimized supply chain. Here again, AM offers an array of benefits. Rather than the traditional manufacturing workflow—with multiple machining steps, significant tooling and fixturing investment, costly work-in-process, and typically lengthy lead-times—even the most complex component can be 3D printed in fewer operations far more quickly and with much less human intervention. For these reasons among others, MRO suppliers to the oil & gas industry are especially keen on additive manufacturing, since its ability to create replacement parts “on-demand” promises to reduce inventory levels without sacrificing customer service.

Granted, the actual AM “build” of a pump part or drill bit might require a day or two to complete, followed by another day or so of post-processing, but compared to the weeks or even months needed with conventional procurement methods, additive manufacturing serves to drastically compress lead-times and shorten the supply chain of certain components. And this can easily mean hundreds of thousands of dollars per day when critical systems are down, the well sits idle, the oil no longer flows.

Image 1: Traditional cutting-tool redesigned using nTop Platform to use less material while satisfying engineering requirements. Designed in nTop Platform by nTopology partner Yamaichi Special Steel.

Image 1: Traditional cutting-tool redesigned using nTop Platform to use less material while satisfying engineering requirements. Designed in nTop Platform by nTopology partner Yamaichi Special Steel.

Designing for both new and legacy parts

While using advanced design software in conjunction with AM promotes the creation of innovative, problem-solving oil and gas components it can also help improve the design and manufacturability of legacy parts.

For instance, a cast component can be less expensive to produce and more durable than one welded together from multiple pieces of steel. Computational engineering software such as nTop Platform not only provides Design for AM capabilities but also advanced part-consolidation and topology-optimization workflows that can quickly turn a welded design into one suitable for casting or forging, greatly automating otherwise cumbersome design procedures while decreasing development lead-times. This is why oil & gas industry engineers are beginning to take a deeper look at their product inventory and ask, “Can we run some of our legacy parts through a computational engineering workflow and find more effective, optimized ways to manufacture them?”

Such design-optimization workflows can also be applied to mold or forging dies used to make these redesigned components. Indeed, tooling-geometry generation is an integral part of the design process with the software, extending its uses well beyond the world of additive manufacturing. And since the software generates 3D objects mathematically—via a function called implicit modeling—rather than the boundary-based generation used with most engineering packages, multiple design iterations can be created and tested far more quickly, further reducing costs and product lead-time. Part consolidation through design optimization also offers the benefits of decreased assembly times and simpler supply chain logistics even for traditional process operations.

Developing the confidence to move forward with new technologies

Despite these robust capabilities, neither advanced computational engineering software nor additive manufacturing is going to “turn the oil and gas world on its head” anytime soon. Change doesn’t happen overnight, especially in an industry with a rich, successful history, that is managed by decision-makers who tend to prefer the tried-and-true over the cutting edge.

That said, it's precisely those folks who can benefit from learning more about the tremendous potential of these new technologies.

It’s important to understand that 3D printing has been in development since the mid-80s and is now a mature, well-understood manufacturing process; Boeing, Airbus, and many other industry leaders wouldn’t be as invested in it as they are now it if it weren’t proven, certified and cost-effective in the right applications.

Secondly, the powdered metals used with direct metal laser sintering (DMLS), electron beam melting (EBM), direct energy deposition (DED), and other metal AM technologies are nothing new. They are, in fact, the same metal powders—albeit on a finer, more well-controlled scale—used in metal injection molding, a process that gained popularity after World War II and is itself used to make diamond-coated oil and gas drilling tips (which themselves present opportunities for the generative design and topology optimization capabilities of advanced computational engineering software).

What’s most notable about all this is the game-changing potential of these new technologies. Cutting heads, heat exchangers, pumping and filtration equipment, drill motors—pick an oil and gas component and chances are excellent that it can be improved through new digital redesign tools and either 3D-printed or produced via more traditional means. Further ahead, the integration of advanced sensors and other electronics into such components raises previously unimaginable prospects for finely tuned, real-time measurement and monitoring of drilling operations.

Software providers are beginning to work on creating specific toolkits, with input from oil and gas partners, that will provide automated, reusable design workflows that enhance collaboration and serve this specific market’s needs best. These virtual tools will help speed optimization of the real-world ones.

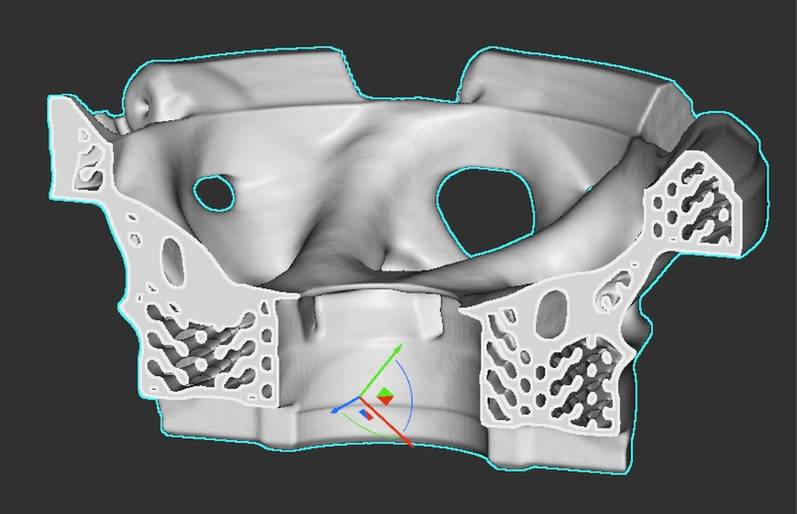

Image 3: Section cut of final cutting-tool part design showing functional lattice structures enabled by additive manufacturing that can be used for lightweighting, thermal management, or fluid flow. Designed in nTop Platform by nTopology partner Yamaichi Special Steel.

Image 3: Section cut of final cutting-tool part design showing functional lattice structures enabled by additive manufacturing that can be used for lightweighting, thermal management, or fluid flow. Designed in nTop Platform by nTopology partner Yamaichi Special Steel.