Mediterranean-focused oil and gas firm Energean said Tuesday the size estimate of its gas fields off Israel has been increased to 729 MMboe, following the completion of an independent Competent Persons Report by DeGolyer and MacNaughton.

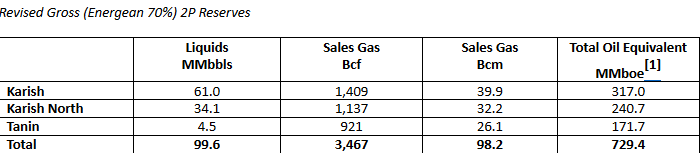

The CPR report which certifies 98.2 Bcm (3.5 Tcf) of gas and 99.6 million barrels of liquids (“MMbbls”) gross (Energean 70%) 2P reserves in the Karish, Karish North and Tanin fields.

Energean’s gross 2P reserves in Israel now total approximately 729 million barrels of oil equivalent (“MMboe”) which represents a 44% uplift to previously estimated 2P reserves.

The increase was principally driven by the upgrade of resources following approval of the Karish North Field Development Plan (“FDP”) by the Israeli government in August 2020. A Final Investment Decision for Karish North is expected in 4Q 2020, Energean said.

The CPR also results in a 21.4% (17.5 MMbbls) increase in gross 2P liquid volumes and the fields are now expected to average 28 kbpd liquid production over a plateau period of approximately five years.

Further upside potential is represented by gross risked prospective resources across Energean’s Israeli portfolio of 62.0 Bcm of gas plus 33.4 MMbbls of liquids (approximately 431 MMboe in total). These prospective resource volumes will be targeted by Energean’s next exploration campaign, which is expected to startin early 2022.

Energean Power under construction in Singapore - Credit: Energean

Energean Power under construction in Singapore - Credit: Energean

According to Energean, all prospects are located near the location where the Energean Power FPSO will be moored, representing potential low-cost tie-back options for future developments.

Mathios Rigas, CEO of Energean said: "We are delighted that our independent reserves auditor has confirmed 2P gas volumes of 98 Bcm within our Karish, Karish North and Tanin fields, offshore Israel, representing another year of continuous reserves growth in our portfolio. This gas, the majority of which has already been contracted, will be sold under fixed-price gas sales agreements that will protect our revenue stream from commodity price fluctuations, which underpins our strategic goal of paying a sustainable dividend."

"The approximately 100 MMboe of 2P liquids reserves and production plateau averaging 28 kbpd over five years, represents a substantial increase on previous estimates, which further supplements our shareholder returns profile with high-margin production that has no incremental impact on our scope 1 and scope 2 CO2 emissions intensity."

"We look forward to progressing the 62 Bcm and 33 MMbbls of risked prospective resources across our Karish and Tanin leases and in Block 12, with the intention to recommence our successful exploration program in early-2022 and, through doing so, will continue to contribute to the diversity and security of natural gas supply into Israel and the wider Eastern Mediterranean.”