2020 has been dismal for upstream dealmakers across Asia Pacific. During a recent conversation with a senior banker in the region, I mentioned that deal activity was so poor this year that as of October, only a sliver over US$400 million and 117 million boe of 2P resources had transacted (vs US$5.1 billion and 1,400 million boe in 2019).

I got a short response: “I’m surprised it wasn’t zero.” Perhaps nobody needs reminding just how tough a year it’s been.

But hey, it’s almost 2021 and optimism is in the air. My colleague Alay Patel, Principal Analyst in our APAC upstream research team, tells me that we can expect a bounce-back as the M&A market is brought off life support over the next 12 months.

The recovery in oil and gas prices should help bring buyers and sellers closer on price expectation, while ongoing consolidation among upstream producers in North America has driven a sharp uptick in global M&A in recent months, likely pushing more non-core APAC assets into the market.

This is raising hopes that long-anticipated deals in Australia, Malaysia, Vietnam, and elsewhere could finally get done. Much will need to go right, but by the end of next year, Asia Pacific could well see signs of a refreshed corporate landscape and companies looking again to growth. Sounds great, but of course challenges remain.

How much could be on the block?

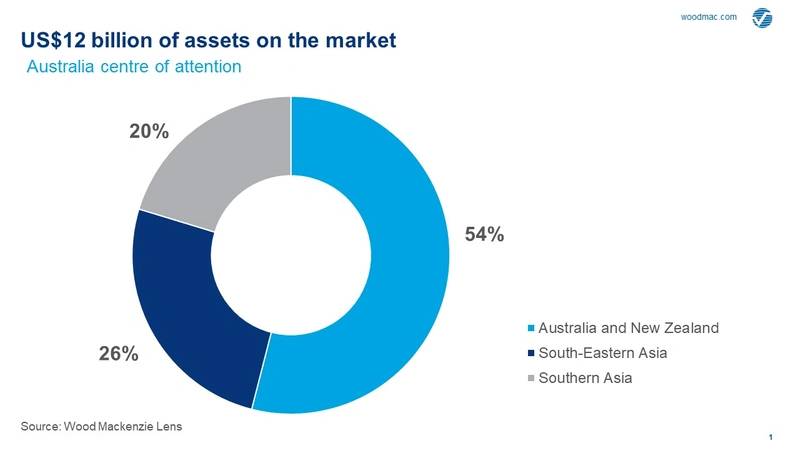

In a recent Insight, Alay and his colleagues identify 11 high-profile prospective APAC deals on their M&A watchlist – including assets both formally on the market and others rumored to be for sale or farm-down. Combined, these account for almost US$12 billion (NPV10, 2021) of value.

And it doesn’t stop there. A further US$26 billion of assets are now in their ‘speculative’ deal bucket as portfolio streamlining and balance sheet deleveraging mean that fresh opportunities are coming onto the market at a steady pace. For the Majors in particular, the longer-term impact of the energy transition is driving further non-core divestments as strategies quickly evolve.

Who is selling?

Perhaps unsurprisingly, it is the Majors and larger IOCs that are the primary sellers of assets, a trend that has accelerated since the oil price crash in March. That said, several NOCs could also be looking to divest, and we identify almost US$5 billion of NOC assets that could come to market – check the speculative bucket. Geographically, Australia is the region’s M&A hotspot.

When looking at the US$12 billion of potential divestments by asset type, LNG opportunities account for more than half of the 5.8 billion boe of resources on offer. About a third of this is associated with producing assets, with 2.7 billion boe located in Australia.

And who is buying?

It’s a worn-out phrase, but it is of course a buyer’s market out there. And the biggest challenge isn’t generating interest in data rooms or sale processes – plenty of tyre kickers out there! – but finding the right buyers with the required capital, experience, and risk appetite.

Despite the number of credible buyers being more limited, and buyer and seller price expectations not quite fully aligned yet, we do see serious buyers beginning to emerge.

Regional independents and traditional NOCs are looking to grow and will be watching closely. But as my colleague Angus Rodger puts it, “It’s not just the usual suspects that have been acquirers in recent years. Infrastructure funds and private equity-backed entities such as Neptune, Trident, and Chrysaor are stepping up their opportunity screening.”

Angus does point out, however, that each of these different buyer groups is focused on very specific asset classes in specific areas.

Late-life asset specialists including Perenco, Jadestone, and Hibiscus will also be active, as will ambitious regional players like Medco Energi. In Australia, infrastructure funds and utility companies are looking for greater integration between upstream assets and their existing portfolios, potentially redefining ‘infrastructure’ to include direct ownership of gas plants and fields.

Reasons to be cheerful, but many challenges ahead

All of this sounds positive as we finally bid farewell to the misery of 2020. But alas, optimism doesn’t wait on facts. Alay is quick to add that the buyer and seller landscape has never been more unpredictable. Many are still trying to find their footing: 2020’s meager pickings have meant that Asia Pacific deal data points are few and far between, making it near impossible to calculate what barrels are worth to investors in region.

As ExxonMobil’s recent decision to take its Australian Bass Strait asset off the market after a long sales process neatly highlights, the pandemic, oil and gas price volatility and weakened corporate balance sheets make executing successful upstream M&A extremely challenging. Let’s hope that 2021 brings greater stability to all three.

Best wishes to you all. The APAC Energy Buzz will be back in January.

The Author

Gavin Thompson is Wood Mackenzie Asia Pacific vice chair, running the APAC Energy Buzz blog. In his blog, Thompson shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.