In 2017, the Brazil National Petroleum Agency (ANP) issued a failure mode alert: stress corrosion cracking (SCC-CO2) triggered by the presence of CO2 in high-pressure pre-salt conditions had been identified as the cause of broken tensile armor wires on a certain flexible pipe installation. Relatively common in other applications where carbon steel is subject to high CO2 concentrations, this failure mode was unknown in flexible pipe – and it presented a major challenge for operators in Brazil’s extensive pre-salt fields.

Flexible pipes have played an important role in Brazil’s history of oil production.

No other oil province in the world has applied flexible pipes so intensively as the Campos Basin, for example, where approximately 2,223 km of risers and flowlines have been installed to connect giant fields including Marlim, Albacora and Roncador, in water depths that range from 1,500m to 2,000m. It’s no exaggeration to say that flexible piping has been crucial to the development of Campos and other basins as viable production sites.

Flexible advantages

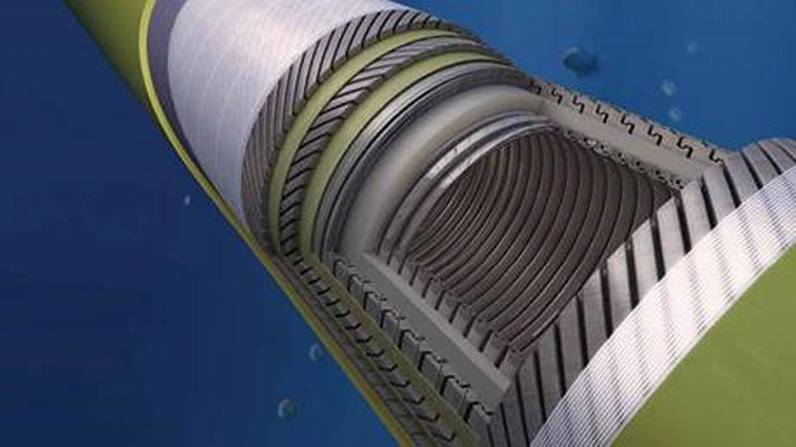

Of course, flexible piping is not exclusive to Brazil. Its widespread deployment is down to the many advantages it offers to so many operators. With concentric and unbonded layers, each of which contributes to the mechanical strength and chemical resistance needed to withstand deep-water conditions, flexible pipes were designed to ensure collapse resistance, internal pressure capacity, bending stiffness and axial-load capacity – among numerous other advantages to deep-water operations.

In addition, this unique design gave operators several logistical advantages. Flexible pipes can be transported on smaller, nimbler, and more cost-effective vessels. Manufacture does not require quality-sensitive offshore processes such as welding or field-joint coatings – both of which have, historically, raised concerns about operational integrity.

As the name suggests, they also give operators the luxury of flexibility and enable them to make subtle but important changes at later stages of a project without incurring severe cost penalties.

Once in production, flexible piping gave operators the option of moving subsea lines and re-positioning pipes in response to production needs, or to postpone the exact location of production-well placement decision. As operators started production and built knowledge of reservoir behavior, that flexibility allowed them to optimize both output and field life.

That ability to be easily recovered, inspected, repaired, re-laid and connected at new sites was key: flexibles proved themselves to be the best way of reducing time to first oil by enabling feasible production in short timeframes, even before reservoir de-limitation and subsea layout consolidation. They reduced the risks of drilling campaigns and delivered associated advantages in terms of time and cost.

The ANP’s announcement about SCC-CO2 in 2017 therefore had implications for the entire industry.

One short-term option was for operators to reduce their perceived risks by moving away from flexible pipe solutions and adopting rigid pipes instead. But by doing so, all the flexibility that had allowed Brazil to develop offshore fields efficiently would be lost.

Operational complexity, such as the water depth, bore size, temperatures, pressures and contaminants found in the Santos Basin, requires constant review and development of the technology – in this case, the optimization of subsea hardware, as well as installation and operational procedures.

For this reason, Baker Hughes directed its considerable research and development efforts to the exploration of alternative mitigation measures for its clients in Brazil. In the aftermath of the problem identified in 2017, and while not experienced on its own manufactured pipes, Baker Hughes began work on an extensive program to improve the resilience of the installed fleet and to deliver the next generation of SCC-CO2-resistant pipes.

Understanding the problem

As the ANP report noted, SCC-CO2 is a condition that can induce cracking and even failure in a pipe’s steel wires. However, three conditions need to be present simultaneously for such cracking to take place: environment (water and concentrated CO2); high tensile stress exceeding a critical level; and very high-strength materials that are consequently crack-susceptible. If one of these three elements are designed out, cracking cannot happen. Since environmental conditions and high levels of tensile stress were unavoidable, the improvement had to come from the materials used in pipe manufacture.

Also, critical to developing an improved pipe solution is the knowledge that the SCC-CO2 phenomenon is defined by two stages – nucleation and propagation – and that managing them requires different, but complementary approaches.

In the case of propagation of an existing crack, fracture mechanics can be used to define the remaining life of the asset and mitigation work needed. However, a completely different approach is needed when considering the susceptibility of a pipe to crack nucleation.

In this case, multiple small-scale tests using armor wires taken from commercial products can be run for six months to simulate severe environmental conditions. When Baker Hughes ran these kinds of tests, wires were exposed to various combinations of contaminants while loaded at stresses close to the yield point.

The lab results showed that it is feasible to design and manufacture a flexible pipe to operate in a SCC-CO2 envelope without incurring any damage. In fact, the tests showed that, in pipes proposed, designed and developed by Baker Hughes, the initiation of cracking would only occur if the loading on the wires and associated stress was raised to double that experienced in the field.

With the results of extensive testing and lab-work as a foundation, Baker Hughes began to develop solutions for its customers. One of the most important steps was to build alliances and partnerships with key material suppliers, test houses, installers and external experts such as the National Composite Centre (NCC) in the UK. This has brought experiences, insights and lessons from other industries to the manufacturing of flexible pipe, adding robustness to the qualification and validation programs.

The outcomes of this work are a new hybrid composite material for pipe manufacturing. The new material offers superior gas permeation performance, but without the traditional metallic layer that is most susceptible to CO2 damage. Not only does the composite pipe reduce the concentration of CO2 at the tensile armors, and is not susceptible to SCC-CO2, it is also lighter than standard flexible piping. This reduces installation costs even further and allows operators to deploy risers in a free-hanging catenary, removing buoyancies, accelerating installation time and improving safety.

Recent pipe designs have also included reinforced outer layers to protect against perforation or damage during installation, while all end-fitting ports and seals can be tested against external pressure to prove their capacity in deep water. A machined area that allows ultrasonic testing inspection for detecting flooding and a visor rated to 2,500m water depth are added to end fittings.

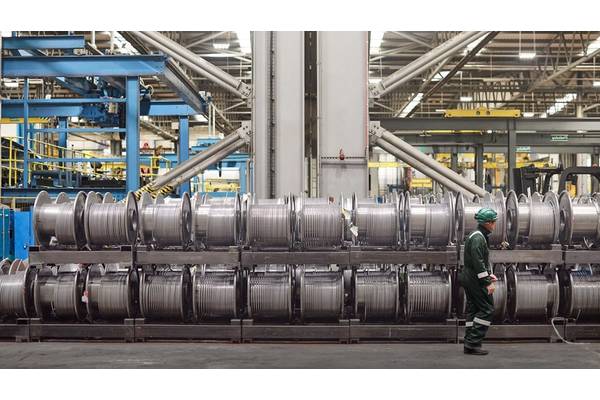

Image: Baker Hughes

Image: Baker Hughes

Recognizing that pipes in service were also a concern for operators, new ways of carrying out dissections to define initial cracks (the starting point for fracture mechanics) and calculating the service life of installed fleets was also needed. This required some means of testing to identify whether a given pipe was flooded or not.

Naturally, this is a key challenge for integrity management teams: the pipes are not designed to have this kind of verification performed once they have been installed and bringing a riser or flowline to the surface for verification is incredibly disruptive.

However, it is an area where sensor technology can deliver exceptional results. Baker Hughes’ proprietary sensor technology is now embedded into current risers for pre-salt and work continues developing methods for retrofitting sensors to installed pipe.

Such a system can detect any ingress of water from the topside into the riser annulus along its full length. It provides continuous monitoring, rather than one-off inspections, without extra vessels or ROVs. It can also cover up to five separate pipes and monitor all riser sections from the FPSO up to a 3,600m range. A database of Baker Hughes’ SCC-CO2 program outcomes also enables quick identification of products that are not susceptible to this damage mode.

A team of engineers is now developing comprehensive sets of modeling tools that will be further calibrated by the test results, as well as undertaking a wide range of manufacturing trials in an automatic fiber-tape placement module. This work will enable the behavior of any pipe structures to be predicted without repeating full qualification testing.

These kinds of testing campaigns will continue in order to confirm that all variables – and any combination of variables – that may influence or trigger the SCC-CO2 damage mechanism – are fully explored, mapped and documented to ensure the industry can develop the mitigation strategies for their particular circumstances.

However, the work in Brazil is part of an even bigger picture. The world’s oil and gas sector faces unprecedented challenges to meet social and political demands for greater environmental responsibility and emission reduction in the face of extraordinary price pressures and capital constraints. There is, as a result, no shortage of speculation about what the new normal will look like: from autonomous operations to extremely efficient, carbon-neutral developments.

What is perhaps less widely discussed is the idea that ‘normal’ of any kind will be an increasingly rare phenomenon within the oil and gas sector – or indeed within any industrial sector. Constant innovation, continual development, permanent evolution, and a relentless re-assessment of what works and what can be done better, will be the defining features of successful operators and their service companies. Whether it’s the use of advanced sensors, data and analytics, or the modification of manufacturing materials, almost every aspect of the business is open to re-evaluation.

The reality is composite flexibles combined with advanced sensors, and conventional pipe design and manufacturing offer a viable way to continue to use flexible pipes in pre-salt without concern for SCC-CO2.

Conventional Pipe. Image: Baker Hughes

Conventional Pipe. Image: Baker Hughes