UK-focused oil and gas firm Jersey Oil & Gas (JOG), on Tuesday announced a significant increase in 2C contingent resource estimate for the Buchan oil field, within the Greater Buchan Area ("GBA") in the UK North Sea.

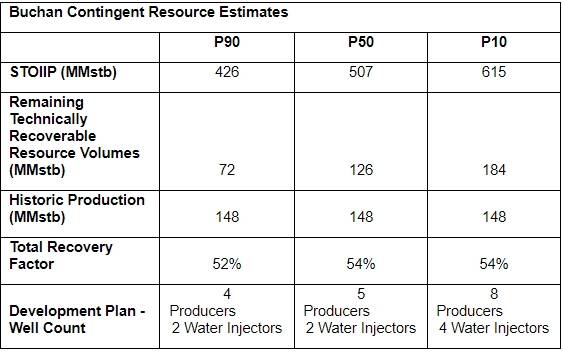

Dynamic reservoir modeling of the P50 stock tank oil initially in place ("STOIIP") case has recently been completed by Schlumberger Oilfield UK Plc a high-resolution reservoir simulator.

According to JOG, dynamic reservoir modeling has determined that the P50 estimate of the technically recoverable resources for the Buchan oil field is 126 million stock tank barrels ("MMstb"), representing an increase of over 50% on previous estimates derived from decline curve analysis.

JOG says that the project workstream has now been independently peer-reviewed as part of a wider scope reviewing the development concept by Vysus Group (formerly Lloyds Register's Energy Business), an engineering and technical consultancy.

The expected ultimate recovery factor is 54% of original oil in place, with historic field production having recovered 29% of the P50 STOIIP estimate. Planned future production will be achieved using optimally located deviated wells placed high in the structure with water injection, JOG said.

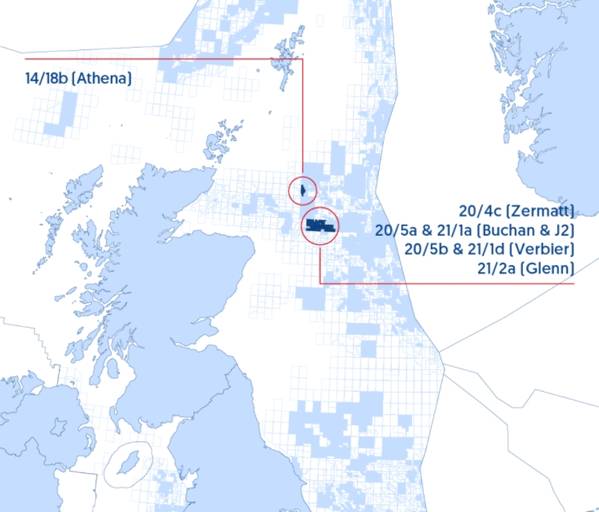

As a result of this increase, the Greater Buchan Area core volume, including the Buchan oil field and volumes from the J2 and Verbier oil discoveries, is now forecast to have 2C contingent resources of 162 MMstb or 172 million barrels of oil equivalent ("MMboe") including associated gas.

JOG further said that the increase in volumes comes ahead of the anticipated launch of the company's GBA farm-out process later this quarter seeking to attract industry partnership to join JOG in "unlocking the significant value that exists within this very exciting major North Sea area hub development project."

"Having selected our preferred development concept for the GBA hub development, management is now finalising the Concept Select report and economics for submission to the OGA ("Oil and Gas Authority") with the aim of commencing FEED in Q3 2021," JOG said.

The company also said it continued to advance its technical and economic evaluation work in respect of electrifying the GBA in order to make it a low carbon emissions project.

Andrew Benitz, CEO of JOG, said: "I am delighted with the results of dynamic modelling which result in an increase in the estimated contingent resource volumes of light sweet crude in the proven, conventional reservoir at Buchan by over 50%. These compelling results demonstrate the substantial inherent value of the Buchan field and the wider GBA development.

"We recognized the potential of Buchan at an early stage and have maintained our strategic focus on this area in the heart of the Central North Sea with the benefit of aggregation of high-value assets becoming self-evident. The GBA development project presents a very compelling investment case that we believe will have a wide industry appeal. We look forward to formally engaging with industry in due course and attracting the right industry partnership aligned and committed to the GBA's future success."