For the offshore wind industry, 2020 was all about ambitions. Policymakers raised the bar for growth, focusing on job creation amid the offshore wind cost-out and the coronavirus pandemic. Renewables targets were raised and decarbonization plans that span the length of the supply chain were brought forward. This momentum is likely to continue in 2021, says Wood Mackenzie, a global energy intelligence group.

Søren Lassen, Wood Mackenzie Head of Offshore Wind Research, has identified three biggest global offshore wind themes to watch this year:

"We expect to see policymakers up offshore wind targets, increase the focus on jobs creation, and facilitate innovation to seed future exports. Power-to-X (PtX) and hybrid projects will continue to dominate headlines.

“Similarly, offshore wind developers have increased their renewables ambitions. Not only in terms of capacity but also by signing power purchase agreements (PPAs) and rolling out decarbonization plans for their supply chains,” said Lassen.

According to Wood Mackenzie, decarbonization will become a larger theme across the industry.

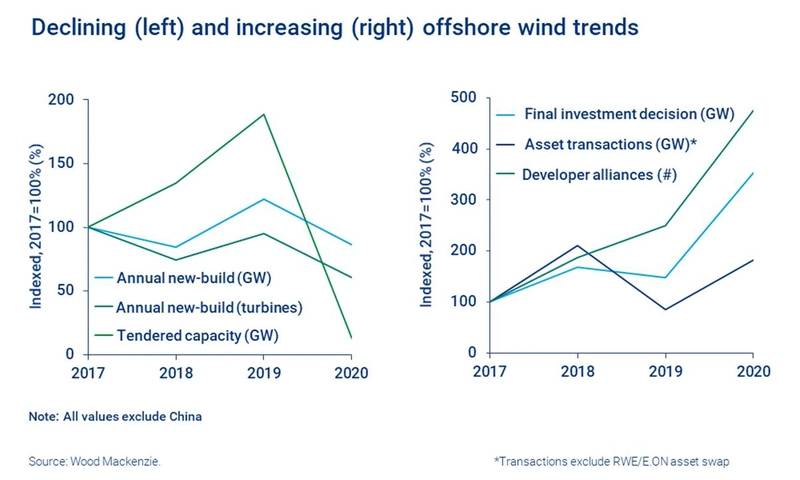

“We saw strong indications of this in the installation segments in 2020, where 96% of the announced offshore wind vessels held green credentials. “The pool of suppliers will continue to grow and globalize in 2021. Both established suppliers and new entrants will evolve their strategies, broadening their role to better capture future growth,” added Lassen. 2020 saw the lowest tender activity in eight years. That did not reflect a lack of appetite for offshore wind, but rather a transition in support schemes, says Wood Mackenzie.

“Tender activity will pick up significantly in 2021 – we anticipate the award of a record 23+ GW of tenders across seven markets. Japan and Poland will award their first commercial offshore wind projects this year, the UK kicks off the world’s largest offshore wind tender, and a new wave of tenders will be awarded across the US. We expect these events to catalyze new supply chain investments,” said Lassen.

Tenders won’t focus solely on price, Woodmac says. Local sourcing and job creation will be particularly important in emerging markets, while the production profile and PtX will play a larger role in the established markets of continental Europe. Wood Mackenzie expects many developers to participate through partnerships, leveraging combined strengths.

Per the company, changing policy frameworks and long lead times have subdued offshore wind build-out in the past four years outside of China. However, the pick-up in FIDs in 2020 will drive an increase in annual installations from 2022, adding certainty to the first half of the decade.

“Pipeline acquisitions will continue to be a source of growth for developers. But we also expect developers to go further back in the development cycles and build up greenfield projects to strengthen margins. We’re already seeing this trend play out in the steep and consistent increase in new developer alliances in emerging markets.

"Greenfield developments will be a central theme in 2021 in both existing markets, where new lease areas will be awarded, and in new markets. That means more frontiers will be broken down and new basins will light up on the offshore wind map,” added Lassen.