A Milan court is due to issue a verdict on Wednesday in the oil industry's biggest corruption trial, a case centered around the purchase of a Nigerian oilfield by Eni and Royal Dutch Shell for $1.3 billion a decade ago.

After more than three years of proceedings and 74 hearings, judges withdrew to their chambers on Wednesday to consider their verdict, said Marco Tremolada, who heads the panel of judges, adding that a ruling was expected in the afternoon.

Prosecutors have called for Eni and Shell to be fined and for a number of past and present managers from both companies, including Eni Chief Executive Claudio Descalzi, to be jailed. The defendants have all denied any wrongdoing.

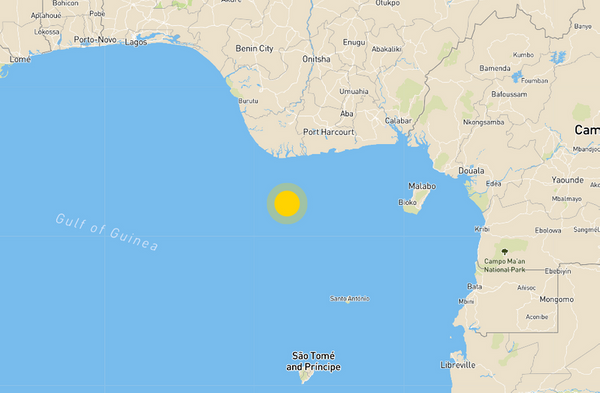

The long-running case revolves around the purchase of the OPL 245 offshore oilfield in Nigeria in 2011 from Malabu Oil and Gas, a company owned by former Nigerian oil minister Dan Etete. OPL 245 location - Credit: Eni

OPL 245 location - Credit: Eni

Prosecutors allege that just under $1.1 billion of the purchase price was siphoned off to politicians and middlemen, including Etete, a convicted money launderer who served as oil minister under Nigerian military ruler Sani Abacha.

The verdict comes at a time when investors are putting more and more pressure on oil companies both to fight climate change and come up with sustainable business models that take into account the social impact of their activities.

"This case certainly doesn't help the two companies and has taken a reputational toll though of course it's hardly the first case of corruption we've seen," says Davide Tabarelli, head of Italian energy think-tank Nomisma Energia.

A guilty verdict for the companies or the executives could also put Nigeria, which has struggled for decades with endemic corruption, in an awkward position. It would come under pressure to rescind the licence from Eni and Shell, which could delay the oilfield's development and the revenue it would produce.

Prosecutors have also asked that $1.092 billion, the equivalent of the alleged bribes, be confiscated from all the defendants.

The defendants say the purchase price for OPL 245 was paid into a Nigerian government account and subsequent transfers were beyond their control.

The exploration licence for the field, some 150 km (95 miles) off the Niger Delta, has not been revoked but it has not been converted into a mining licence and no oil has been produced.

(Reporting by Emilio Parodi, Alfredo Faieta and Stephen Jewkes in Milan, Shadia Nasralla and Ron Bousso in London; Editing by David Clarke)