Equinor’s Troll Phase 3 project has been described as a real Kinder surprise. It’s Equinor’s most profitable project ever and comes with a minimum CO2 intensity for an offshore project. Elaine Maslin takes a look.

Later this year, Norway’s Equinor is due to bring on stream its “most profitable project ever”. With a breakeven of less than $10/barrel, it’s indeed a low-cost project. It’s also got a low carbon footprint; the project is set to deliver about 2.2 billion barrels of oil equivalent with a CO2 intensity of 0.1 kilo per barrel.

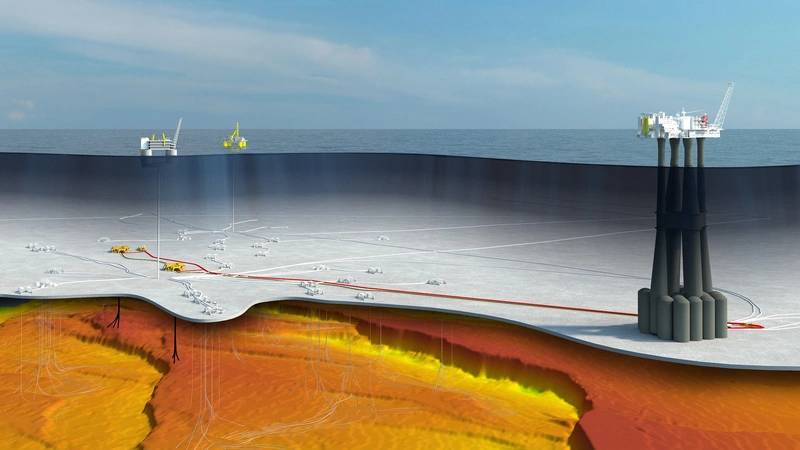

The project is Troll Phase 3, which will produce the gas cap over the Troll West oil column, in about 330 m water depth, 80 km off Bergen in the Norwegian North Sea. The NOK 7.8 billion (US$900 million) Troll Phase 3 project will extend the plateau production for gas from Troll for about seven years and the expected productive life by about 17 years. The development includes two subsea templates, eight new big bore production wells, a 36-inch pipeline back to the Troll A platform and a new processing module on Troll A.

Rune Mode Ramberg, subsea, umbilicals, risers and flowlines (SURF) manager on the project told the Underwater Technology Conference (UTC) late last year about the project. “Troll Phase 3 is a really good kinder surprise,” says Ramberg, who is now SURF manager on Equinor’s Northern Lights carbon capture and storage (CCS) project. “The amount of energy we are able to deliver is huge. It’s more than the amount of energy we have delivered from Phase 1 of Johan Sverdrup.” But, critically, he says, it’s also doing it with a low carbon footprint, thanks to Troll A having been powered from shore from day one. “Troll A has been producing oil and gas since 1996, without any burning of gas offshore,” he says, “it’s been powered from shore the full time.” In addition burning natural gas compared to coal generates 50% less CO2, , says Ramberg.

“This is also a really good example of how subsea tieback projects can be really economic, with only minor topside modification, we have been able to use the installed capacity using the subsea technology to get all the gas back to Troll A. This is a really good example how profitable subsea solutions/tie-backs can be in our projects.” The project has also benefitted from forward thinking by Shell, as the development operator for Troll A, resulting in pre-installed critical equipment now being utilized by the Troll Phase 3 project.Troll – a big project from day one.

Despite the low break-even price and carbon intensity, it’s still a big project. Everything about Troll is big. It contains some 40% of the total gas reserves on the Norwegian continental shelf (NCS). It’s also one of the largest oil fields on the NCS, producing 400,000 barrels per day at its peak in 2002. The Troll A gas platform, standing on a massive concrete support structure, is the tallest structure ever moved by humans over the surface of the earth, according to the Guinness Book of Records.

But it could have been bigger. A lot of thought also went into the design of Troll A. Processing was moved from offshore to Kollsnes, onshore, so that the facilities could be smaller. Troll A was also built to be powered from shore with Norway’s green hydropower electricity – and it remains so. Thought also went into the future phases of Troll – including having pipe bends ready to be used to tie in new subsea pipelines; they were stored from day one, ready and waiting at the bottom of the massive concrete riser shafts the facility stands on.

“Back in the 1990s, they were really ahead of their time,” says Line Hoff Nilsen, Troll A platform manager. “They planned for connecting more pipelines to the platform; a fantastic example of forward thinking. At the bottom of the riser shaft there are several pipe bends waiting for this day. It would not have been possible to put them in place today, as there is no access now.”

Troll Phase 3 beneath the surface. Source: Equinor.

Troll Phase 3 beneath the surface. Source: Equinor.

Contracts and operations

Troll Phase 3 was approved in 2018. It will see the gas cap on Troll west finally developed. It had been deliberately held back to balance and stabilize the oil column, so that oil recovery at Troll West Could be maximized.

Aker Solutions was awarded the contract for the subsea production systems, Nexans was contracted for 27km of umbilicals with power, fiber optic and hydraulic cores, as well as a MEG services line for chemical injection. DeepOcean was contracted for marine operations, including installing the two integrated template structures (ITS – into which the Xmas trees are installed) with manifolds, two pipeline foundation structures (with 11m-deep legs for installation in soft soil), pipeline end manifolds (PLEMS) and spools, as well as laying the MEG line and umbilical lines, tie-ins and commissioning. Allseas was contracted for the 26km pipe lay and IKM got a pipeline detailed design award. The linepipe for the 36 inch pipeline was delivered by Marubeni.

Aker Solutions was also awarded a contract for engineering, procurement, construction and installation contract of a new 1200-tonne processing module on Troll A following Aker Solutions’ front-end engineering and design work. The process module was built at Aker Solutions yard in Egersund, Norway.

The eight new wells were drilled during 2019-2020, using the semisubmersible drilling rigs COSL Promoter and Transocean Equinox in order to produce the 347 billion cubic meters of gas. The new NOK 1 billion, 40m-long, 10m-wide process module (designed to slot into a space on Troll A) was installed in August 2020; six months delayed due to lowering staffing levels because of the Coronavirus pandemic.

The world’s largest pipelaying vessel, Solitaire, was used to lay the 26 km of new large bore 36-inch pipeline between Troll A and the Troll Phase 3 well sites. Some 400 people worked on the vessel, 24/7, welding and laying pipe, with eight pipeline supply vessels constantly providing new sections of pipe to continue the operations, notes Steinar Helle, Troll Phase 3 construction and commissioning manager.

A large bore subsea production system was used to take the gas from the reservoir through to the production facilities to help minimize the pressure loss, so the existing power at Troll A didn’t need to be increased, notes Ramberg.

A 400m section was laid and pulled into Troll A through a pre-installed conduit using a 900mm wire fed up to a winch on the platform deck. The pipe was then connected to pre-installed risers using the pipe bends already available at the bottom of the riser shaft. Once the rest of the pipeline was installed it was then connected to the 400 m section via a 90m-long, 36-inch diameter spool piece with 100-tonne dry weight.

According to DeepOcean the 36in spool and the 20in spool installed at the well site end of the 36inch pipeline, were some of the largest spools it has ever manufactured and installed. “It was a world record being able to connect these two pipelines. DeepOcean had to use both the Edda Freya’s vessel cranes simultaneously (for lifting and lowering this spool piece),” says Ramberg.

The spools were installed using a subsea H-frame lifting tool in to align the two pipelines – tools, including a pig launcher and receiver, which had been used at Aasta Hansteen some years ago. The umbilical and MEG line were piggy backed together and pulled through a J-tube installed at Troll A.

In total, the project clocked up about 650 vessel days, says Ramberg. “It was a huge program, but a lot of pipe and steel went into the ocean,” he adds. “Troll Phase 3 is a genuine kinder egg, providing a huge amount of energy with a very small CO2 footprint and it’s shown the subsea tieback is very profitable. Subsea technology is a part of the solution.”

“Troll Phase 3 is a pretty unique project, and unlikely to be repeated. It’s also not a huge surprise if it rates as Equinor’s most profitable ever,” says Robert Morris, principal analyst, upstream, at Wood Mackenzie.

“Using our Lens Upstream platform, we estimate the project will generate an IRR in excess of 60%, under our current pricing assumptions. That is the highest of any major upstream project to be sanctioned back in 2018. Costs and prices have obviously changed since then, but among all projects in Wood Mackenzie’s pre-final investment decision (FID) upstream project tracker (which benchmarks all major pre-FID projects globally), it would also rank well above average for subsea tiebacks of the future [i.e. those in the project pipeline but not yet sanctioned].

“Troll Phase 3’s extremely attractive economics are more a sign of a high-quality project than a function of low subsea costs. For context, it is a gas blowdown project: after years of injecting produced gas to support oil production, this new phase will result in gas finally being produced and sold. In cost and scope, very little new investment has been required to access huge reserves. You could think of it as similar to a 50 million barrel subsea tieback in the North Sea, except that the reserves base is more than 2 billion boe. So the unit development cost is incredibly low, at just US$0.40/boe.”

The H-Frame used to install the 36in spool. Source: Equinor.

The H-Frame used to install the 36in spool. Source: Equinor.