Danish offshore drilling company Maersk Drilling has struck a deal to sell the drilling and production unit Mærsk Inspirer, on contract with Repsol at Yme offshore field in Norway, to Havila Sirius for $373 million.

As part of the deal, Repsol will, on behalf of the Yme field partners, charter the rig from Havila Sirius and assume responsibility for the day-to-day operation of the rig on the Yme field.

Maersk Drilling said it would deliver certain transitional services, adding that certain employees are expected to be transferred from Maersk Drilling to Repsol.

The parties agreed that for a period of 12 months post-closing of the sale of the rig, Maersk Drilling will provide drilling management services, for a fee not included in the sale price.

"It is expected that the transaction closing will take place in the second half of 2021, subject to authorities’ approval and completion of offshore (commissioning) activities for the rig to be ready to receive hydrocarbons," Maersk Drilling said.

Providing the rationale for the transaction, Maersk Drilling said the deal was in line with its objective of aligning its fleet to its core business - drilling - while also further strengthening Maersk Drilling’s balance sheet through a material reduction of net debt. Some of the profits will be used to partially repay the syndicated credit facility.

As for the rig, Mærsk Inspirer was originally delivered as a jack-up drilling unit in 2004, and after an initial drilling program in the UK, the rig was converted to provide simultaneous drilling and production service on the Volve field offshore Norway for Equinor in the period from 2007 to 2017.

At the end of 2020, after completing onshore modifications at Egersund yard in Norway, Mærsk Inspirer was towed offshore to prepare for a five-year contract with additional options for combined drilling and production activities at the Repsol-operated Yme field in the North Sea, offshore Norway.

The buyer, Havila Sirius is a subsidiary of Havila Holding, a family-owned investment company with ownership within offshore supply vessels, ship technology, ferry operations, tourism, and real estate.

Jørn Madsen, CEOMaersk Drilling said: "We are very pleased to enter this agreement with Havila Sirius and Repsol who have a special interest in taking ownership of Mærsk Inspirer’s production capabilities as part of the rig’s long-term commitment to Yme.

"Operating a production module is not part of Maersk Drilling’s core business and we believe that this is an attractive transaction which will create value for Maersk Drilling’s shareholders while securing a good future home for the rig."

Maersk Drilling said the transaction would not impact its financial guidance for 2021. Just last week, on the back of good recent performance with drilling rig contract, Maersk Drilling upgraded its financial guidance for 2021 EBITDA before special items to $260-310 million, compared to the previous guidance of USD 225-275 million.

"As a result of the [Maersk Inspirer] transaction, Maersk Drilling’s contract backlog will be reduced. As of 31 March 2021, Maersk Drilling’s contract backlog was USD 1.8bn of which approximately USD 440m relates to Mærsk Inspirer," the company said Thursday.

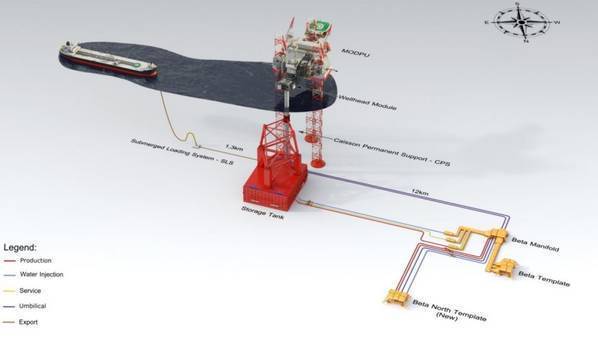

When it comes to the Yme field, it is an oil field located in the southeastern part of the Norwegian sector of the North Sea, 130 kilometers northeast of the Ula field. The water depth is 77-93 meters.

The development plan includes the use of Maersk Inspirer jack-up unit for five years, with a five-year extension option.

The plan is to reuse the nine wells pre-drilled in 2009-2010 and to drill seven additional wells. Oil from the field will be transported with tankers and the gas will be reinjected.

Repsol is the operator with a 55% stake. Lotos owns 20%, OKEA has 15%, and KUFPEC holds 10%. Yme field layout - Image by Repsol

Yme field layout - Image by Repsol