Oil major BP has hired a Valaris drillship for drilling operations offshore Mauritania and Senegal, where it operates the Greater Tortue Ahmeyim project.

Valaris said Tuesday that BP would use its double hull DP drillship VALARIS DS-12 to drill four offshore wells.

The contract for the 2013-built drillship is scheduled to begin in the first quarter of 2022 and will last for 285 days. The financial terms of the agreement were not disclosed by Valaris.

Esgian's Bassoe Analytics shows the estimated dayrate for the deal to be around $200,000, which would bring the total value of the contract to around $57 million. According to the rig's AIS data, the drillship - formerly named Ensco DS-12 - is currently located offshore the Ivory Coast, where the rig recently secured a deal with TotalEnergies.

Tortue Ahmeyim

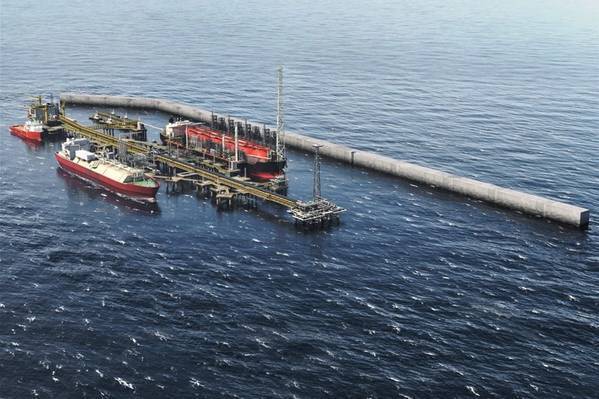

The BP-operated Greater Tortue Ahmeyim cross-border development in Senegal/Mauritania offshore area is one of Africa's deepest offshore projects at 2,000 meters below the sea surface. It will produce gas from an ultra-deepwater subsea system and mid-water floating production, storage, and offloading (FPSO) vessel, which will process the gas, removing heavier hydrocarbon components.

Gas will then be transferred to the GIMI FLNG at a nearshore hub located on the Mauritania and Senegal maritime border. The FLNG facility is designed to provide circa 2.5 million metric tons of LNG per annum on average. Total gas resources in the field are estimated to be around 15 trillion cubic feet.

Kosmos Energy discovered the Greater Tortue Ahmeyim field in 2015, and BP signed onto the project through an agreement with Kosmos in 2016.

BP is the project operator. The partners sanctioned the first phase of the project development in December 2018.

FPSO delay expected. Costs rise

In a separate update earlier on Tuesday, Kosmos as a partner in the project said that project partners had received a revised forecast from the EPCIC contractor, TechnipFMC, that the delivery of the FPSO is likely to be slightly delayed due to labor shortages at the COSCO yard in China following a ramp-up in activity at the shipyard as the pandemic recedes.

"This delay, currently anticipated to be around three months, is expected to push the timing of first gas to the third quarter of 2023," Kosmos said.

According to Kosmos, BP, as the operator, has informed partners that due to the impacts of COVID-19 (including the FPSO delay), cost inflation, and scope growth, Phase 1 project costs are expected to increase.

"On the basis of the revised schedule, Kosmos currently expects the gross cost for the project to be approximately 15% higher, resulting in an estimated increase of Phase 1 costs to first gas net to Kosmos of around $100 million, coming primarily in 2023," Kosmos said.

While delays are expected, work on the project is progressing, Kosmos said that for the FLNG construction, the four remaining sponsons have been integrated in the final dry dock. At the FPSO, the living quarters have been installed.

The project will include an offshore breakwater, and according to Kosmos, five caissons have now been transported offshore with the first caisson installed. Subsea, all the subsea trees have been constructed, Kosmos said.

Related: