Harbour Energy, a London-listed oil firm created through a merger between Chrysaor and Premier Oil, has decided to exit the Sea Lion oil field development in the Falkland Islands.

The company has a 60 percent stake in the oil field, with Rockhopper Exploration holding the remaining 40 percent stake.

The field was discovered in 2010 by Rockhopper, but the project development start-up has been delayed several times. In 2014, Premier Oil (now part of Harbour) and Rockhopper targeted first oil for 2019; however, years later, the field development has yet to reach a final investment decision.

"While the Sea Lion discovery has significant resource potential, development of the project is not deemed a strategic fit for Harbour. Therefore the group has decided to explore the options to exit the project and its other license interests in the Falkland Islands," Harbour Energy said Thursday.

Harbour also said it would exit its exploration licence interests in the Ceará Basin in Brazil and in the Burgos Basin in Mexico.

"This is in line with the Group's exploration strategy which is focused primarily on infrastructure-led, lower risk opportunities in areas with an existing Harbour producing presence," the company said.

The Sea Lion project is estimated to hold 2C resources in excess of 500 million barrels.

Rockhopper has noted Harbour's announcement and said it planned to continue to pursue the development of Sea Lion.

Rockhopper and Premier Oil in January 2020 entered into a deal with the Israeli firm Navitas that would see Navitas eventually obtaining a 30% interest in the Sea Lion offshore blocks. Then, the collapse in oil prices and the global pandemic ensued, affecting the deal's completion. In November 2020, the three companies agreed to extend the exclusivity period for the latter's farm-in into the project until September 30, 2021.

Difficult moment

Rockhopper said Thursday it was in discussions with Navitas Petroleum LP around its potential entry to the Sea Lion project following Harbour's decision not to proceed.

"Rockhopper notes that Navitas and partners have recently raised project financing in excess of $900 million and taken final investment decision on the 330 million barrel deep-water Shenandoah project in the US Gulf of Mexico," the company said.

"The previously announced Heads of Terms with Premier Oil and Navitas will expire on 30 September 2021 (unless extended by mutual consent before that date). If the Heads of Terms expire, Harbour will have an initial 90 days to elect how to proceed with their exit. Rockhopper will continue to be funded (excluding licence fees, taxes, and project wind-down costs) by Harbour during that period under the terms announced on 7 January 2020 and 30 April 2020," the company added.

"Rockhopper will now work with Harbour and the Falkland Islands Government to ensure an orderly exit by Harbour from the Falkland Islands," Rockhopper said.

The Falkland Islands government earlier this year agreed to extend the terms of several offshore oil and gas licenses, including the one containing the Sea Lion field.

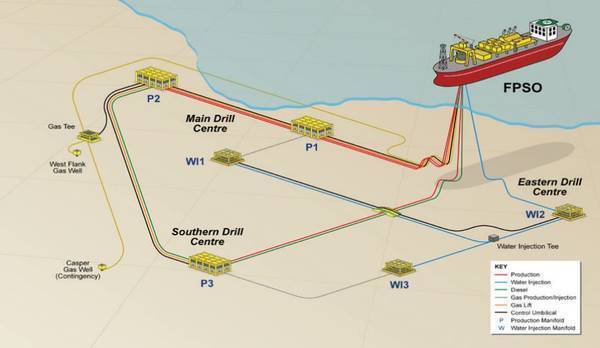

Premier Oil and Rockhopper have previously said that the Sea Lion would be developed in phases, with the first phase developing 250 million barrels (mmbbls) of resources in PL032 using a conventional floating production, storage, and offloading unit (FPSO) based scheme.

Sam Moody, CEO of Rockhopper said Thursday: "This represents both a difficult moment for Rockhopper and a huge opportunity. Whilst we are disappointed that Harbour has decided not to proceed with Sea Lion, we remain committed to unlocking its development.

"Navitas' recent financing on its Shenandoah project demonstrates that funding remains available to independent E&Ps in the international markets for large-scale offshore oil developments and we very much look forward to working with them to progress Sea Lion."