Australian oil and gas firm Bounty Oil and Gas has agreed to farm into four oil-prone offshore licenses in Western Australia, owned by Coastal Oil and Gas.

Bounty will acquire a 25% stake in licenses EP 475, EP 490, EP 491 and TP 27 (collectively “Cerberus”) by funding AUD $6 million towards the costs of drilling three offshore exploration wells.

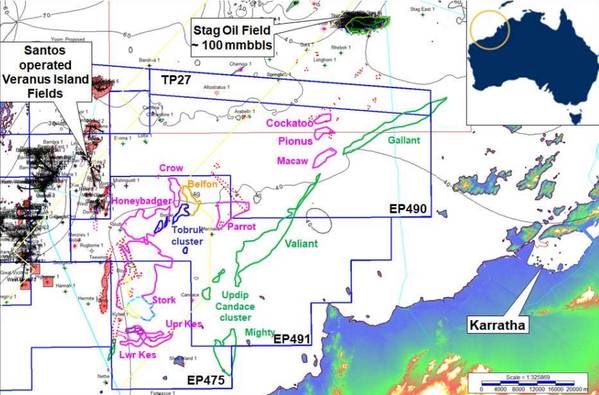

The permits EP 475, EP 490, EP 491, and TP 27 (“Cerberus”) lie south of the Jadestone Energy Plc operated Stag Oil Field, north-east of the Chevron Australia Pty Ltd operated Barrow Island Oilfields and east of Santos Limited operated Oil and Gas Fields on Thevanard Island.

Under the agreement, Bounty Group will have options during the next six months to earn two 25% tranches for additional participating interests by funding AUD $9 million and AUD $12 million respectively towards the Drilling Program.

The primary prospects identified for drilling are Triassic stratigraphic plays that are direct lookalikes to the Santos Limited operated Dorado, Phoenix South, and Roc discoveries.

Three of Bounty’s preferred Triassic prospects for the Drilling Program are the large Dorado lookalikes Stork, Parrot and Honeybadger which are already identified on 2D and 3D seismic and target Gross Mean Unrisked Prospective Resources of 627 million barrels

Bounty said that an expression of interest call has been issued to the rig market to assess the timing and cost of the Drilling Program, estimated to be between US $20 - 30 million for the three wells.

The Cerberus prospects are located in shallow water (25 to 50 meters) and lie directly adjacent to the most prolific hydrocarbon production areas of the Carnarvon Basin operated by majors and independent energy companies. Prospects are mapped at four different geological age levels, being the Lower Cretaceous, Lower-Middle Jurassic, Lower-Middle Triassic, and Permian.

"The recently discovered Dorado oil field, being developed by Carnarvon and Santos Limited is a large Lower-Middle Triassic shallow marine and basin fan accumulation that has significantly upgraded the Cerberus prospectivity," Bounty said.

Operators of the nearby field have drilling programs scheduled for 2022 and Coastal and Bounty are looking at the possibility of usinga jack-up rig from one of these campaigns to minimize mobilization costs for their drilling program.

The Gallant prospect, a prospect mapped at the same Cretaceous level as Stag and Wandoo fields is favored for drilling by both Coastal and Bounty with a Gross Unrisked Mean Prospective Resource of 44 million barrels.

Coastal plans to engage Petrofac as the Well Project Manager for the drilling program. The duo expects the costs to be around USD 20-30 million and expects it would take up to 40 days to complete the entire campaign.

Bounty Oil and Gas CEO, Philip Kelso commented: "This farmin to the Cerberus Project West Australia will see Bounty shareholders participating in 3 relatively low risk very high impact oil exploration wells in 2022/23 as oil prices strengthen in the face of disinvestment by majors and in a very low sovereign risk State. Cerberus is an exciting play with some of the largest seismically defined drillable offshore oil prospects in Australia and proximity to production and transport infrastructure. Honeybadger and Stork are examples of prospects with the potential for hundreds of millions of barrels of oil to be found."