Shell Midstream Partners said on Friday that its offshore and onshore crude and product systems will mainly drive its cash delivery.

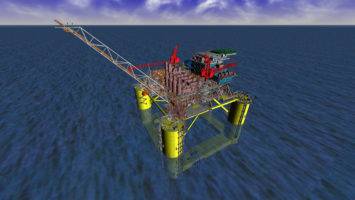

Deepwater projects in the Gulf of Mexico including Vito and PowerNap will flow into the company's systems and not only replenish, but grow the company's cash flows in the midterm, the company said during its third quarter earnings call.

"With our assets and the ongoing activity in the Gulf of Mexico, we believe the region will continue to grow," said Chief Executive Steve Ledbetter.

The company also intends to expand in the Auger corridor, an offshore corridor pipeline that transports crude from the central Gulf of Mexico. The expansion would capture new production in the area that is ready to come online in the midterm, the company said.

Investments in positions such as the company's intended expansion to its Lockport storage terminal will drive onshore growth, it said.

The company expects demand to return to pre-COVID levels, it said.

Shell Midstream is also evaluating using excess cash for a potential buyback program or increasing distributions in the future.

"Timing of that will be as we move along and grow excess cash through the cycle," Ledbetter said.

(Reporting by Stephanie Kelly; Editing by Steve Orlofsky)