Norwegian oil and gas company Equinor has agreed to sell its stake in the Corrib offshore gas project in Ireland to Vermilion Energy.

The transaction is organized through a share sale of Equinor Energy Ireland Limited, a company 100% owned by Equinor ASA. Equinor owns 36.5% of the Corrib project, alongside Vermilion (the operator with 20%) and Nephin Energy (43.5%).

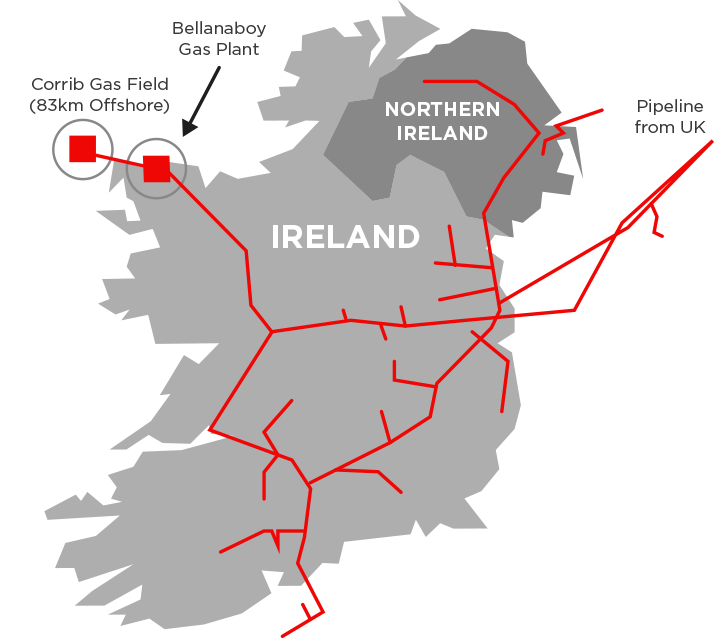

The Corrib field started production in 2015 and is located 83 kilometers off Ireland’s northwest coast in water depths of almost 350 meters. The equity gas volumes to Equinor for 2021 are estimated at ~58 MMScf/d.

"Equinor and the buyer have agreed a consideration of USD 434 million, before closing adjustment, with an effective date set at 1 January 2022. As part of the transaction, Equinor and Vermilion have agreed to hedge approximately 70% of the production for 2022 and 2023, and have also agreed a contingent payment that will be paid on a portion of the revenue if European gas prices exceed a given floor level," Equinor said.

"The Corrib field has been an important non-operated project for Equinor for several years. We have taken the decision to sell the asset to focus our portfolio, in line with our strategy, to capture value from the current strong market and to free up capital that we can re-invest elsewhere,” says Arne Gürtner, senior vice president responsible for the United Kingdom & Ireland.

The deal is subject to approval by partners, government and regulatory bodies.

The sale of Corrib means that Equinor will no longer have active business presence in Ireland, after also deciding to withdraw from an early phase offshore wind project in the country, Equinor said. Credit: Vermilion Energy

Credit: Vermilion Energy

In a separate statement, Vermilion said that the Corrib acquisition would add around 23 mmboe of 2P reserves and is expected to produce approximately 7,700 boe/d in 2022. Vermilion became the operator of the Corrib field after Shell sold its stake in a transaction that closed in 2018.

"Based on forward commodity prices, the Corrib Acquisition is forecast to generate approximately $365 million of FFO and $361 million of FCF in 2022 which equates to an FFO and FCF netback of approximately $130/boe," Vermilion said.

"Vermilion's operated interest in Corrib will increase to 56.5% upon closing, significantly increasing our exposure to premium-priced European natural gas. On a 2022 full-year pro forma basis, European natural gas will represent approximately 22% of our production and approximately 42% of FFO. The acquisition also rebalances our international weighting to approximately 39% of production and 60% of FFO based on 2022 full-year pro forma estimates, further enhancing our geographical and commodity diversification which is a unique differentiator in our business model," the company added.

"Corrib's natural gas production features world-class ESG, with best-in-class Scope 1 and 2 emissions intensity of 4.2 kgCO2e/boe and a robust plan for long-term biodiversity enhancement," Vermilion said.

The company also said it planned to reinstate a $0.06 per share quarterly dividend starting in Q1 2022.