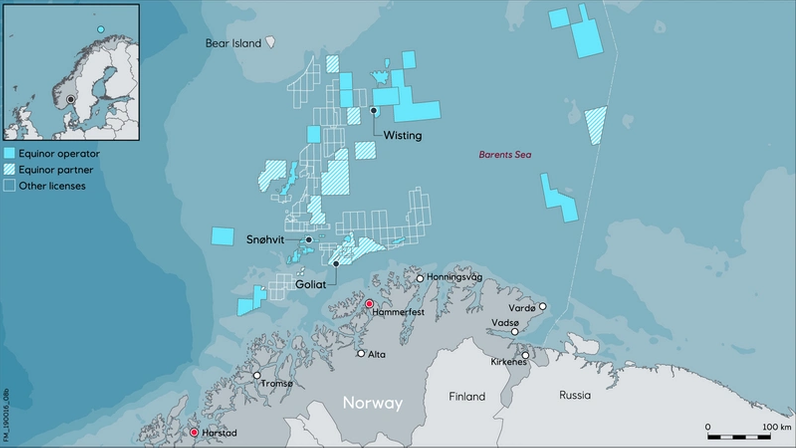

Austrian oil and gas company OMV has completed the sale of its stake in the Wisting oil field in the Barents Sea, offshore Norway, to Lundin Energy.

The two companies had signed the sale and purchase agreement in October 2021, and after obtaining the necessary approvals from Norwegian authorities, OMV on Friday closed the divestment of its entire 25% stake in the Wisting licenses (PL 537 and PL 537 B) to Lundin Energy AB.

The purchase price is USD 320 million, with a contingent payment of up to USD 20 million depending on the final project CAPEX.

"The sale of these licenses is in line with OMV’s focus on low-carbon projects and on increasing the share of natural gas versus oil in the future product portfolio," said OMV, which discovered the Wisting oil field in 2013.

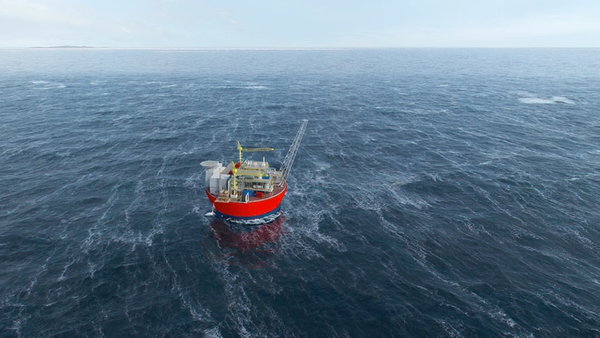

The acquisition takes Lundin Energy’s working interest in the project to 35 percent in the 500 million barrel oil (MMbo) development and adds net 130 million barrels of oil equivalent (MMboe) fully appraised contingent resources at an acquisition price of approximately 2.5 USD/boe. Credit: Equinor

Credit: Equinor

In a separate statement, Lundin confirmed the completion of the acquisition and said it had agreed with Equinor for Equinor to retain operatorship of the Wisting development into the operations phase, allowing operational synergies across their various developments in the Barents Sea.

Lundin also said it would collaborate further with Equinor in the Wisting development by secondment of Lundin Energy employees into key technical and operational positions within the Wisting project

"This agreement further strengthens the relationship between Equinor and Lundin Energy and sets out a strong collaboration for exploration and operations in what will be the next Barents Sea production hub," Lundin Energy said.

The partners are looking to develop the oil field using a cylindrical FPSO powered from shore, and the project is on track to submit a Plan for Development and Operation (PDO) by end of 2022, with first oil scheduled for 2028.

Capital investments for the development of Wisting are expected to be in the order of NOK 60-75 billion.