From being an ugly duckling, floating offshore wind is now the Cinderella of the offshore renewables world. Attention is now being paid to floating and even subsea substation concepts to help bring this power to shore.

Over the past year, expectations around the growth in the floating offshore wind development have grown, significantly. Many are piling into the market, seeing that it could give them a chance to ramp up renewables capacity quickly, with 15MW turbines on the horizon and the possibility of GW-scale projects looming by the end of the decade.

Much has been said about the different floating turbine concepts. However, there’s also thought going into floating and seabed substations, to help corral and then boost the voltage of the power to a level useful enough to export it to where it’s needed.

Consultant Justin Jones at engineering firm Petrofac says: “Floating wind farms are going to be a major contributor to the carbon free energy mix, initially close to shore, within 20-30km, but the next stage will be significantly bigger in scale and in deeper water. Once you go to 100m water depth, it’s expected that floating substations will be used to collect, convert and transmit high voltage power to shore because, at those water depths, fixed structures will become relatively large and heavy. Because of the increased wave load, they will need a bigger footprint and the natural period of the structure and fatigue become more important.”

For countries like Japan and the US west coast, where depths drop to 700 – 900m quickly, floating will be a necessity, if they want to build out offshore wind at scale. In fact, Japan has already trialed a small, 25MVA, 1,00-tonne floating transformer at the Fukushima Forward project. Installed in 2013, a decision was recently taken to decommission the structure – a sort of spar – over the profitability of running it and the three demonstration turbines it collected power from.

Others are looking at floating concepts, too, such as Newfoundland and Labrador, where there’s been a study into these types of structure for offshore wind. Meanwhile, subsea substations are also being proposed, including for the current ScotWind floating offshore wind round. Some of those working on concepts are building on their experience from the oil and gas industry where transformers, seabed and topsides, have been developed and delivered for the oil and gas industry for some time.

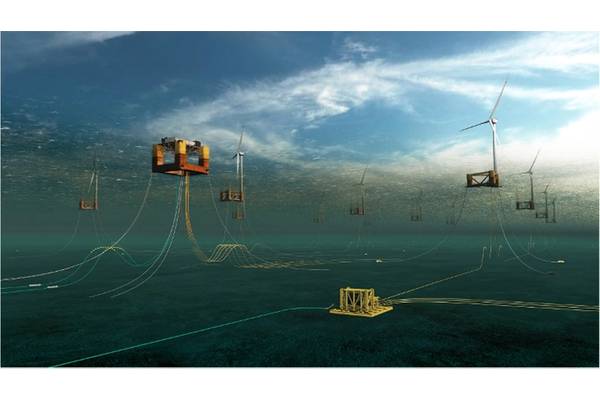

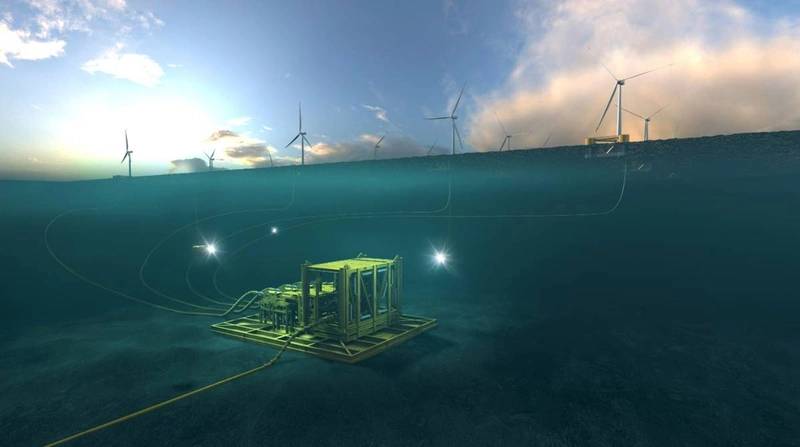

Image courtesy Aker Offshore

Image courtesy Aker Offshore

Kenneth Simonsen, SVP for Offshore Wind, at Aker Solutions says its floating substation design is focused on serving wind farms ranging from 250MW to 1.3GW and 220KV, and is based on the standardized building blocks it’s developed and proven in oil and gas. “The simple hull is based on our design for the Blind Faith (Aker Kværner designed semisubmersible production) platform that has been in operation for over a decade (in the US Gulf of Mexico), and the Njord platform (semisubmersible, built at Kværner Stord and installed in 1997), which we’ve used as a reference for the flat top deck, has been operating for 20 years,” he says, with HV electrical equipment from an original equipment manufacturer whose systems have been proven in an operating environment. The design will likely be fairly similar, but may, for example, require more enclosures in the North Sea, compared to more temperate locations like the Mediterranean or western US.

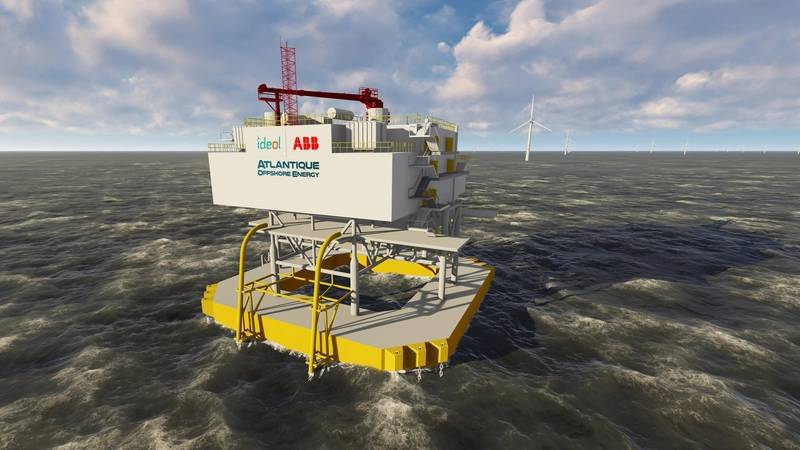

In 2018, power and automation group ABB said it had joined French floating wind foundation designer Ideol and STX Europe Offshore Energy to develop a floating substation design. The idea was being developed under a research and development project called Optiflot, which also involved French industrial process firm SNEF, and was based on Ideol’s damping pool concept. In June this year, BW Ideol (having had BW Offshore as a shareholder since February 2021) said it was working with Hitachi ABB Power Grids on “scalable floating substations”, using Ideol’s shallow-draft floating platforms. BW Ideol said this collaboration follows the Optiflot project, which had now completed. ABB wasn’t able to provide an update. A substation concept under the Optiflot project between Ideol, ABB and STX. Image from Ideol.

A substation concept under the Optiflot project between Ideol, ABB and STX. Image from Ideol.

Earlier this year, construction engineering company Linxon and its parent companies Hitachi ABB Power Grids and SNC-Lavalin/Atkins partnered to “make floating substations for offshore wind a reality”. Daewoo Shipbuilding & Marine Engineering and Korea Electric Power Technology Company have also said they’re working on offerings for the floating offshore wind substation market for both deep and shallow waters.

Petrofac has been doing some detailed work on floating substation concepts. As projects scale up from 250MW pilot scale projects to GW-scale farms, and from high voltage AC to DC transformers, Jones says there will be different design requirements. For pilot projects, HVAC will be used. As projects ramp up to gigawatt scale far from shore, they will need HVDC substations. For HVDC projects, floaters will be larger, because DC takes up more space, due to more equipment and the requirement to keep the high voltage DC equipment adequately separated. They are also sensitive to accelerations, so a semisubmersible is a good solution, says Jones. “A deep spar could be a problem when you need that topside mass and footprint. There are other options, such as a tension leg platform (TLP), but it would need a similar hull size to the Hutton TLP.”

For an HDVC solution, Jones said you’d be looking at a 66m x 70m footprint, on a four-column semisubmersible with a stressed-skin topsides, for strength and stiffness. In fact, this is just the type of structure – in the form of drilling rigs or floating production units – that’s been laid up in the downturn and could potentially be converted, subject to many caveats, not least related to fatigue, but it’s feasible, says Jones.

HVAC substations have a smaller footprint and are lighter weight than HVDC for the same capacity, which makes semisubmersibles less attractive; they’re only really optimal once the structure has a topside footprint above 50m by 50m, says Jones.

For GW-scale projects Petrofac came up with a deep-draft semisubmersible design, giving low motion, but retaining shallow draught for transportation and maintenance, with a minimal braced topside structure. “The design has the added advantage that the cable outlet is well below the water surface, giving reduced cable fatigue," he says. The first projects with substations may have a capacity closer to 250MW, connecting 20-25 turbines. “Our concept for a pilot-scale substation is a minimum structure TLP facility, which has a really quite efficient weight structure, and good motion vertically, but increased cost of moorings. The early commercial HVAC substation projects will need some innovative thinking to achieve the most efficient design,” he says.

The dynamic export cable is a critical element that will be needed to get the power from a floating structure to shore. These cables, at about 300 mm diameter at 220kV or more, will need a low fatigue environment and currently no cables exist that could do the job. Jones thinks there are solutions within the oil and gas industry that could fit the bill. But even then, floaters would need to be designed by the requirement to minimize the fatigue loading on the cable, he says. “You may want to pay, up front, higher capex to have a design in which the cable motion, and therefore cable fatigue, is lower to reduce the likelihood of cable failure over the 25-year life,” he says. “You might want to go for a deeper, lower motion floater and have the cable outlet lower beneath the surface, where wave loads are lower.”

Collaborating to set industry standards

DNV is hoping to launch a joint industry project to align best practice in this space so that technology development can happen and scale-up faster. The organization says there’s a standard for offshore substations (DNV-ST-0145), but that with a trend towards floating wind, it wanted to develop rules for floating substations.

More than 20 companies took part in an initial workshop and 29 partners are now interested, with kick off is expected in Q1 2022. “The whole value chain from developers, technology suppliers, sub-suppliers, integrators and infrastructure owners are on the list,” says Kristin Nergaard Berg, Senior Principal Consultant and JIP Project Manager. “The core scope is on design and qualification of new technology, getting the right design and qualification requirements into the standards to reduce risk of taking these systems into use. We expect to see the main gaps related to HV power equipment and dynamic cables, but there may also be other areas we need to address.”

While much of the equipment is the same, there are differences between floating and fixed substations that need to be considered. “The main difference is the movement and accelerations of the floater, combined with the high-capacity specifications the power equipment will see, and the dynamic capabilities required of the cable, combined with high voltage,” says Berg. “There are experiences to build on from power equipment onboard ships, but not to the specifications required for this equipment. There are also experiences for dynamic power cables from oil and gas, but this is limited compared to what we need in order to take floating substations into use, and for both AC and DC applications. Smaller projects may require less of the equipment and as such represent less of a technical gap. Some floating wind farms may even be able to use bottom-fixed substations, when the water is not too deep. However, for big commercial windfarms in deep waters and far from shore you need a substation of high capacity – either floating or subsea.”

Floatgen 3, using BW Ideol’s damping pool technology. Image from Ideol & V Joncheray.Going subsea

Floatgen 3, using BW Ideol’s damping pool technology. Image from Ideol & V Joncheray.Going subsea

Others are developing subsea substation solutions, which wouldn’t need dynamic export cables. ABB unveiled its subsea power system back in 2019. While developed to meet oil and gas requirements, they also saw its applicability to offshore wind. The 100 MW capacity, 3000m water depth system comprises of a subsea transformer, switchgear and subsea power distribution up to 600km. This year ABB added offshore wind to an agreement it has with Aker Solutions around seabed solutions, while Aker Solutions has unveiled a subsea substation concept for floating wind.

Egil Birkmore, VP, HV infrastructure, Renewables, Aker Solutions, says, “Subsea transformers have been used since the 1990s, with no failures to date, and it means we don’t need dynamic export cables.” Putting the transformer subsea could be 50-70% less capex compared with putting it in on a semisubmersible, he says, but this isn’t a one size fits all solution – there are sweet spots, depending on water depth and how much power needs to be transmitted, he says. There’s also an opportunity to share infrastructure with oil and gas facilities, electrifying existing facilities, which could allow a phased approach to wind farm development. ABB and Kellas Infrastructure Partners are working on this idea, Birkmore says.

Developer Aker Offshore Wind has said it will deploy a subsea substation if it wins its ScotWind bids – a major licensing round in Scotland, the winners of which will be announced next year. Leif Holst - SVP Projects - Aker Offshore Wind says, “It’s an innovation we’re taking from the energy sector and applying to offshore wind.” He says having it on the seabed has a number of benefits, including using the natural cooling offered by the seawater, having it entirely unmanned and easier to maintain. “This is an area we’ve seen where we can push the LCOE down further and where we have technology in the (Aker) group that we can leverage,” he says.

However, depending on the water depth, these might face challenges, i.e. very deep waters with long power cables will challenge economics, says Ralph Torr, program manager, at the UK’s Offshore Renewable Energy (ORE) Catapult.

Njord A – a template for a future substation floater? Image from Equinor, by Thomas Sola.

Njord A – a template for a future substation floater? Image from Equinor, by Thomas Sola.