Oil and gas firm Eco Atlantic has increased its stake in JHI Associates by acquiring additional 800,000 common shares in JHI in return for 1,200,000 new common shares in Eco.

"The purchase of the 800,000 common shares in JHI is expected to be completed on 21st January 2022, increasing the total number of shares currently held by Eco in JHI to 5,800,000 shares," Eco Atlantic said Wednesday.

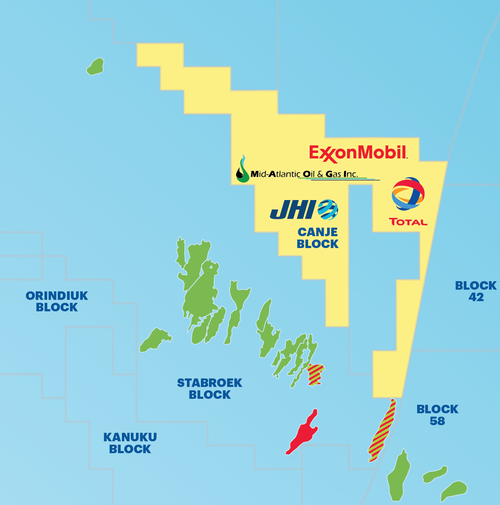

Back in June 2021, Eco acquired 5 million common shares representing a 6.4% interest in JHI Associates Inc. ("JHI"), a private Canadian company, which holds a 17.5% working interest in the Canje Block, offshore Guyana.

"The Operator of the Canje block, ExxonMobil, and block partners are working to technically define additional drilling prospects in the cretaceous and deeper in the santonian, where the Sapote-1 well recorded hydrocarbon shows while drilling in 2021 and following the January 2022 santonian Fangtooth-1 discovery on the prolific Stabroek Block offshore Guyana," Eco Atlantic said.

Worth noting, while Eco Atlantic said that Sapote-1 well had recorded hydrocarbon shows, those shows, at least at the time of drilling, were deemed non-commercial. Exxon's other two wells, Bulletwood-1 and Jabillo-1, drilled before Sapote-1, failed to unearth evidence of commercial hydrocarbon volumes, too.

As for Eco's purchase of JHI shares, the company will now hold a total of 5,800,000 common shares in JHI, representing approximately 7.35% of the issued common shares in JHI. Eco also retains a warrant to subscribe for a further 9,155,471 new common shares in JHI at an exercise price of US$2.0 per share for a period of eighteen months (the "JHI Warrant"). If the JHI Warrant is exercised in full, Eco will hold an interest, ceteris paribus, of 11.4% in JHI on a fully diluted basis.

"This investment is consistent with Eco's strategy to create shareholder value through advanced exploration programs on the offshore Atlantic margins for advantaged barrels as developing nations bridge the essential reserve requirements through the stages of the energy transition," Eco Atlantic said.

Gil Holzman Co-Founder and CEO of Eco Atlantic commented: "We are committed to creating material value for our shareholders through a multi catalyst, high impact, exploration portfolio. As such, we are pleased to increase our exposure in the Canje Block by building our equity holding in JHI.

"This also marks another step in the broader consolidation amongst smaller exploration players, in which we want to lead. Following the work undertaken on Canje in 2021, which ExxonMobil and partners in the block continue to review, and after the recent highly positive drilling results on the nearby Stabroek block, we believe this to be another exciting opportunity in our portfolio."