Borders & Southern Petroleum, a company with oil and gas exploration assets offshore the Falkand Islands, is looking to raise $1.8 million via a placement of shares. It will use the proceeds for general working capital purposes and for work on its Darwin offshore discovery in the Falklands.

The London-based independent oil & gas exploration company plans to raise around US$600,000 (approximately £450,000) before expenses by way of direct subscription for 34,702,000 new ordinary shares, and up to around US$1.2 million (approximately £900,000) before expenses by way of an open offer of up to 69,156,926 new ordinary shares at an issue price of 1.3 pence per new ordinary share.

Borders & Southern Petroleum's Chairman, Harry Dobson, is the sole participant in the subscription and has agreed to invest approximately US$600,000 (approximately £450,000) in new Ordinary Shares by subscribing for all of the Subscription Shares through the Subscription

As part of the plan to raise up to $1.2 million (approximately £900,000), the company proposes to raise these funds by the issue of up to 69,156,926 new Ordinary Shares pursuant to an Open Offer to qualifying Shareholders at the Issue Price, thereby implying an allocation of 1 new Ordinary Share for every 7 Ordinary Shares held.

"In the event that the exchange rate of British Pounds Sterling to United States Dollars fluctuates significantly before the date of a Circular relating to the Fundraising (the "Circular"), the number of New Ordinary Shares to be issued may change," Borders & Southern Petroleum said.

"The fundraising is subject to approval by Shareholders at the General Meeting, the details of which will be announced and the associated circular posted to shareholders shortly," Borders & Southern Petroleum said.

" The net proceeds of the Fundraising will be used to enable the Company to continue to explore the best options to appraise and develop its Darwin gas/condensate discovery, as well as for general working capital purposes," the company said. Borders & Southern Petroleum made the Darwin discovery in 2012.

"Assuming the open offer is fully subscribed for, the New Ordinary Shares issued (pursuant to the Subscription and the Open Offer) will represent up to approximately 21 percent. of the Company's currently issued share capital. The Issue Price of 1.3 pence per New Ordinary Share represents a discount of approximately 25 percent. to the closing mid-market price of 1.73 pence per Ordinary Share on 3 March 2022," Borders & Southern Petroleum said.

Borders & Southern Petroleum's Production Licences in the Falkland Islands, PL018, PL019 and PL020, which grant exclusive rights for surveying, drilling and production within the specified area, along with the Darwin Discovery Area Licence, were due to expire on January 31, 2022.

However, on January 31, Borders & Southern Petroleum said that it had been granted an extension to its Falkland Islands licenses until December 31, 2022.

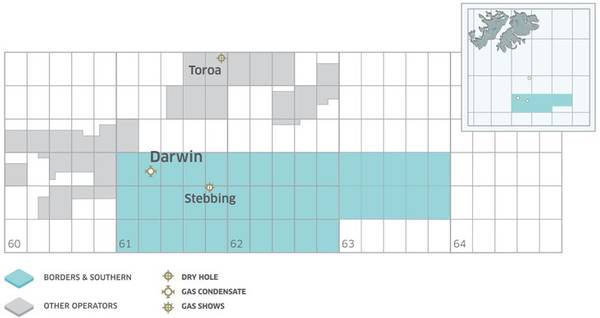

Darwin

The Darwin offshore area comprises two adjacent tilted fault blocks, Darwin East and Darwin West. The discovery well is situated on Darwin East.

According to the company, the reservoir is located 2.8 km below the seabed, and at reservoir temperature and pressure conditions, the hydrocarbons are in a gas phase. At surface temperature and pressure conditions, the fluid separates into a gas and liquid phase. The liquid has properties of a light crude oil, 46 to 49 API. The initial liquid yield is relatively rich, 123–140 stb/MMscf.

Based on the current mapping of the combined Darwin East and Darwin West fault blocks, the estimated un-risked (PSO) recoverable resource is 360 million barrels, info on the company's website shows.

A number of development scenarios have been considered, including the full development of Darwin East and Darwin West or a phased development.

According to Borders & Southern Petroleum, engineering studies have demonstrated that the discovery, if successfully appraised, could be commercialized by a straightforward FPSO development, utilizing proven, off-the-shelf technology. The liquids would be produced and the dry gas re-injected back into the reservoir. A leased FPSO would be located in either 2,000 meters of water, above the discovery, or in 1,100 meters of water using a 14-kilometer subsea flow line.