By Akif Chaudhry, Principal Analyst, Corporate Research, Wood Mackenzie

No longer in its infancy, offshore wind is a proven technology on course to play a key role in the decarbonisation of the global economy. Over the next decade, the industry will attract almost US$1 trillion in new investment.

A growing number of competitors are flocking to take advantage of the massive opportunities that will be created by the boom. The Majors – notably the European Majors – are no exception. Right now, their share of the market is small, but ambition is ramping up as they bet bigger with their investments in the zero-carbon value chain. And there is all to play for as the offshore wind industry scales rapidly and globally.

[Wood Mackenzie's] insight Why the Majors need to consider margins in weighing up offshore wind uses a proprietary new metric to break down why offshore wind offers a big prize for Big Oil. Using the expertise of our Corporate Service, we provide a detailed analysis of the relative performance of new field assets across the oil and gas industry and compare that to offshore wind.

Offshore wind delivers by some margin

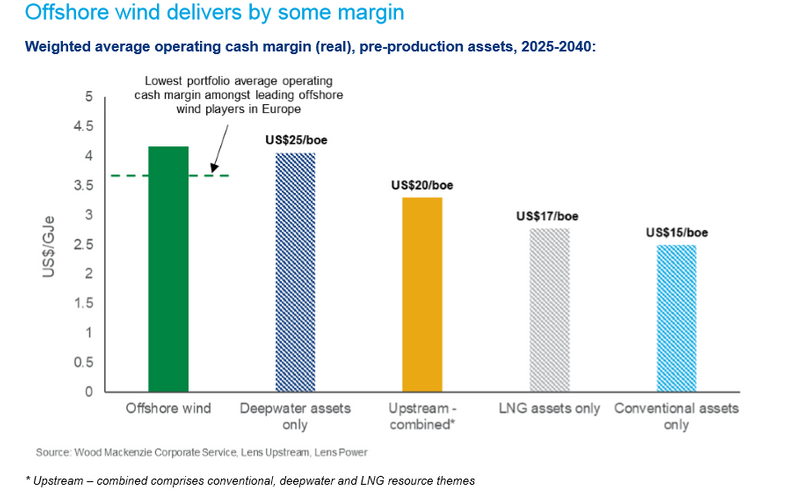

The upstream sector has long analysed cash margins on a per barrel of oil equivalent (boe) basis. This well-understood metric reveals how much operating cashflow upstream oil and gas assets generate per unit of production. It’s especially useful for articulating cash generation capacity and benchmarking portfolios.

Conventional analysis of renewables pitted against oil and gas investment usually focuses on relative risk and returns. But comparison with the legacy business needs new metrics. [Wood Mackenzie's] new cash margin metric – operating cash flow per gigajoule equivalent (GJe) – goes beyond traditional comparisons. And it reveals that offshore wind comes up trumps. Credit: Wood Mackenzie

Credit: Wood Mackenzie

Drawing on composite data from [Wood Mackenzie's] Lens Upstream and Lens Power platforms, [Wood Mackenzie's] study shows how a group of renewable leaders’ offshore wind portfolios stack up against the Majors’ oil and gas portfolios on this key metric. Tracking this asset-by-asset data demonstrates that offshore wind will deliver 25% higher unit operating cash margins in comparison to new field oil and gas projects.

Even the lowest offshore wind portfolio average operating cash margin is above the upstream average. And the renewable technology’s margins trump deepwater – Big Oil’s highest margin asset class.

Offshore wind’s strong operating cash margin performance shows that the financial prize is more than simply long-term and steady cash flows. Such a cash wedge within a business is a good way to support other portfolio areas or, indeed, a significant dividend commitment, and to hedge exposure to carbon and hydrocarbon prices.

Returns do, of course, matter. Falling IRRs from offshore wind projects will not be sustainable if the sector is to attract the capital required for it to play its part in meeting global climate goals. Mid-single digit returns will not be acceptable.

Companies have already been leaning on traditional tools of debt-financing and asset rotation to lift IRRs. As the sector matures other levers, such as increasing merchant exposure, power trading and building power-to-x projects, will also come into play to boost returns.

The Majors can play the long game with offshore wind

Offshore wind is not without challenges: dark clouds of supply-led cost inflation and rising cost of debt are looming large. The industry is currently grappling with oversupply, while the demands of next-generation technology mean that massive investment will be needed to back new tower production facilities.

But after years of managing volatility in oil and gas, the Majors are equipped to get the balance between risk and return right. And they are flush with deep pockets of cash to take advantage of the huge upcoming opportunities.