With volatile markets and increasing speed of technological changes – led by digitalization and decarbonization – Richard Ward discusses subsea production trends, opportunities and challenges.

I've been in the upstream industry for 30-plus years, starting out on the well side of the industry, spending about five years offshore through Africa, the Middle East, North America, and the Gulf of Mexico. Then like a lot of people in our industry, I had the opportunity to grow my career and went through engineering, into business management, through to supply chain, living and working across the world. Today, I have the privilege of leading the Subsea Production Systems business for Baker Hughes within our oil field equipment business line.

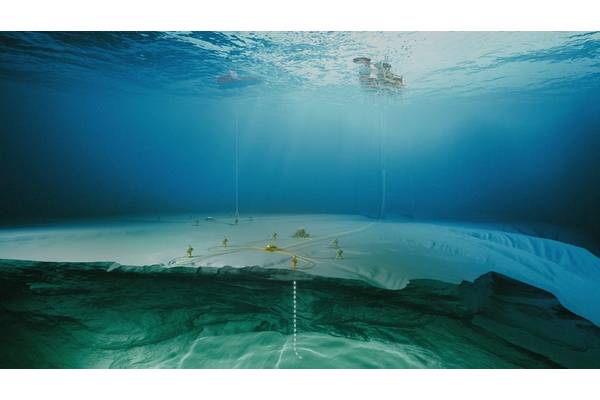

Absolutely. I’ll start a bit further out and then zoom in from a Baker Hughes standpoint, because sometimes there's a bit of confusion with the breadth of the portfolio. So, it’s really framed around four large product companies centered around two industrial segments. The upstream, which is our oil field services business around wells, exploration, production, development. Our oil field equipment business, inside of which is a subsidy production systems business. We also have more of an industrial midstream downstream segment framed around turbo machinery and also, our digital solutions business. It's a tremendous portfolio breadth. From an SPS standpoint inside oil field equipment, we focus on the hardware that's offshore subsea. So, the infrastructure that allows our customers to develop, produce hydrocarbons and or inject in that subsea environment.

The last six years been a significant downturn in the industry, but it's not the first time we've seen this. I've been in it for more than 30 years, and the commodity pricing has changed drastically through that period with peaks and troughs. I don't think the fundamentals of success through the cycles has really changed that significantly. As an industry and then as a business unit focusing in on industrial scale productivity and efficiency, which translates into cost certainty, obviously underpinned with flawless safety is the key. From the offshore market, I think we've gone from a project world that was under-capacitized to one that had significant capacity, which added a third dimension to the stress that the industry's seen.

To win in that world you need to make sure that your offering into your customer base has the value proposition that drives not only through the CapEx side of a project, but also through the life of the project. So our focus has been looking at CapEx reduction, but also looking at operating expenditure reduction through life-of-field, looking at interface management. As we look at projects across the world in our space, but actually in analogous industries, then cycle time and cost accuracy have been poor at best, quite frankly, with upwards of half projects missing their initial targets. One thing is actually physically having the portfolio of equipment technology that can drive the right economic value for a customer, but the other one is the workflow process to ensure seamless interface and schedule and cost security within that environment.

That doesn't matter whether oil is greater than $100, or if you're down in a much lower range. The fundamentals of the business must drive to continuous improvement around this. I think we see examples of brilliance in the industry on a project-by-project basis, then we see great variability as well. Putting consistency in top quartile is the key, and of course I am saying with that everything has to be underpinned in our world by the very nature of the environmental backdrop. I say environmental not just from the environment, but I'm talking societal and stakeholder engagement must be with the highest levels of assurance around safety and the environment.

“Without major acceleration in technology development, deployment and implementation, the industry won't meet the [emission reduction] targets that we've set ourselves … Hydrocarbons are here. They are fundamental in the energy value chain for at least the next three decades, but within that we need to be the custodians of it and do it with the least emissive profile as possible.”

“Without major acceleration in technology development, deployment and implementation, the industry won't meet the [emission reduction] targets that we've set ourselves … Hydrocarbons are here. They are fundamental in the energy value chain for at least the next three decades, but within that we need to be the custodians of it and do it with the least emissive profile as possible.”

Richard Ward, SVP, Subsea Production Systems, Baker Hughes

Photo courtesy Baker Hughes

That’s a pointed question into one of the key challenges that I see inside the industry. If I step back and take Baker Hughes' view of the world, there are three hard truths that we see as a company.

One is that without major acceleration in technology development, deployment and implementation, the industry won't meet the targets that we've set ourselves. Second is hydrocarbons are here. They are fundamental in the energy value chain for at least the next three decades, but within that we need to be the custodians of it and do it with the least emissive profile as possible.

Third is that there is no pathway to ‘net zero’ without partnership and collaboration through the entirety of the supply chain.

If I boil that view down to my business segment, material management is key. The efficiency from a manufacturing standpoint, from a installation commissioning standpoint, and through life-of-field is key. My personal opinion is electrification is also a major driver behind a less emissive profile for the offshore world. As we look at that from a Baker Hughes standpoint and SPS standpoint, then we have programs in flight around our hardware, specifically focused at understanding emissions by equipment type through operating life.

There are sub-components in the subsea world that already are electric. What we are looking at more broadly though is an ecosystem that is electrified. So, not requiring power generation from an emissive combustible source. So, we generate power from a renewable source offshore. We drive power subsea hardware. We drive to the top side with electrical power capability. We enable that through a digital framework and a data framework that gives us insights around the productivity, the efficiency and the reliability of the system. So, all that has to tie together. So it's not about an actuator, for example, that is electrical. It's about the full system interface all operating and playing off another. Today, the industry's still at component level, and what we're really looking at is full system electrification.

"We've launched a technology called Aptara which is around all of the hardware subsea, the tree, the manifold, the control units. It's a radical way of looking at it, and it's very modular, very interchangeable." Photo courtesy Baker Hughes

"We've launched a technology called Aptara which is around all of the hardware subsea, the tree, the manifold, the control units. It's a radical way of looking at it, and it's very modular, very interchangeable." Photo courtesy Baker Hughes

I'd boil that down to three areas that I like to think about when we talk about the digital impact to operations or equipment or solutions. One is around data: what data is available and what do you do with it? The other one is around efficiency, which can translate to cost, to safety in other areas. The third one is reliability of a system. Making sure we can get the right data at the right time in the right sequence, so it's usable to provide insights.

Those insights can then be used by the operator, by the customer to modify, change, because we've now put actuation from electrification standpoint into the system to improve production or safety. When it comes to efficiency, those insights are there to drive total recovery from reservoir or total injection volumes through the entire system. It ties in parallel to reliability, including becoming far more predictive on maintenance of critical items, but also total system reliability and maintenance, which in turn can lead to less interventions, less offshore vessels flowing through. I think it's an area that we've cracked the surface on, but truly, I don't think we've unlocked the true potential as an industry in the offshore subsidy world of what the data, the insights, and then the ultimate action as a result of that can derive into operations through the supply chain.

I'll bring it to home within Baker Hughes. We talked about how do we battle with these cycles in the industry as we see commodity price fluctuate? We've launched a technology called Aptara which is around all of the hardware subsea, the tree, the manifold, the control units. It's a radical way of looking at it, and it's very modular, very interchangeable. It's not focused just on early life production or injection. It's around full life-of-field. Your total field economics are reduced significantly, so, for me, I think that's very exciting. I think a challenge for the industry is how fast we adopt. Within the upstream sector, that if you go back over time, I think some of the big changes that are coming from a technology standpoint, the time to full adoption is long. So. I think the challenge on us as industry is how do we get comfortable with the profile of new technology in these arenas of complex water depth, high cost, safety assurance, equipment assurance? We've got to get there.