Oil and gas exploration is likely to continue to have an important role in the decades to come, a view reinforced by the 2022 energy crisis and growing energy security needs, according to energy intelligence group Westwood.

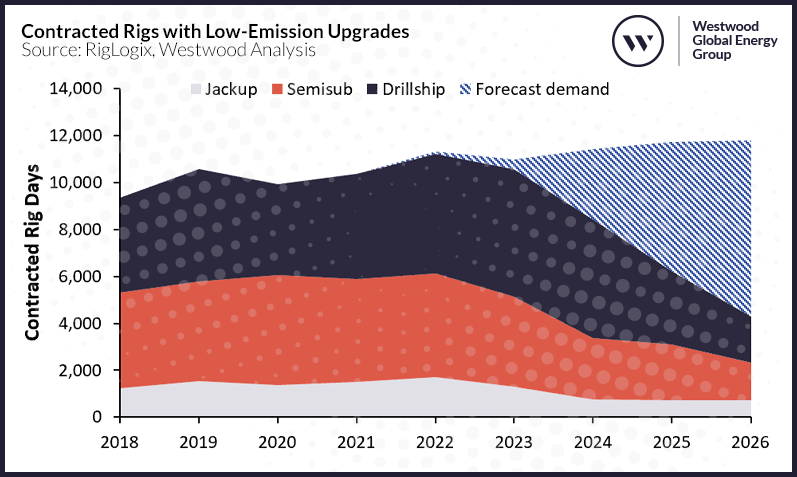

In the offshore drilling space, Westwood says that the year 2022 has seen a continued increase in jackup, semisubmersible, and drillship demand, utilisation, and dayrates, all of which have reached highs not seen since 2014.

What is more, Westwood expects to see further increases through 2026.

With growing offshore rig demand and utilization, Westwood sees growing emissions from the offshore drilling fleet. That is, if they remain unimpeded.

However, there are incentives for offshore drilling contractors to keep those emissions at bay, and not only for the drilling companies' inherent desire to be more sustainable and meet climate goals.

Namely, Westwood's analysis has shown that most of the current upgraded offshore drilling rigs have healthy backlogs and are being fixed at dayrate premiums when compared with standard counterparts. Westwood did not provide details on the exact dayrates.

Meanwhile, Westwood said, there are currently only two “eco” designed semi-subs currently under construction and two drillships in shipyards with green credentials, one of which has work in place and the other is being actively marketed.

Drilling contractors are trying many different things to meet their goals and cut down on their carbon footprints.

Per Westwood, these measures include (but are not limited to), upgrading rigs with energy efficiency and emission tracking systems as well as fuel, energy and emissions analytics software, undertaking trials of alternative fuels as well as adopting the use of fuel additives, securing “eco” notations for rigs from classification societies and integrating energy management systems such into their fleets.

Westwood says that a lot of attention is also paid to the different things that can be done to cut down on the time it takes to drill a well, as this is a very effective way to cut emissions during a campaign. In addition, most drilling contractors are also implementing crew training for engine management performance as well as incentives for emissions awareness and reductions, Westwood adds.

Drilling companies' customers, the oil and gas companies, also have ambitious climate targets to meet and several are now using upgraded low-emission rigs or partnering with drilling contractors on emission reduction efforts during drilling campaigns, in a bid to reduce their own Scope 1 emissions.

Westwood says that the Norwegian oil company Equinor is in the lead when it comes to hiring rigs that produce less emissions.

"[Equinor] has an ambitious target to reduce Scope 1 GHG emissions from drilling rigs and floatels and Scope 3 emissions from vessels contracted – 50% by 2030 (2005 baseline) offshore Norway and 50% by 2050 (2008 baseline) globally. Shell, Chevron, Aker BP, and Petrobras are also in the top five users of these rigs," Westwood said.

Challenges

Making offshore drilling rigs greener is not without challenges. According to Westwood, among the reasons for slow progress in this area are the high investment costs of new technologies coupled with a rig market downturn that lasted around six years, lack of government funding, supportive legislation and regulation, the accessibility and availability of alternative fuels, and a lack of incentivization from operators outside of Norway.

"This does not mean that there are not opportunities to be found, however. Some operators are offering emission-lowering bonus incentives on rig contracts, meanwhile assets with emission-reducing upgrades earn higher dayrates on average than non-upgraded counterparts. Increasingly, rig tender documents are asking for emissions information, and drilling contractors that can offer proven “eco” credentials will have a competitive advantage," Westwood said.