As the dust settles from Wednesday's California floating wind auction, and developers begin to discuss their plans, energy industry intelligence firm Intelatus says development of the floating wind manufacturing and installation supply chain must speed up.

Developers are beginning to release details of their bids for yesterday’s California floating wind auction. The successful bidders for the two north California Humboldt sites, RWE and CIP, both bid the highest prices per square kilometer of lease area.

Both companies have also identified comparatively low development potential of at 1.6 GW and at least 1 GW, respectively. One expects upside in the CIP capacity estimates.

In the Morro lease areas, Equinor and Golden State Wind (Ocean Winds-Canada Pension Plan) have identified potential of at least 2 GW each. Invenergy has yet to declare an estimate, but one anticipates that this will be above 1.5 GW.

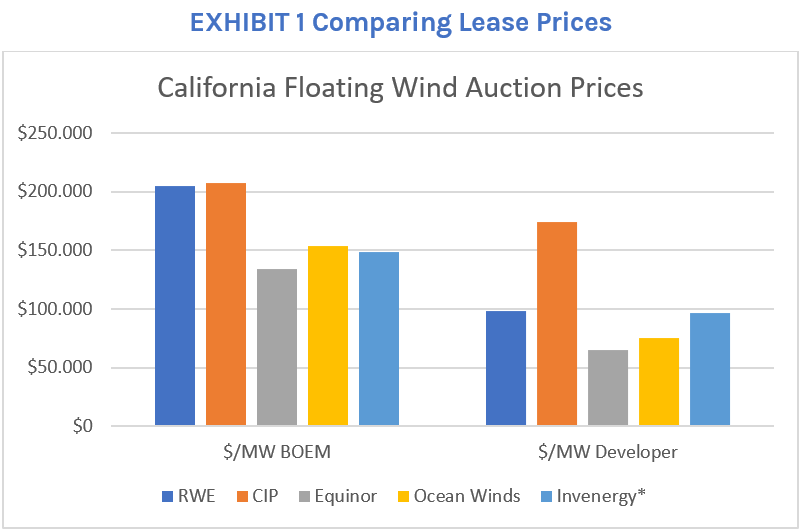

A summary of the bidding prices is shown in Exhibit 1.

Source: Intelatus Global Partners

Developers will now finalize leases with BOEM and commence site assessments as a precursor to submitting construction and operations plans for federal review.

This process is expected to take at least eight to nine years. During this time, the projects will target power offtake agreements with California organizations and develop supply chain strategies.

Bidders have begun to identify commitments for local supply chain and workforce development. However, the floating wind manufacturing and offshore installation supplier base on the West Coast is relatively immature. Intelatus expects projects to be developed with a combination of local and overseas capabilities.

Those choosing concrete substructures can consider component manufacture and assembly in California. Those focused on steel structures will likely import components or completed substructures, depending on the technology chosen.

In both cases, the port areas required for marshaling, assembly, mating with the turbine, and storage are very large – and securing suitable waterfront sites will be a key success factor for developers.

It is difficult to see the rationale for turbine nacelle plants to be located in the West Coast. Intelatus estimates turbine volumes of around 400-550 for all five lease areas. An investment in a nacelle plant will require project volumes to increase and expand to include Oregon, Washington, and Hawaii. Intelatus anticipates that turbine components will be imported.

Mooring systems will be a unique challenge given the deep water of most sites. Not only is the volume of mooring chain, wire rope, and synthetic rope significant but so will be the number of anchors. These moorings need manufacturing, marshaling, and installation. The vessels required to install these systems are amongst the largest of the offshore fleet. There are also not that many.

Intelatus’ analysis points to a shortage of suitable vessels and crews once these projects are deployed.

Floating wind farms require dynamic power cables. The challenges to dynamic cables posed by floating wind projects are unique.

Development of the manufacturing and installation supply chain must speed up if floating wind projects are to be grid connected in time, whether in California or elsewhere.

Finally, the question of how to repair and maintain floating wind infrastructure continues to be discussed, and solutions investigated.

Given that there are no commercial floating wind arrays operational today, there is limited experience and still many questions.

This will certainly be a busy period for developers and the supply chain.

For more information about the Intelatus Global Partners, please visit www.intelatus.com or contact Philip Lewis at +44 203-966-2492.

Philip Lewis is Director Research at Intelatus Global Partners. He has extensive market analysis and strategic planning experience in the global energy, maritime and offshore oil and gas sectors.